Here’s the factor that signals Bitcoin may soon see immense gains

Here’s the factor that signals Bitcoin may soon see immense gains Here’s the factor that signals Bitcoin may soon see immense gains

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

It’s no secret that Bitcoin (BTC) was the best performing asset of the last decade, clocking returns of such a great magnitude that early investors could essentially turn pocket change into millions of dollars.

Although this growth has slowed as the market has grown, BTC is already the best performing asset of the new decade, and one key indicator signals that it may continue incurring immense upwards momentum in the weeks, months, and even years ahead.

Bitcoin Bulls Maintain 2020 Uptrend After Defending Key Support Level

In early-January, sellers attempted to spark another capitulatory drop in an effort to force Bitcoin below the strong support it had established around $7,000 in late-2019.

This selling pressure ultimately lead the cryptocurrency as low as $6,800 before the immense buying pressure that existed in this region threw BTC into a firm uptrend that ultimately led its price to climb as high as $8,400.

Although Bitcoin has dropped from these highs, bulls were able to defend its EMA8 at roughly $7,700 during an overnight sell-off, which allowed the crypto to once again climb up towards $8,000.

The cryptocurrency’s 18 percent rally from its January 3rd lows has made it the best performing major asset so far this decade, and bull’s ability to continue defending key support levels like the EMA8 may signal that a further extension of this momentum is imminent. Bob Loukas, a prominent analyst and trader, noted while referencing the overnight bounce.:

“BTC retraced the breakout and bounced nicely. Very simple. Nothing to do but sit long and see what it could do.”

This Factor Signals BTC is Bound for Immensely Further Bullishness

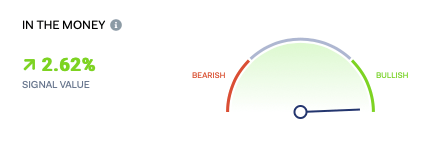

One factor that should be closely considered when determining the macro trend of Bitcoin and other digital assets is the percentage of wallet addresses that are “in the money.”

Data from CryptoSlate partner IntoTheBlock shows that the sheer amount of BTC wallet addresses that are profitable is one of the most bullish fundamental factors currently underpinning the cryptocurrency.

The recent rally has naturally allowed this figure to increase significantly, and it appears that the overnight bounce from Bitcoin’s EMA8 led this number to jump 2.62 percent.

There is an abundance of other factors that IntoTheBlock takes into consideration while determining an asset’s macro trend, but at the moment this is the most bullish factor going for Bitcoin, as it signals that the crypto has firm upwards momentum and confident investors.

Bitcoin Market Data

At the time of press 5:47 am UTC on Jan. 12, 2020, Bitcoin is ranked #1 by market cap and the price is down 0.19% over the past 24 hours. Bitcoin has a market capitalization of $146.95 billion with a 24-hour trading volume of $24.83 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 5:47 am UTC on Jan. 12, 2020, the total crypto market is valued at at $216.06 billion with a 24-hour volume of $85.38 billion. Bitcoin dominance is currently at 68.03%. Learn more about the crypto market ›