Research: Ethereum’s 2 years peak dominance over Bitcoin has not translated into new ATH

Research: Ethereum’s 2 years peak dominance over Bitcoin has not translated into new ATH Research: Ethereum’s 2 years peak dominance over Bitcoin has not translated into new ATH

Bitcoin performs better in a risk-off environment while Ethereum performance is better in a risk-on market.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin (BTC) might be worth more than Ethereum (ETH), but available Glassnode data, as analyzed by CryptoSlate, shows that ETH’s peak dominance has outperformed BTC’s in the last two years.

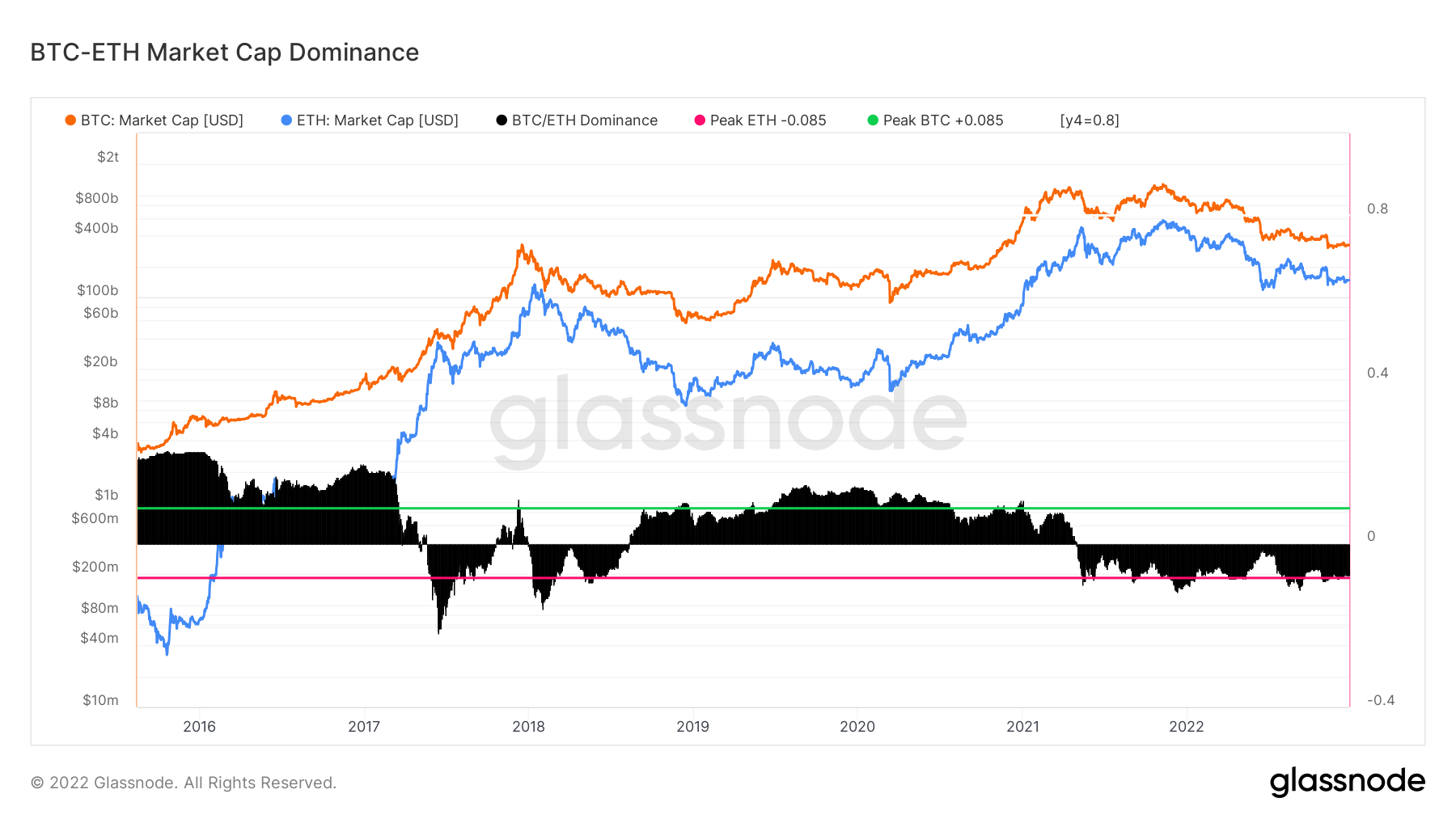

Glassnode’s BTC-ETH Market Dominance metric is an oscillator that tracks the macro performance trends for the top two cryptocurrencies. The market cap dominance discounts lost and long-dormant coins, providing a model that accurately assesses the capital inflows and outflows of the assets. This metric considers BTC and ETH’s market cap alone.

The chart above shows that Ethereum had its peak market dominance as far back as 2017, even before the asset’s realized market cap peak. ETH also saw its dominance return in 2018 and has maintained it since late 2021.

BTC peaked during the bear market period between the end of 2018 and early 2021 — showing that it is a better asset during the risk-off environment.

A risk-off environment describes a bear market situation where investors exit risky assets like stocks and hedge their funds in safe-haven investments like gold and bonds. This might explain why many analysts and investors consider Bitcoin digital gold.

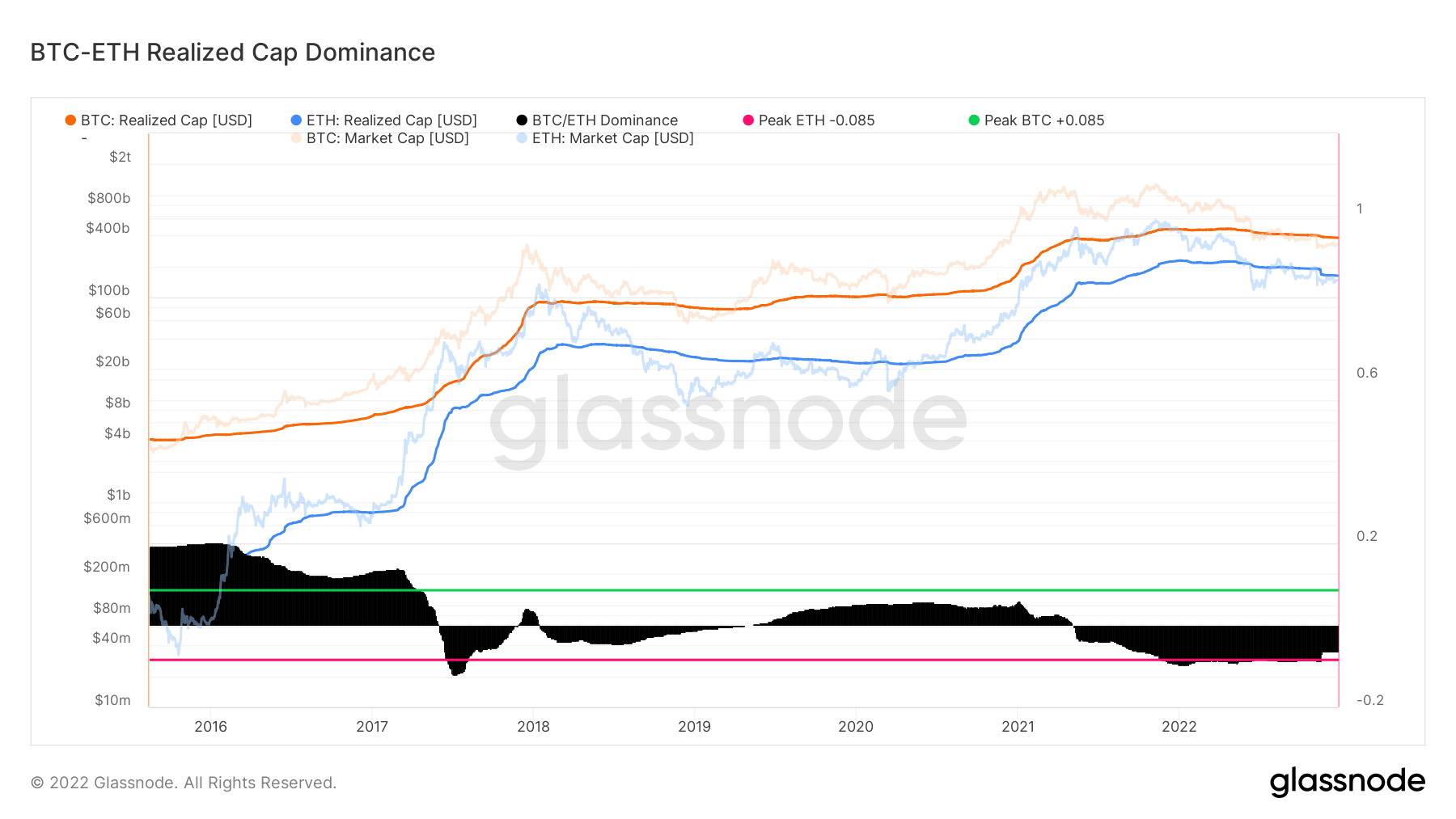

On the other hand, ETH trades better in a risk-on environment when investors are more willing to put their funds into risky assets. This is why ETH’s dominance flipped that of BTC since the early bull run of 2021 and has maintained that performance until now. Ethereum’s dominance over BTC in terms of realized market cap peaked at over 0.765, according to the Glassnode chart below.

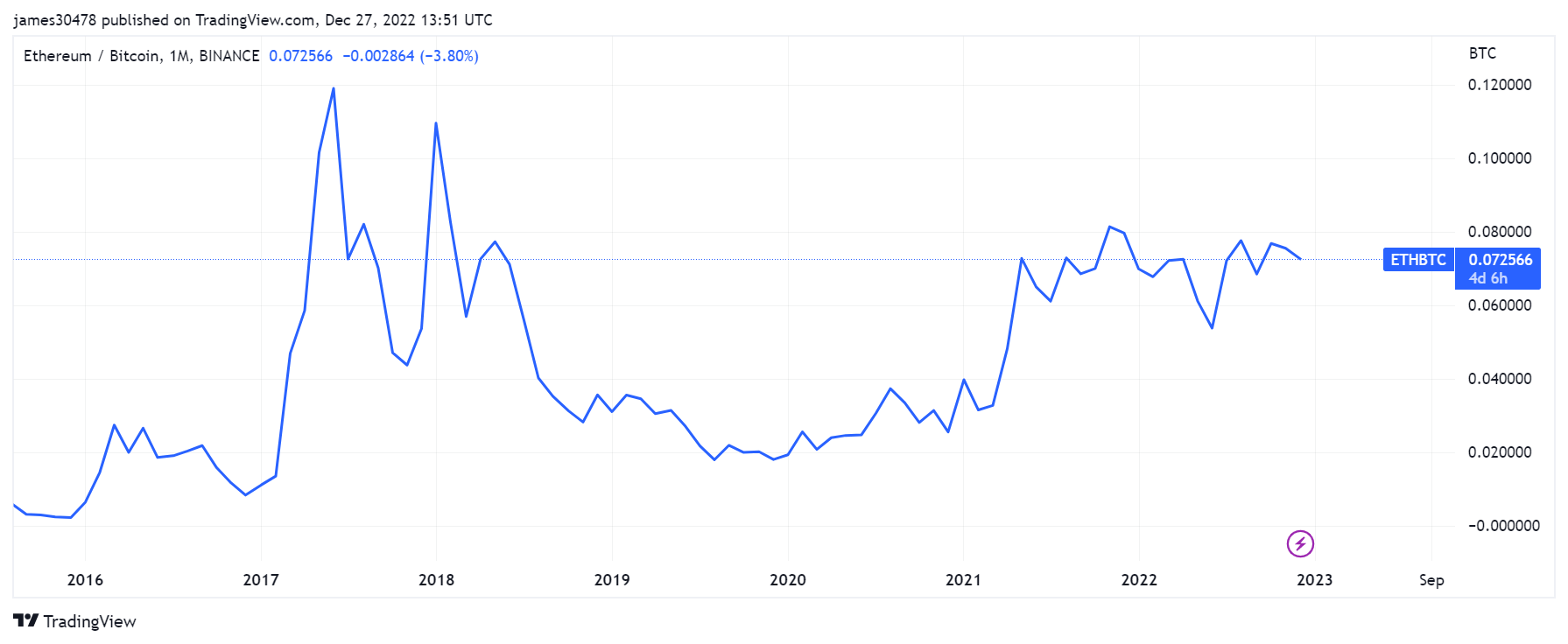

However, ETH’s dominance over the past two years has not translated into better performance for the asset. Its dominance has gradually declined since 2017, with all other peaks in 2021 and 2022 failing to beat the previous highs. The reason behind this decline remains unknown.

However, the success of the Ethereum Merge has seen the asset turn deflationary a few times, and its issuance rate has substantially declined. Reports have suggested that the asset might be gradually turning into a store of value based on the conviction of long-term holders.

With the markets becoming more bearish again, BTC is already showing signs that it could outperform ETH in a risk-off environment. It has surpassed Ethereum in the last 60 days.

Several data and market analysts are predicting a recession in 2023; this could continue to play into BTC’s strength of being a safer asset in a risk-off environment.