Crypto scams, exploits down 71% YoY as $370M lost since January

Crypto scams, exploits down 71% YoY as $370M lost since January Crypto scams, exploits down 71% YoY as $370M lost since January

Euler Finance, BonqDAO, and CoinDeal recorded the highest losses with $196 million, $120 million, and $45 million, respectively.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The crypto sphere lost $372 million to scams and exploits in the first quarter of 2023, according to a recent report from the creators of Rekt Database, De.Fi (formerly DeFiYieldApp.)

According to the report, Euler Finance, BonqDAO, and CoinDeal suffered the top three most considerable losses with $196 million, $120 million, and $45 million, respectively.

Q1 losses

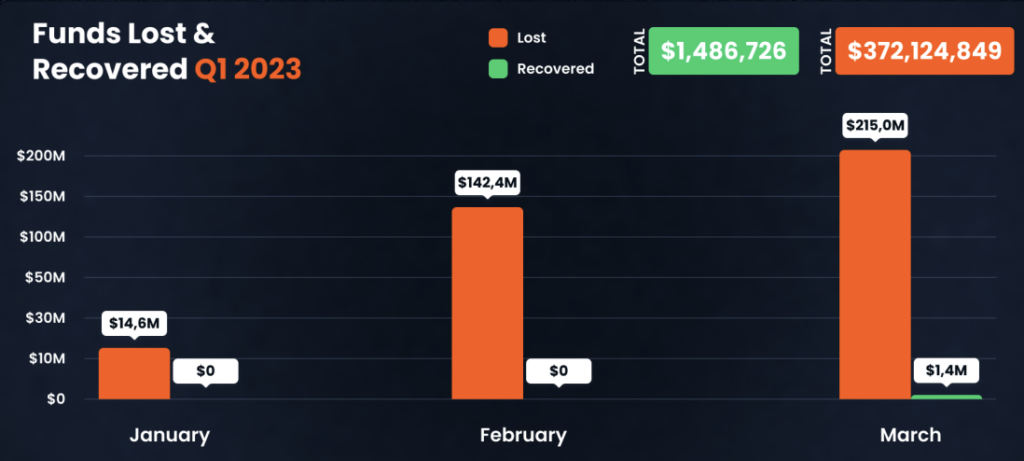

The amount lost to scams and exploits recorded a steady growth from January to March. The $14.6 million recorded in January grew by 875% in February and reached $142,4 million. This amount grew by another 50% to see $215 million in March.

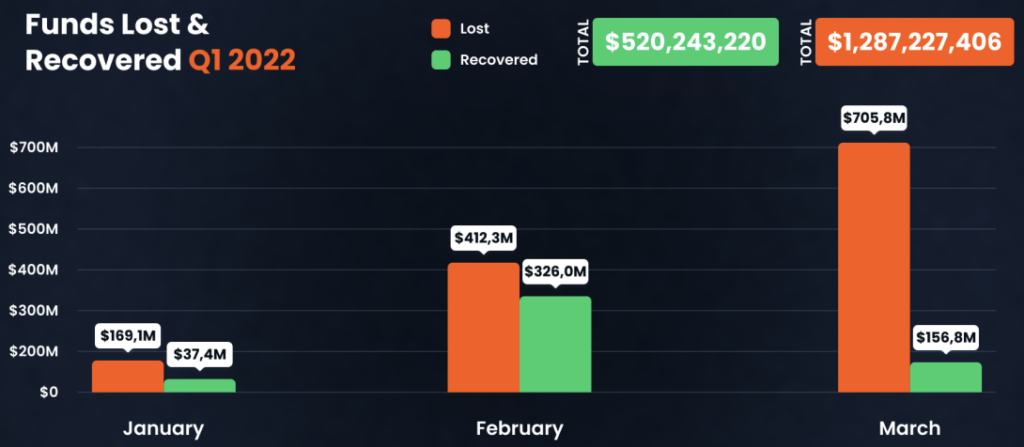

It is worth noting that this year’s $372 million reflects a 71% decrease from the $1.2 billion recorded in the first quarter of 2022.

Biggest losers

The report also noted that Euler Finance, BongDAO, and CoinDeal contributed the most to the amount lost to exploits and schemes.

On March 13, Euler Finance suffered a flash loan attack and lost $197 million, which placed Euler at the top of the charts as the most significant loss of the first quarter of 2023. BonqDAO followed Euler Finance by losing $120 million to an oracle issue on Feb. 2. CoinDeal scheme is placed third as it raised $45 million until it got busted on Jan. 4.

The aggregate amount lost by Euler Finance and BonqDAO added up to $317 million, which accounts for 85% of the total losses recorded since January. The report also noted that flash loan attacks resulted in the most considerable losses during the first three months of the year, while oracle issues followed as the second, corresponding with the methods of the two most significant attacks of the first quarter.

Chains most attacked

When the attacks are categorized based on their chain, BNB Chain (BNB) emerged as the most popular chain for crypto criminals. BNB Chain suffered 18 episodes out of 47 recorded during the first three months of the year, which account for over 38% of the attacks.

Ethereum (ETH) followed BNB Chain as the second most popular choice by being the target of 10 attacks, accounting for 21% of the attacks. Arbitrum (ARB) was placed third by suffering seven attacks during the first quarter of 2023.

Recovery rate

According to numbers, the losses recorded in January and February accounted for 42% of the total losses recorded in the first quarter of 2023, with a zero recovery rate. Only $1.4 million was recovered in March, compensating for less than 0.3% of the total losses recorded since January.

This rate appears considerably lower than the recovery rate recorded in the first quarter of 2022. Over $1.2 billion was lost to scams and exploits during the first three months of 2022. Of that amount, $520 million was recovered, which accounted for 40% of the total amount lost.