Long-term Bitcoin holders selling off could signal more price increases

Long-term Bitcoin holders selling off could signal more price increases Quick Take

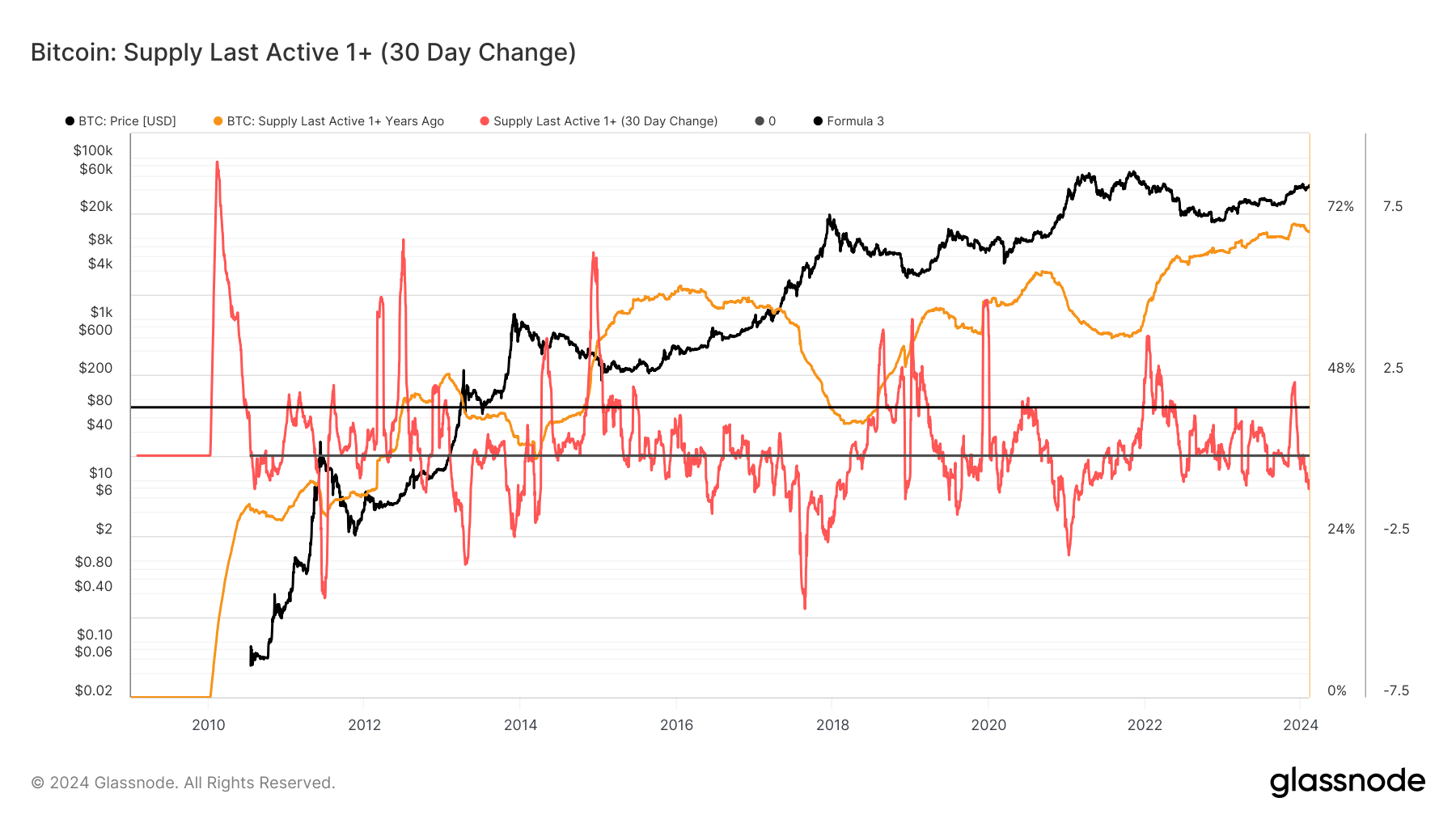

Bitcoin market forces are demonstrating an intriguing trend. The cohort of Bitcoin holders who have kept their Bitcoin for over a year, also known as the Supply Last Active (SLA) 1+ year, reached an all-time high of approximately 71% in November 2023.

As a general principle, these holders tend to acquire Bitcoin during bear markets when prices are low, holding onto it until prices rise. As the market transitions into a bullish phase, this cohort starts liquidating their Bitcoin assets, garnering profits from their initial low-cost purchases.

Consequently, as Bitcoin prices surge in bull markets, the SLA 1+ year decreases. This trend appears to confirm itself as Bitcoin recently soared to $46,000. Correspondingly, the SLA 1+ year supply has dipped by over 1% from its peak to 69.2%.

This trend, initially noted by CryptoSlate in December 2023 and confirmed by Dan Pantera, hints that if the SLA 1+ year supply continues declining, Bitcoin prices could rise further. This trend is worth keeping a close eye on as it may have significant implications for the Bitcoin market going forward.