Innovation around Bitcoin has reduced tx fees, transactions at 2017 highs at 15% the cost

Innovation around Bitcoin has reduced tx fees, transactions at 2017 highs at 15% the cost Innovation around Bitcoin has reduced tx fees, transactions at 2017 highs at 15% the cost

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

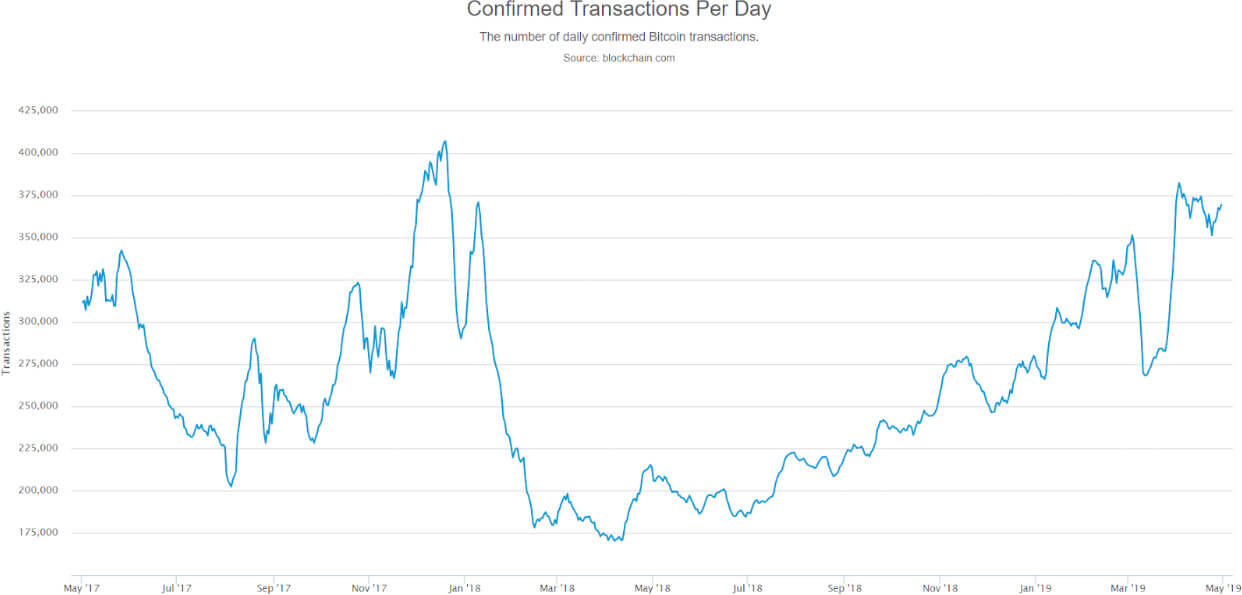

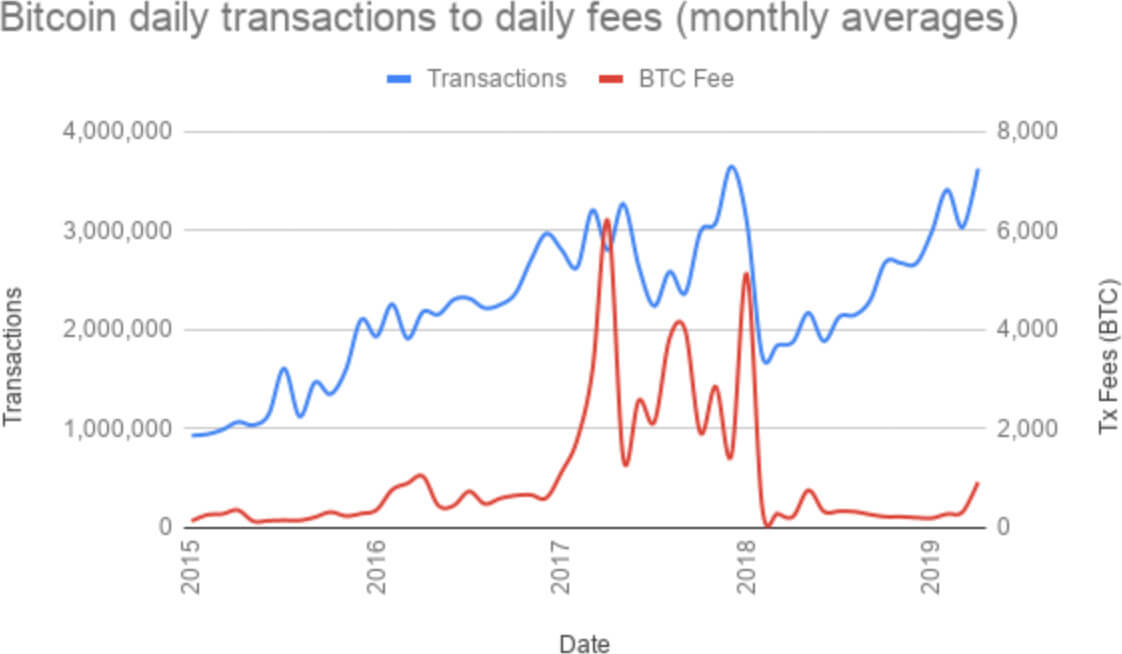

Bitcoin transactions are approaching all-time highs while fees remain low. The number of transactions conducted in April is comparable to the peak of the market in December of 2017, yet total BTC fees decreased by 85 percent. What changed?

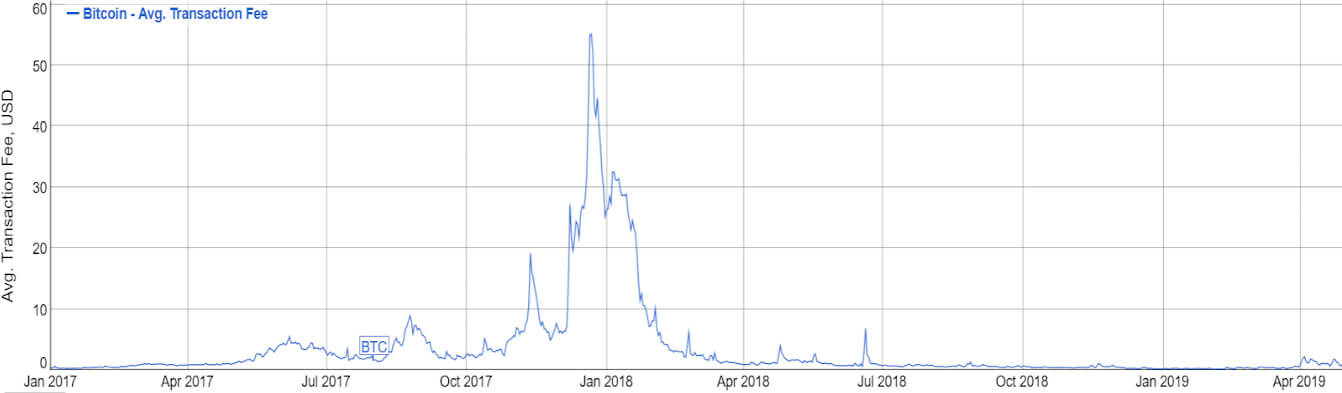

Bitcoin Transaction Fee History

Transaction fees on the Bitcoin network rose to absurd levels during 2017. At the start of the year, average fees were below $0.40 per transaction. Accelerating interest in the technology in conjunction with skyrocketing BTC prices culminated in average fees of $20. For several days in December of 2017 an average transaction cost $55 to send.

Fees plummetted following the onset of the bearish crypto market as the number of transactions dropped. Average fees once again returned to sub $1.00 levels in March of 2018 and dwindled through 2018—even when transactions over the Bitcoin blockchain steadily increased.

Following bitcoin’s rally from $4,100 to over $5,000 on Apr. 1st, bitcoin trading volume and transactions per day rose to levels not seen since early 2018. Transactions averaged over the month of April are comparable to levels seen during December 2017. Yet, fees are substantially lower in both USD and BTC terms.

The decrease in transaction fees (in satoshis) likely stems from two factors—SegWit and transaction batching.

Segregated Witness (SegWit)

Activated in August of 2017 via soft fork, SegWit (Segregated Witness) made transactions smaller by removing signature data while increasing block capacity. Moreover, blocks created after SegWit activated could theoretically include almost four times as much data as they could previously.

Consequently, this made transactions cheaper, on average, by increasing both the throughput of the network by increasing the number of transactions that can be included in a single block.

That said, since SegWit was implemented via soft fork, not all users were required to use the new standard. However, its use has steadily increased since implementation.

Transaction Batching

Another factor that has kept fees low is transaction batching. Prior to 2016, nearly all transactions included a single sending address (input) and a single recipient address (output). However, it is possible to ‘batch’ multiple financial transactions in a single Bitcoin transaction by combining multiple sends and receives.

By using this technique a sender is able to reduce the space a transaction takes on the blockchain, through the elimination of redundant data, by up to 75 percent. Compared to sending individual transactions, batching can reduce the cost per financial transaction by upwards of 80 percent.

Analysis suggests that batching increased substantially following the fee crisis of 2017. As fees reached astronomical levels, members of the community called for exchanges and payment processors to begin batching transactions to conserve block space. Now, many exchanges send transactions with 100 or 200 recipients in a single Bitcoin transaction.

In May of 2018, 12 percent of all transactions were batched. These transactions accounted for 40 percent of all outputs and between 30-60 percent of transaction value in BTC. These figures have continued to trend upwards.

Something else to keep in mind, the total number of economic transactions that take place using the Bitcoin network is still underrepresented if second-layer solutions such as the Lightning Network are included.

Innovations around Bitcoin have once again addressed some of the limitations of the technology. Whether it’s through software upgrades, second-layer scaling, or surrounding infrastructure changes, BTC is slowly improving—allowing the network to remain secure while users to enjoy lower fees.

Bitcoin Market Data

At the time of press 2:52 am UTC on Nov. 7, 2019, Bitcoin is ranked #1 by market cap and the price is up 0.49% over the past 24 hours. Bitcoin has a market capitalization of $95.7 billion with a 24-hour trading volume of $13.32 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 2:52 am UTC on Nov. 7, 2019, the total crypto market is valued at at $175.83 billion with a 24-hour volume of $40.73 billion. Bitcoin dominance is currently at 54.37%. Learn more about the crypto market ›