Nearly 450,000 BTC acquired by short-term holders since December

Nearly 450,000 BTC acquired by short-term holders since December Quick Take

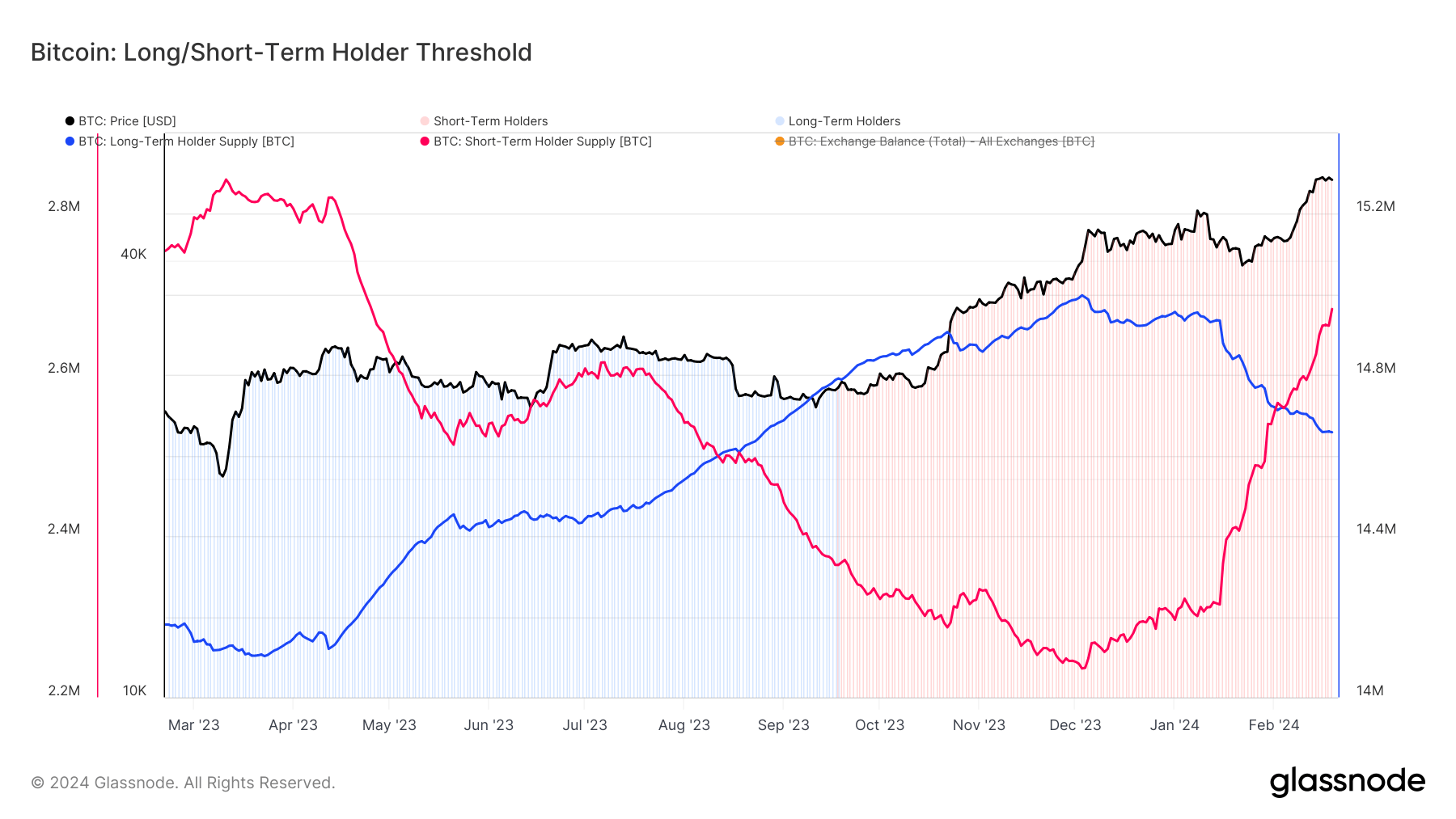

Short-term holders (STHs), defined by Glassnode as investors who’ve held Bitcoin for less than 155 days, have significantly bulked up their holdings since Dec. 3, moving from 2,236,571 to 2,682,061 Bitcoin, marking a substantial increase of 445,490 BTC, roughly a 20% increase.

Conversely, long-term holders (LTHs)—investors holding Bitcoin for more than 155 days—have seen their holdings dip by approximately 340,000 BTC during the same period. Their current holdings come up to 14,658,137 BTC.

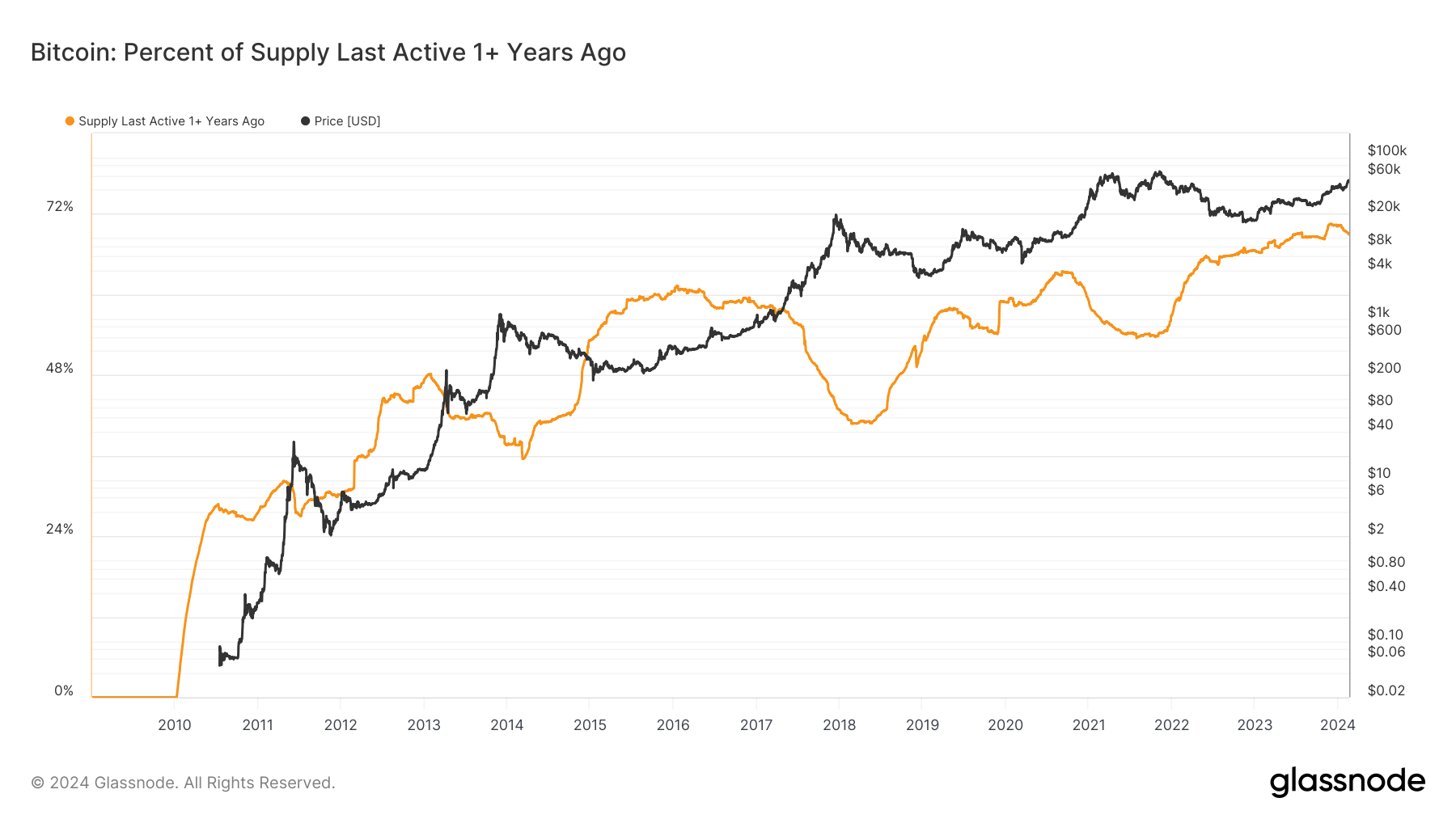

Historically, CryptoSlate has noted a trend in LTHs distributing their holdings in line with Bitcoin gains, often seen as “smart money” cashing in on the price rise. Despite this, an impressive 69% of coins have remained motionless for at least one year.

Currently, the cumulative total of both short and long-term holders stands at roughly 17.3 million Bitcoin, leaving an estimated 2-2.3 million Bitcoin circulating on exchanges.