Ethereum stands to benefit greatly from DeFi “eating” traditional finance: analysts

Ethereum stands to benefit greatly from DeFi “eating” traditional finance: analysts Ethereum stands to benefit greatly from DeFi “eating” traditional finance: analysts

Photo by Smit Patel on Unsplash

As it stands, decentralized finance (DeFi) overtaking or rivaling Wall Street is a quixotic dream for its proponents.

There are many hacks of DeFi applications, like when a hacker recently drained $25 million worth of Ethereum and other crypto assets from a decentralized lending platform called dForce. And due to misunderstandings about protocols and coins, there is clearly much education to be done regarding how these applications work.

Despite these barriers to entry, a prominent investor believes it is only a matter of time before DeFi “eats” finance.

Investor explains why DeFi will “eat” traditional finance

DeFi threatens traditional finance due to the benefits of accessibility and liquidity, “active” DeFi investor and Ethereum proponent “Arthur_0x” wrote in a recent edition of Camilla Russo’s The Defiant newsletter/publication.

Cheong explained that with the introduction of trustless and permissionless systems with Bitcoin and its derivatives, DeFi immediately one-ups traditional banks because it “can provide universal access to financial services.” This industry, as a result, can and will provide “much better products and services at scale than traditional finance,” he added.

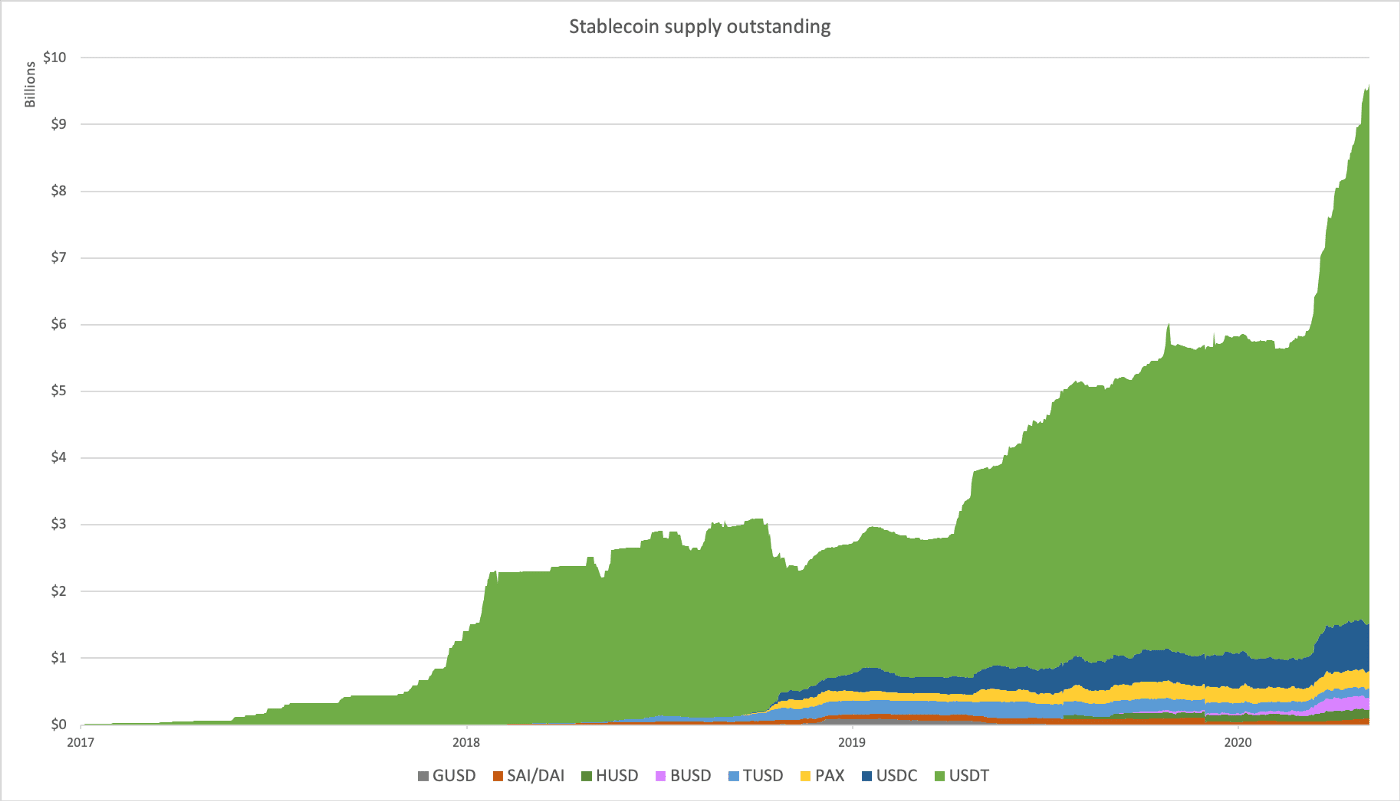

He illustrated this assertion with the image below, showing the supply of stablecoins on the Ethereum blockchain. Due to the recent U.S. dollar shortage, demand for “blockchain dollars” have gone parabolic, with assets like USDT somewhat filling the holes in global demand for dollars.

Notably, there is no hard evidence to confirm that the real-world dollar shortage is causing demand for blockchain dollars to spike, but the timelines do match up.

The investor added that with the (relatively) high-interest rates offered by applications like Aave and Compound, coupled the low (and even negative) interest rates offered by traditional banks, the DeFi bull case is bolstered even further.

Ethereum stands to benefit.. really benefit

Many blockchains have their own role in DeFi — Tron has JUST, Bancor operates on EOS, and even Bitcoin acts as a transaction medium for crypto exchange and financial services company Abra.

But by and large, DeFi is an Ethereum-centric trend, with the blockchain hosting an $800+ million DeFi ecosystem by some estimates.

That means that should DeFi continue to grow, Ethereum — and ETH the cryptocurrency especially — stands to benefit.

Ryan Selkis, chief executive of crypto researcher and data provider Messari, explained that the introduction of this use case gives ETH a “higher ceiling” than 2017/2018 to rally towards in the next crypto bull market. For reference, the asset reached $1,400 in 2018 and a BTC price of around 0.12.

This was echoed by MakerDAO founder Rune Christensen, who recently said that Ethereum will “attract all value [in crypto]” due to DeFi:

“4 million Dai was just minted with WBTC in a single transaction. This really showcases the latent demand for non-ETH assets, and it’s the beginning of a broader trend of DeFi acting as an economic vacuum that will eventually attract almost all value to the Ethereum blockchain.”