Bitcoin leverage drops to historical lows

Bitcoin leverage drops to historical lows Quick Take

Understanding critical metrics provides essential insights as the digital asset market constantly evolves.

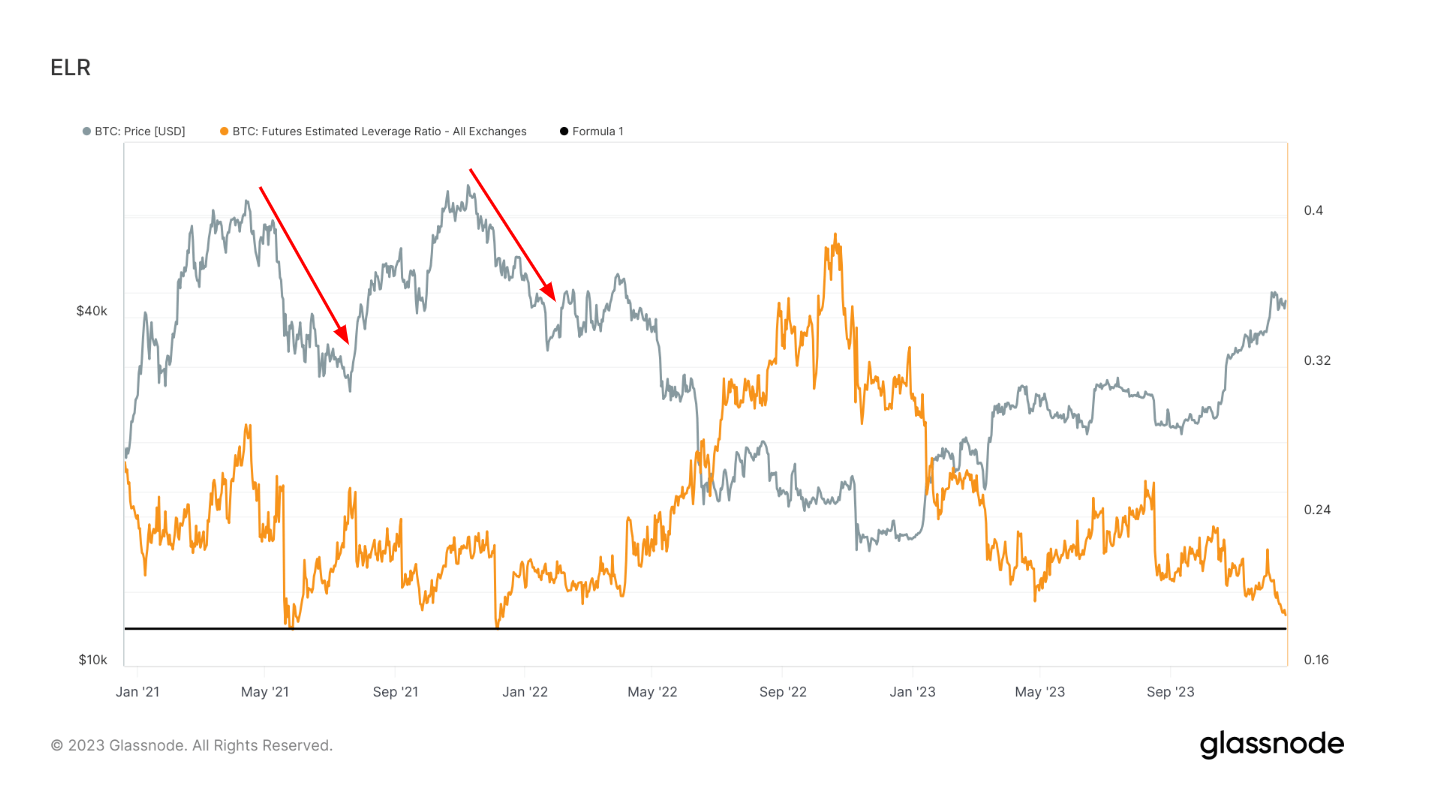

One such indicator, the Estimated Leverage Ratio (ELR), offers a glimpse into the market’s leverage and is noteworthy. Currently, the ELR is nearing historical lows—an occurrence witnessed only twice prior. This indicates a significant reduction in market leverage, implying a conservative approach from traders in the futures market.

Concurrently, the open interest, another pivotal measure, is also approaching year-to-date lows. This is particularly beneficial for Bitcoin, robustly perched over $43,000, as the apparent absence of derivatives and leverage signals a healthier and arguably more sustainable market environment.

The exchange landscape isn’t uniform, however. Deribit is the only prominent exchange currently observing significant leverage. Conversely, Binance, a major player in the digital asset exchange arena, continues its downward trend, nearing an unseen low since Dec. 2022.

Historically, when the Estimated Leverage Ratio (ELR) bottoms out, it has been followed by a downward trend in Bitcoin’s value. This pattern was observed during two critical periods: May 2021, amid China’s mining ban, and Nov. 2022, in the aftermath of the FTX collapse. On these occasions, Bitcoin’s value declined until it found a new local bottom. This recurring sequence suggests a correlation between ELR lows and Bitcoin market value adjustments.