Germany’s stock exchange will list first “centrally cleared” Bitcoin ETF, BitGo to serve as BTC custodian

Germany’s stock exchange will list first “centrally cleared” Bitcoin ETF, BitGo to serve as BTC custodian Germany’s stock exchange will list first “centrally cleared” Bitcoin ETF, BitGo to serve as BTC custodian

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin-pegged institutional trading products like ETFs and futures have been a running theme since 2016. However, the road has proven difficult, with regulators and lawmakers impeding most of such developments.

But Germany’s forward-thinking financial sector seems to have embraced such products. The country’s stock exchange will now list a BTC-pegged exchange-traded fund (ETF), after a new development on June 9.

Bitcoin, now at an exchange in Germany

The Deutsche Börse’s XETRA platform will commence trading of Bitcoin ETC before July, as per an announcement.

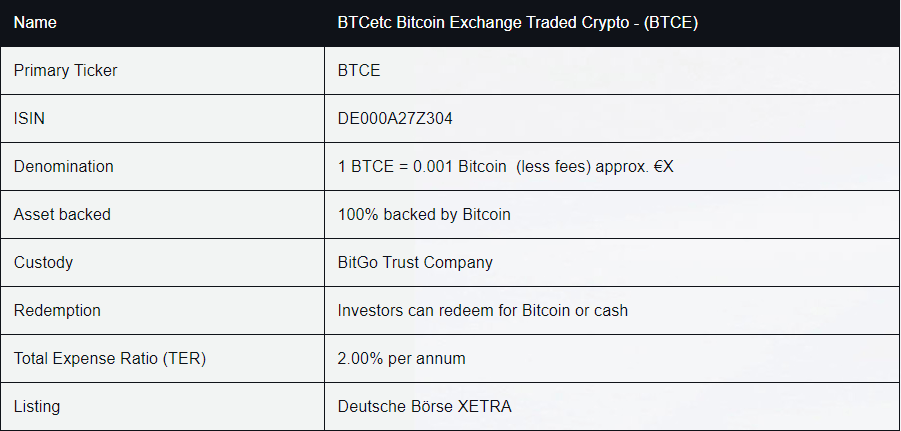

Touted as the world’s first “centrally cleared” Bitcoin ETF, the fund backs Bitcoin’s volatile movements and is 100 percent backed by “physical Bitcoins.” A look at the prospectus shows U.S. cryptocurrency custodian and wallet firm BitGo will serve as the custodian for all Bitcoins locked in the ETF.

To be listed under ticker “BTCE,” the ETF provides German, European, and all international accredited investors to gain exposure to Bitcoin and potentially profit off the pioneer cryptocurrency’s infamous price spikes.

Each unit of BTCE gives the holder serves as a “claim” on 0.001 BTC — about $10 at current prices. Holders have an option of redemption in Bitcoin, in case they wish to.

However, the risk for equally huge losses remains, as some funds experienced in March 2020 after “Black Thursday” saw Bitcoin falling over 45 percent in two consecutive trading sessions.

BTCE is the first cryptocurrency product to launch on XETRA, and the first such product offered by the ETC Group. The latter is backed by several institutional investors from London, and hopes to bring expertise and technology from traditional markets to the regulated digital assets sector.

Bradley Duke, CEO of ETC Group spoke on the development:

“BTCE brings transparency and investor protection that regulators and institutional investors require to the world of Bitcoin. The crypto sector has been held back by concerns about complexity, accessibility, and governance.

Duke added BTCE serves as a catalyst for mainstream Bitcoin adoption among regulated markets and seasoned players. The move, he notes, also eliminates the need to purchase Bitcoin via obscure exchanges and dealing with the hassles of storing private keys.

Market makers to ensure liquid BTC markets

Apart from issuing the ETF, the ETC is partnering with HANetf, another German firm, to create educational and insightful content pertinent to cryptocurrency storage and investing.

Trading and investing in BTCE is similar to how Bitcoin purchases work on crypto-exchanges. All transactions are identical to traditional ETFs, with the same regulatory protections in place. This supersedes any additional steps on part of a potential BTCE investor.

The ETF is approved by BaFin, Germany’s financial regulator. In March 2020, the regulator confirmed that they officially recognize cryptocurrencies as financial instruments.

A set of institutional Market Makers have been appointed to provide on-exchange liquidity and tight spreads, reducing any potential market impact.

It remains to be seen how well the Bitcoin ETF works in the German market. Similar products on America’s CME have not seen huge volume and have failed to usher in billions of institutional capital, as CryptoSlate reported on previously.