BitMEX and Coin Metrics launch a new set of technical tools

BitMEX and Coin Metrics launch a new set of technical tools BitMEX and Coin Metrics launch a new set of technical tools

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

BitMEX and Coin Metrics announced the release of a new technical tool that aims to provide in-depth data about the state of the Bitcoin network.

Bitcoin transactions statistics

BitMEX Research, the research arm of the cryptocurrency derivatives exchange BitMEX, in collaboration with one of the leading providers of crypto asset market and network data, Coin Metrics, announced on the release of TXStats.com. This is a website that provides comprehensive and thorough data analytics about the usage of the Bitcoin network.

TXStats.com will replace P2SH.info. This was a project created by the lead data engineer at Coin Metrics Antoine Le Calvez. The idea behind it was to monitor pay to script hash transactions (P2SH). And, produce up-to-date charts about the volume of these transactions, their average amount, and other relevant information.

Now, the new platform will provide several dashboards focused around specific elements of Bitcoin transactions. It highlights the usage of the network by tracking essential statistics. These include batching transactions, multi-signature usage data, Lightning Network channels data, Bech32 adoption, and many more.

Bitcoin scalability solutions

One of the many statistics provided by TXStats.com is the implementation growth of different solutions to the Bitcoin scalability problem.

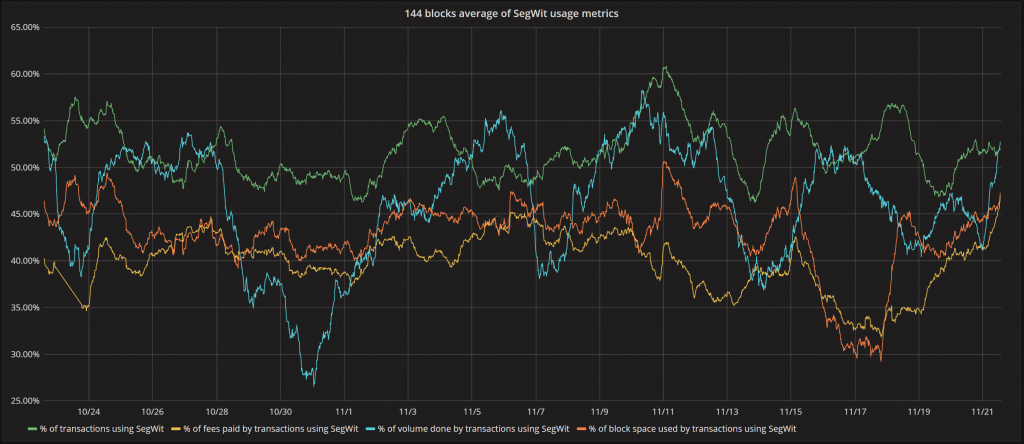

Segregated Witness or SegWit, for instance, is a solution that was implemented via soft fork on Aug. 2017. It removes signature data from transactions freeing up to 65 percent of the space in a given transaction. Subsequently, allowing more of them to fit in a block.

Based on data from TXStats.com, SegWit transactions recently hit an all-time high. These transactions rose to nearly 61 percent of all the activity on the Bitcoin blockchain. This is a clear sign that its adoption continues to experience steady growth even though some of the most prominent companies in the space have failed to implement it.

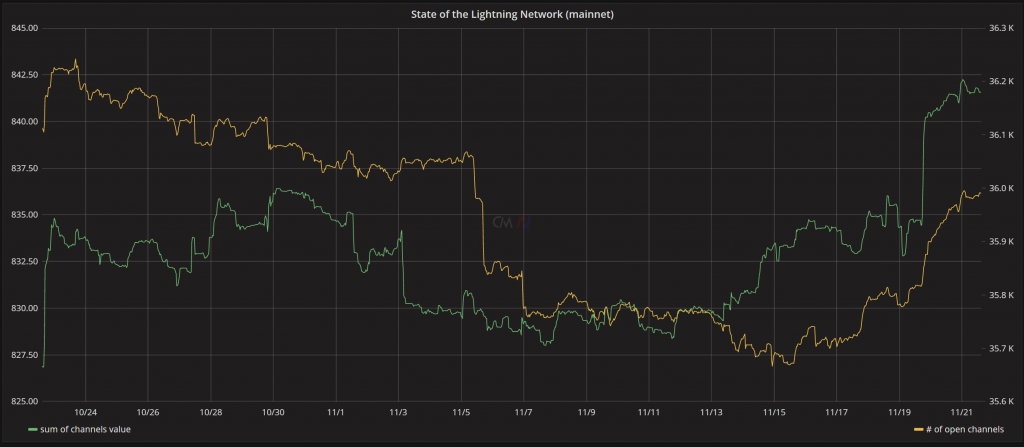

Additionally, the Lightning Network, a decentralized system for instant and high-volume Bitcoin micropayment, has seen the total value of payments transacted within payment channels rise over the last few weeks. Despite experiencing a sharp decline since late October, the number of open channels is surging once again, with almost 36,000 payment channels open.

The fluctuation seen on the value and the open channels in the Lightning Network proves that people are not just setting up and running network nodes. People are opening and closing payment channels regularly, which demonstrates that Bitcoin’s Lightning Network is growing.

Moving forward

The data provided by BitMEX Research and Coin Metrics on their new site, TXStats.com, represents a breakthrough for those analysts who are not only looking at the price of Bitcoin. With more in-depth information, anyone can evaluate the growth of the network as this cryptocurrency becomes widely adopted. According to both firms, they would add more crucial statistics to the website based on the community’s feedback. This will help the site grow, and investors make wiser decisions.