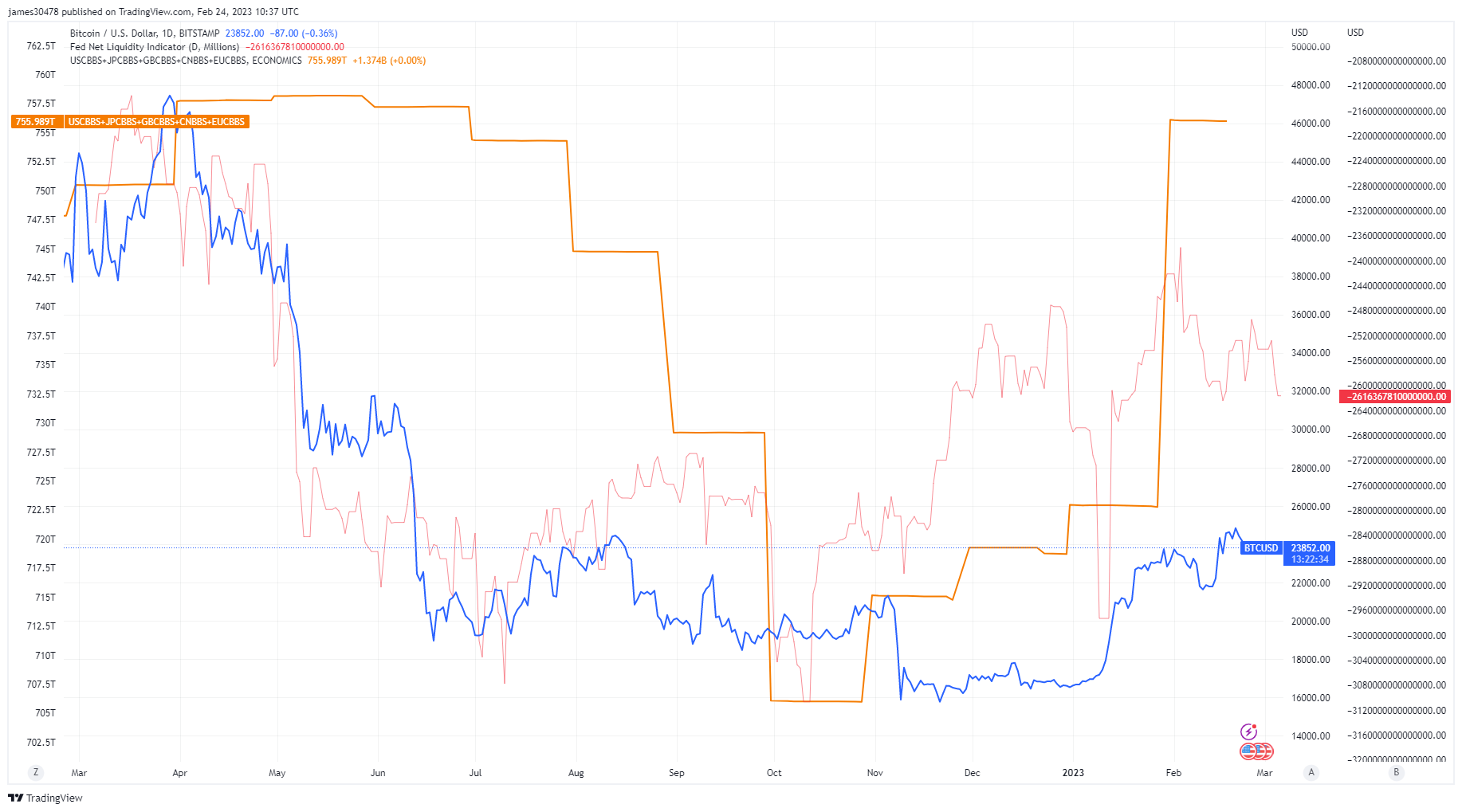

Bitcoin continues to follow the liquidity plus the aggregation of central bank balance sheets

Bitcoin continues to follow the liquidity plus the aggregation of central bank balance sheets Quick Take

- As the global world faces extreme inflation, central banks try to rein in inflation by decreasing their balance sheets (quantitative tightening) and increasing interest rates.

- The blue line is Bitcoin which has soared roughly 50% year to date.

- The orange line aggregates central bank balance sheets, including the US, EU, UK, Japan, and China.

- The red line is the fed net liquidity indicator; the formula is as follows; net liquidity = (fed balance sheet – (Treasury General Account + Reverse Repo)) / units.

- All three metrics have increased from their respective bottoms in October 2022 — while the balance sheet of the major central banks has increased to 756 trillion from roughly 706 trillion

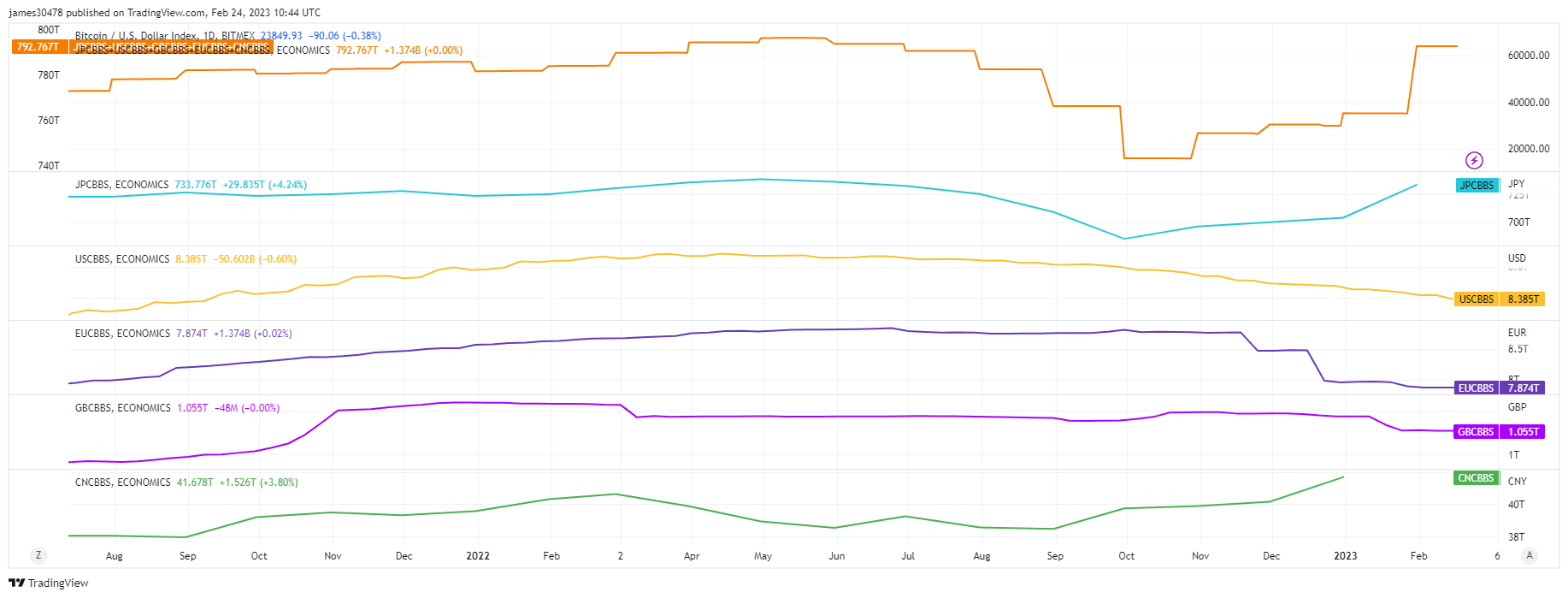

- Japan and China have continued to increase their balance sheet — despite high inflation and undoing the work the US, EU, and UK are trying to achieve.