Bitcoin price jumps above Dow Jones Index (DJI) while Ethereum nears $1,100

Bitcoin price jumps above Dow Jones Index (DJI) while Ethereum nears $1,100 Bitcoin price jumps above Dow Jones Index (DJI) while Ethereum nears $1,100

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Two of the world’s largest cryptocurrencies by market cap set new records over the weekend.

The day Bitcoin ran

After Bitcoin, the world’s first and current largest cryptocurrency by market cap, crossed the $34,000 level on Saturday, it set both a record all-time high and crossed a major US index — the Dow Jones Industrial Average (DJIA).

#Bitcoin has now overtaken the Dow Jones after its incredible performance. (HT @bespokeinvest) pic.twitter.com/rACFJWhKyW

— Holger Zschaepitz (@Schuldensuehner) January 2, 2021

Popularly called the Dow Jones, or simply the Dow, the DJIA is a stock market index that measures the stock performance of 30 large companies listed on stock exchanges in the United States.

It’s one of the oldest indices — formed in 1896 and second only to the Dow Jones Transportation Average — and had a market cap of $8.33 trillion as per 2019 official figures.

The Dow Jones even set its own record high last week after touching the 30,000 value, buoyed up by its various constituent companies like Apple, Microsoft, Honeywell, and others.

But Bitcoin’s now higher than that. It currently trades at $33,000 after meeting a brief sell-off during the Asian session this morning. Dow, on the other hand, traded at 30,606 and is closed for trading since Friday.

However, the figures are only in terms of the index value. Bitcoin’s market cap, as per CryptoSlate’s data page, remains a relatively tiny $611 billion — or over 15 times lesser than what the Dow Jones is currently worth.

This suggests Bitcoin — despite its high prices — still remains a niche asset class with further room to grow. And for the broader space, the run’s only getting started.

Ethereum touches 2017 levels

Ethereum, the world’s most-used blockchain, touched a price of $1,047 per ETH this morning amidst a stronger fundamental narrative and Bitcoin prices cooling off.

Many crypto industry observers suggest that while Bitcoin is now limited to a “digital gold” narrative, Ethereum can function as both a currency (for everyday use) and as a store-of-value backed by all the other use cases and blockchains that it bootstraps.

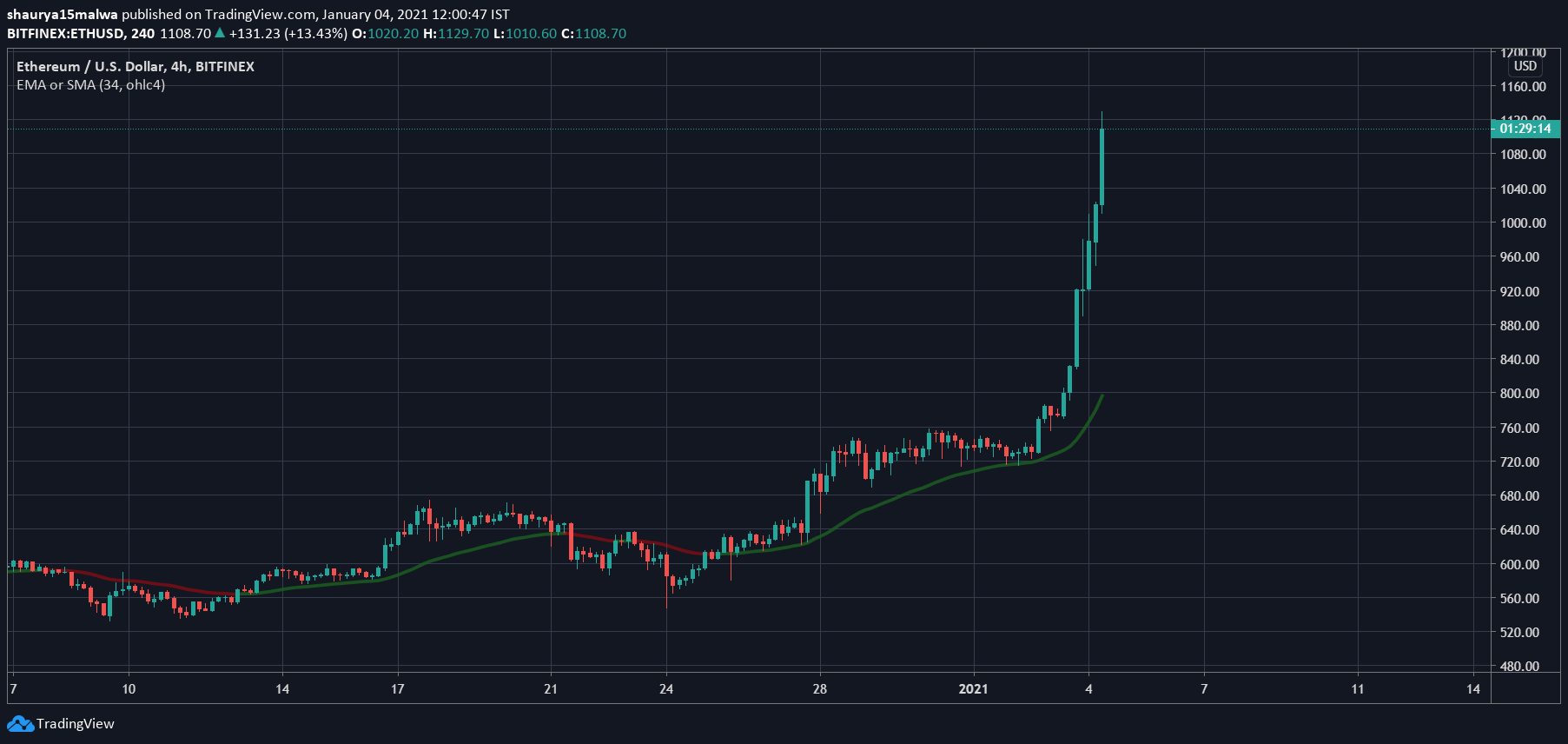

Following a near-vertical move, ETH trades above the 34-period exponential moving average as of press time. The trend began earlier this month, as the chart shows, around the $550 mark — netting investors and speculators nearly 100% if they held on.

CoinGlass

CoinGlass

ETH

ETH