High correlation between Bitcoin and high yield corporate debt, small caps and growth stocks in 2022

High correlation between Bitcoin and high yield corporate debt, small caps and growth stocks in 2022 Quick Take

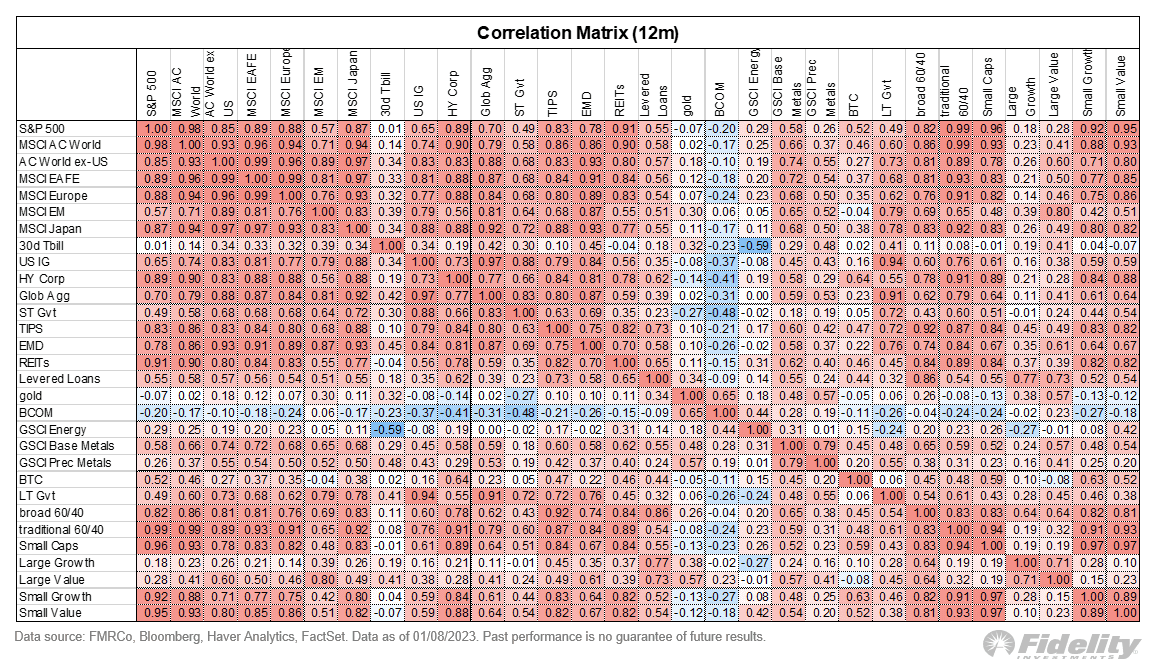

- The majority of assets suffered during 2022, including Bitcoin — which spent the year with a high correlation with high-yield corporate debt, as well as with small-cap and growth stocks.

- Red shows positive correlations, and blue shows negative ones.

- Bitcoin’s correlation with small caps was 0.59, the correlation with high-yield corporate debt was 0.64, and small growth stocks were 0.63.

- These assets could all be considered risk-on or have greater potential over the long term but are more vulnerable to negative events and bearish sentiment.