Bitcoin price races past $12,000 as Ethereum, XRP, and Litecoin pairs get decimated

Bitcoin price races past $12,000 as Ethereum, XRP, and Litecoin pairs get decimated Bitcoin price races past $12,000 as Ethereum, XRP, and Litecoin pairs get decimated

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin’s meteoric rally continues as the price nears $12,000. Meanwhile, altcoin/BTC pairs—including Ethereum, XRP, and Litecoin—are getting decimated as funds flow into the predominant cryptocurrency.

Bitcoin’s rally continues to accelerate

Bitcoin is once again on a tear. After breaking $10,000 just four days ago, the coin is now nearing the $12,000 price level. Reported 24-hour volume is at robust $26 billion compared to the 7-day average trading volume of $20 billion.

The last time BTC traded at $12,000 was at the end of January of 2018, shortly after the market started to decline from its peak. The year-long bear market followed as prices plummeted.

Current state of the market

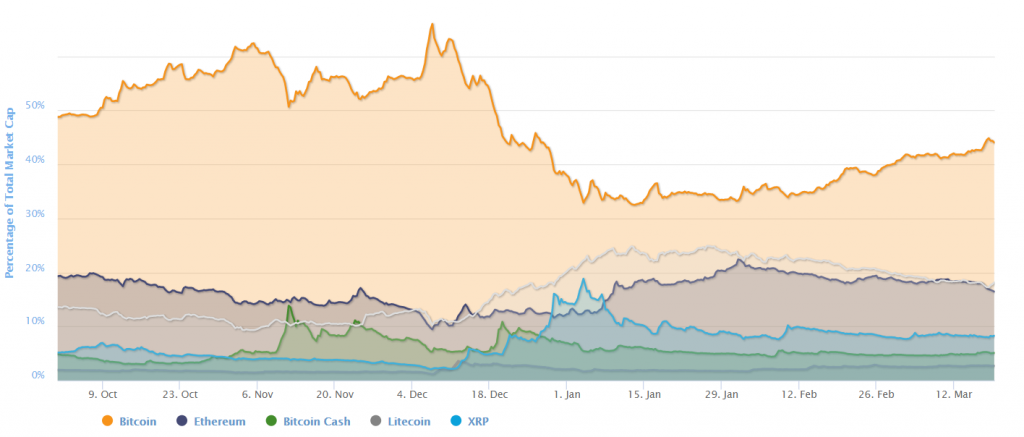

Currently, Bitcoin dominance, the percentage of overall market capitalization attributed to BTC, is climbing towards its previous two-year high.

During the previous bull market, BTC dominance reached a high of 69.46 percent in December of 2017. It then dropped sharply the following month, falling to 35.11 percent as altcoins underwent their historic eye-popping rally.

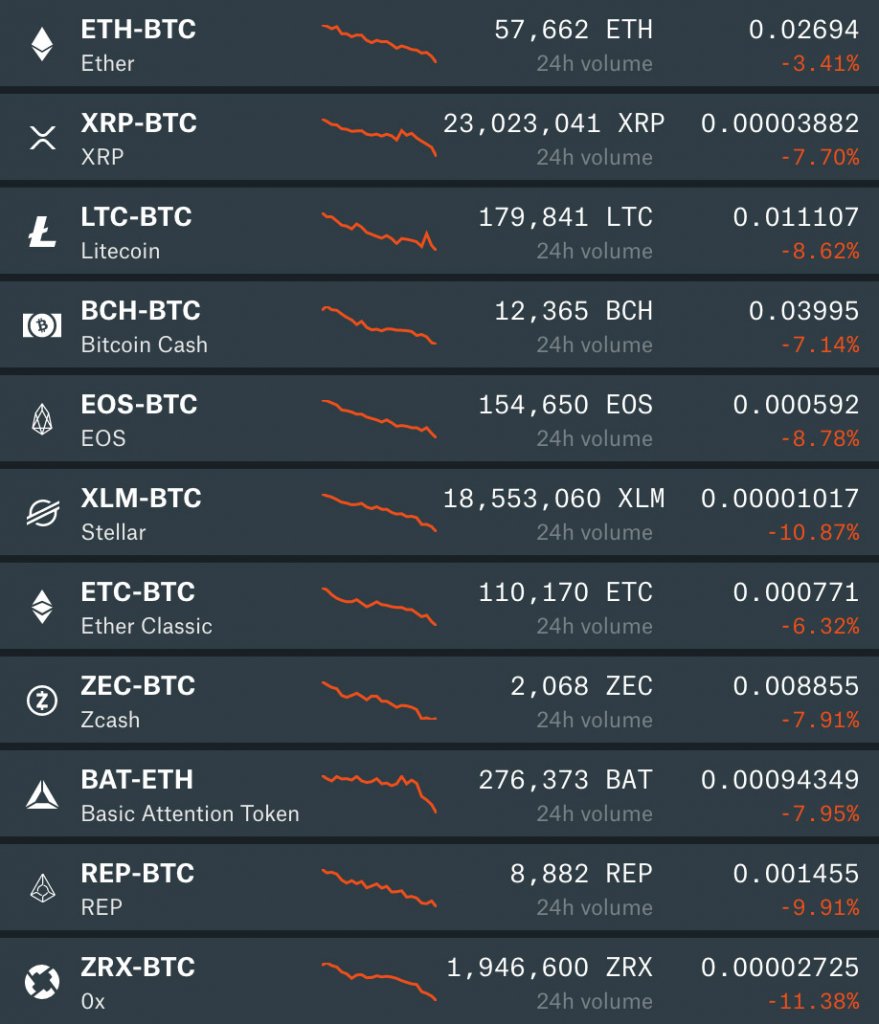

As a function of growing dominance, altcoins are depreciating relative BTC, with most major altcoins experiencing single-digit losses in the last 24-hours.

Of the top 10 altcoins, Ethereum lost the least value relative to Bitcoin with the pair only losing 5.0 percent of its value.

Bitcoin outperforms altcoins

As a function of growing BTC dominance, Bitcoin has outperformed nearly all altcoins since the beginning of the year.

Over the last six months, the only top 10 coin to outperform Bitcoin has been Litecoin—which appears to largely be driven by the upcoming halving—with gains of 340.5 percent compared to BTC’s 219.9 percent.

Of the top 20 altcoins, Ontology and NEO have also outperformed Bitcoin over the last six months, with gains of 455.2 and 252.0 percent, respectively.

Altcoin season on the horizon?

Historically, altcoins do not peak until Bitcoin finishes its rally. During the 2017 bull market, the altcoins more closely correlated with BTC—Litecoin and Bitcoin Cash—peaked in December shortly after Bitcoin. Ethereum and XRP followed in January.

From Dec. 1 to their peak, Litecoin went from $82.7 to $368.7—an increase of 346 percent. Bitcoin Cash saw a similar rally, going from $1,254 to $3,992—gains of 218 percent.

For coins that peaked in January, Ethereum went from $425 to $1,417—an increase of 233 percent. Finally, XRP’s range was the most impressive, going from $0.224 to $3.29 for gains of 1,369 percent.

Although many professional crypto traders doubt the resurgence of “alt season” during this bull market, others are converting their Bitcoin positions into altcoins in anticipation of another round of outsized gains.

Bitcoin Market Data

At the time of press 2:52 am UTC on Nov. 7, 2019, Bitcoin is ranked #1 by market cap and the price is up 11.55% over the past 24 hours. Bitcoin has a market capitalization of $222.64 billion with a 24-hour trading volume of $28.42 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 2:52 am UTC on Nov. 7, 2019, the total crypto market is valued at at $361.42 billion with a 24-hour volume of $89.94 billion. Bitcoin dominance is currently at 61.42%. Learn more about the crypto market ›