Crypto liquidations hit $280 million as long and short positions bleed amid market volatility

Crypto liquidations hit $280 million as long and short positions bleed amid market volatility Crypto liquidations hit $280 million as long and short positions bleed amid market volatility

Binance leads short position liquidations in choppy market.

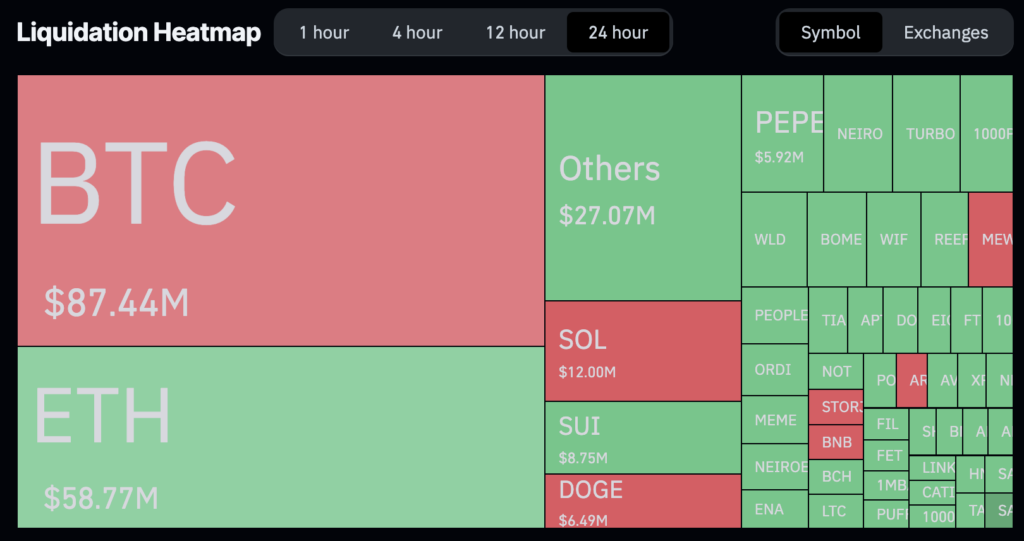

Over the past 24 hours, $280.71 million worth of crypto positions were liquidated, impacting 79,153 traders. Bitcoin’s price increased by 2.79% to $67,861.28, approaching its all-time high of $73,686.93, before retracing slightly to around $67,400. Ethereum saw a rise of 0.93% to $2,628.81.

Long positions accounted for $151.47 million of the liquidations, while shorts made up $129.24 million, according to data from Coinglass. The largest single liquidation occurred on OKX’s ETH-USDT-SWAP, valued at $6.55 million.

In the last four hours, $31.73 million was liquidated, with shorts comprising 73.13%. During this period, Binance led exchanges with $18.89 million in liquidations, 78.23% of which were short positions.

Bitcoin’s market capitalization is now $1.34 trillion, and Ethereum’s is $316.47 billion. Over the past week, Bitcoin and Ethereum have gained 9.8% and 8.26%, respectively.

The significant liquidation of short positions suggests traders betting on a market downturn faced substantial losses as prices climbed. This trend indicates a potential shift in market sentiment toward bullishness.

Farside Investors

Farside Investors