MicroStrategy outperforms BlackRock Bitcoin ETF by factor of five in 2024

MicroStrategy outperforms BlackRock Bitcoin ETF by factor of five in 2024 MicroStrategy outperforms BlackRock Bitcoin ETF by factor of five in 2024

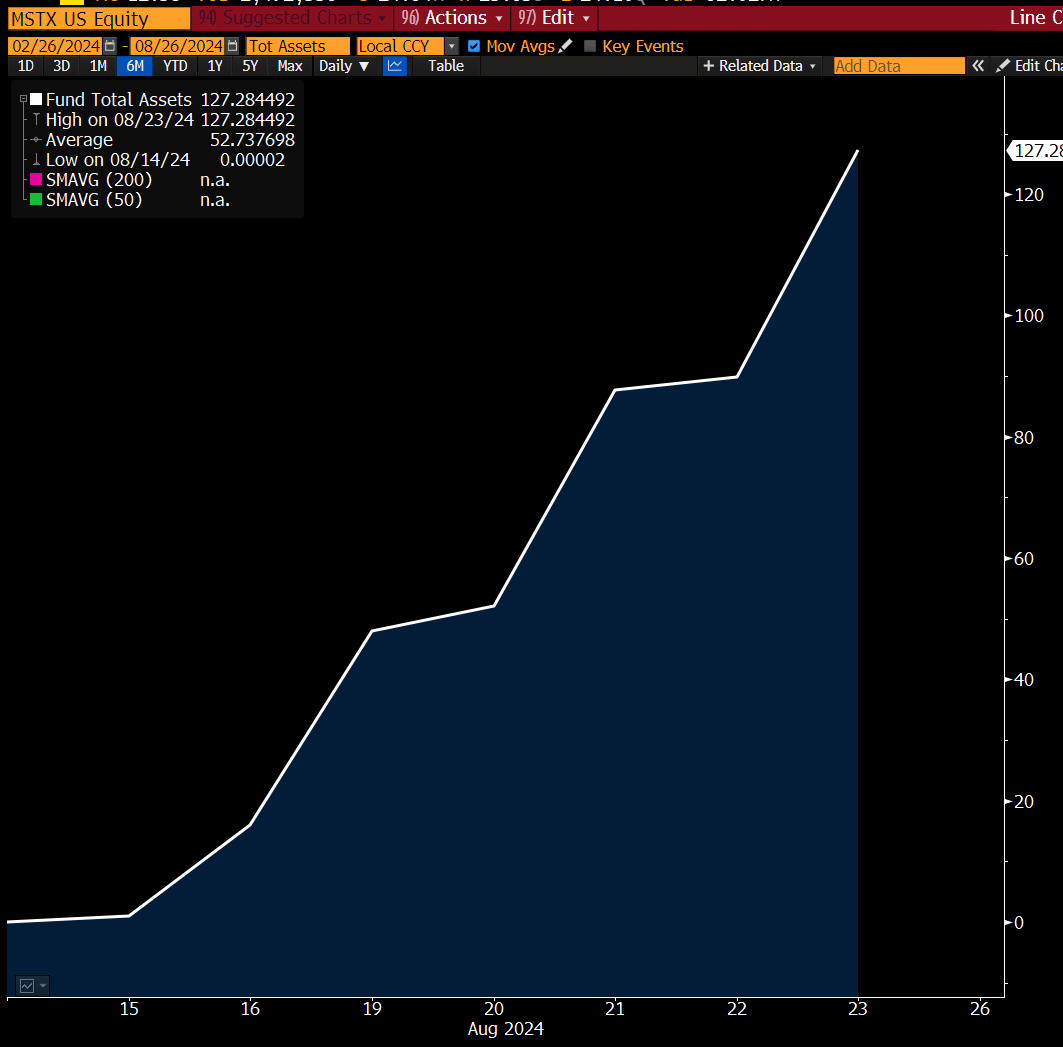

Explosive growth: MicroStrategy's new leveraged ETF amasses $127M in assets quickly.

Quick Take

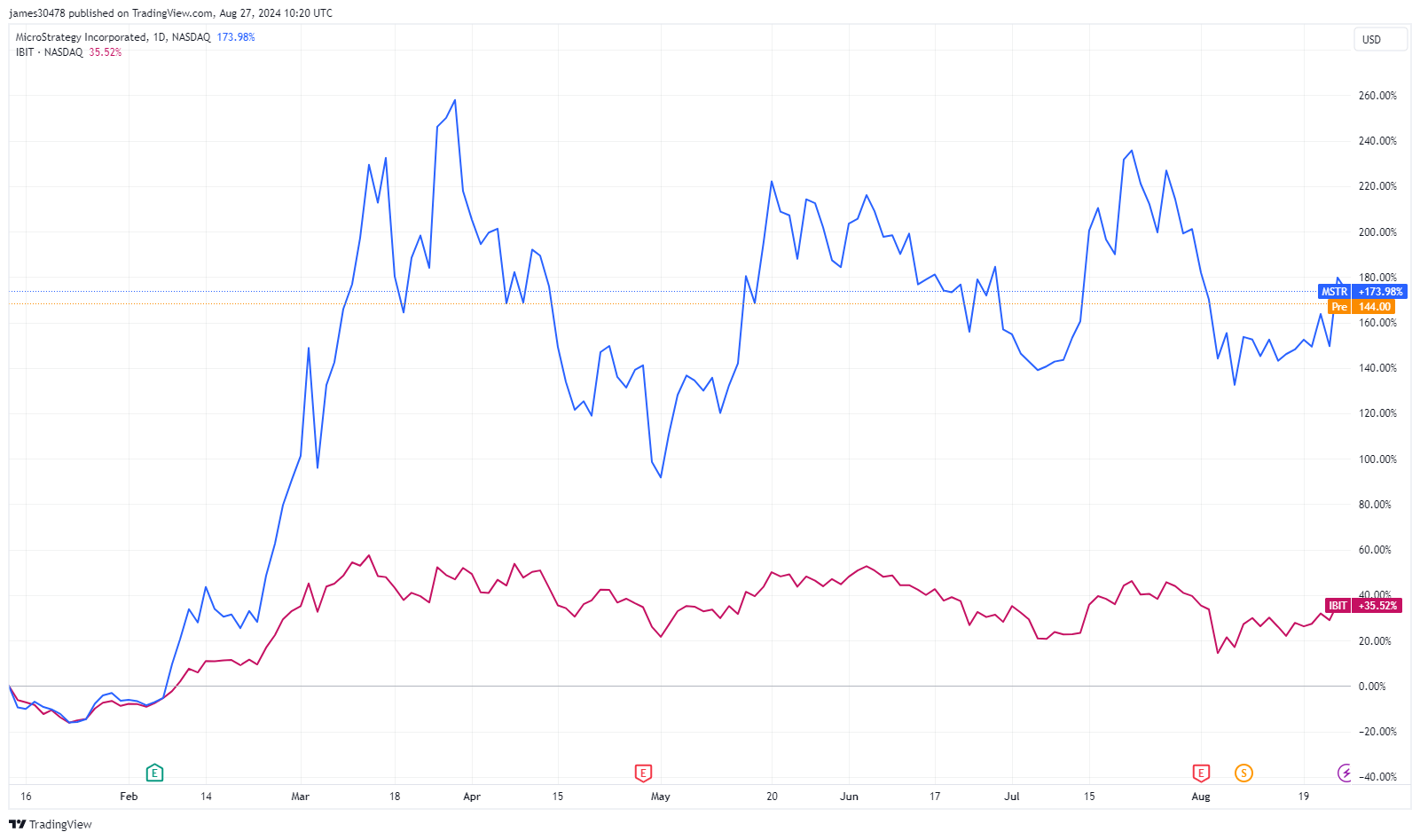

Since the start of 2024, MicroStrategy (MSTR) has delivered an impressive 174% return, far outpacing the 35% return of BlackRock’s Bitcoin ETF (IBIT). To put this in perspective, the IBIT return is notable, as the GLD ETF, which tracks gold, didn’t achieve a 35% return over almost two years. This means MSTR has outperformed IBIT by a factor of five.

Quant Research Analyst Ryan highlighted that MSTR has outperformed IBIT by a factor of 5. Additionally, he notes that current trendlines indicate a continued divergence, suggesting that MSTR is likely to outpace IBIT further.

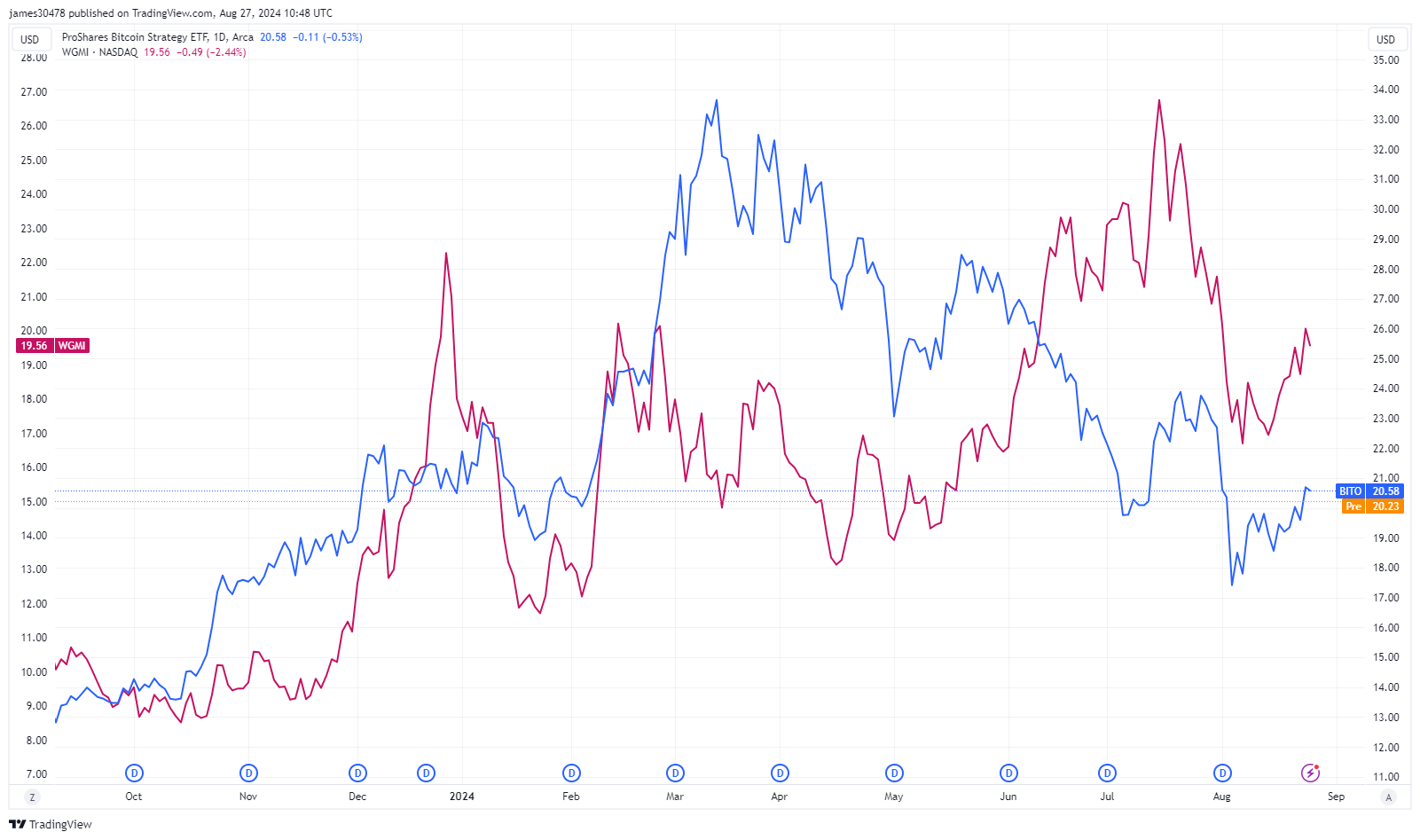

Leading up to the IBIT ETF launch, there was a significant Bitcoin run from $25k in October 2023 to $50k in February 2024, with substantial inflows into BITO, another Bitcoin-related ETF, while Bitcoin miners showed strong performance. Initially, IBIT outperformed MSTR, maintaining this edge until the end of February. However, since then, MSTR has surged ahead.

The momentum for MicroStrategy continued with the launch of the 1.75x leveraged MSTR ETF on Aug. 21. According to Eric Balchunas, a senior ETF analyst at Bloomberg, this ETF has already amassed $127 million in assets, with daily trading volumes exceeding $100 million. Balchunas highlighted its volatility and high trading activity.

“equivalent of a mechanical bull,”