Bitcoin options market shows it is “open air” for BTC after $14,000

Bitcoin options market shows it is “open air” for BTC after $14,000 Bitcoin options market shows it is “open air” for BTC after $14,000

Photo by Jesse Gardner on Unsplash

Bitcoin is currently caught within another bout of sideways trading as its price hovers within the upper-$11,000 region.

This trend comes close on the heels of the strong multi-week upswing that allowed it to climb from lows of $9,000 to highs of $12,100 that were set yesterday evening.

The lower-$12,000 region has been established as a strong resistance zone for the benchmark digital asset.

Last Saturday, BTC faced a harsh rejection at this level that led it to lows of $11,000. Yesterday, it faced yet another rejection at this level, although its price only dipped as low as $11,700.

One occurrence within the options market shows that the cryptocurrency’s mid-term outlook remains incredibly bright despite its inability to break $12,000.

If Bitcoin can push higher and eventually surmount $14,000, it’s open skies until it reaches its all-time highs of $20,000.

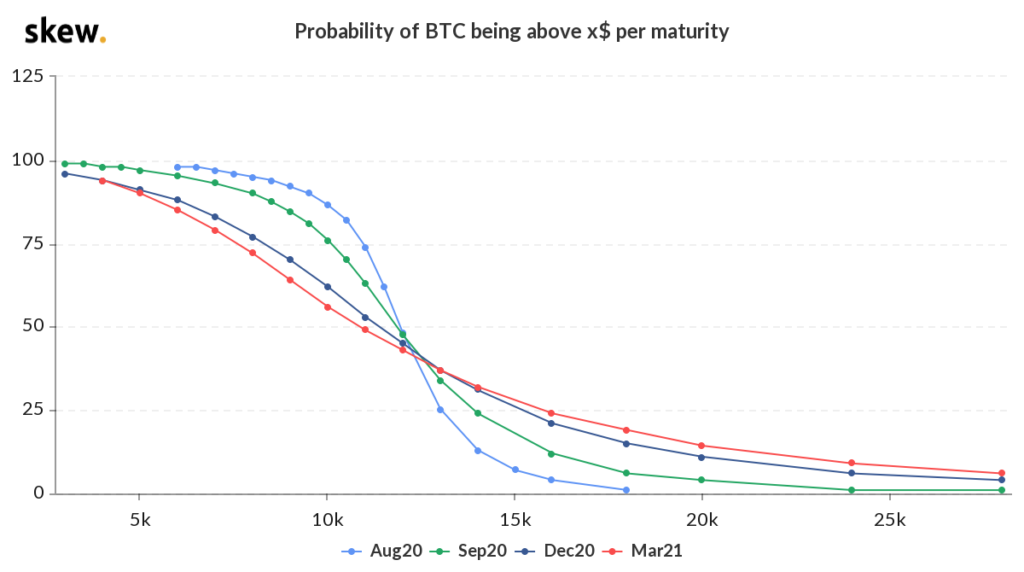

Options market places an 11% chance on Bitcoin reaching $20k by December of 2020

Bitcoin has been climbing higher ever since its price bottomed out at $3,800 in mid-March.

After rallying as high as $10,500 in May, it entered into a multi-month consolidation phase that would ultimately result in a breakout rally that led it up to its recent highs of $12,100 that were set yesterday evening.

Despite not being able to break above $12,000, the strength of Bitcoin’s multi-month uptrend doesn’t appear to be faltering.

The options market, however, still thinks the benchmark cryptocurrency will end the year below its all-time highs of $20,000.

According to data from analytics platform Skew, the current probability of BTC trading at, or above, $20,000 by the end of December is 11%.

While looking towards March of 2021, this probability jumps to nearly 15% but remains rather low.

Here’s the key level BTC needs to break to push significantly higher

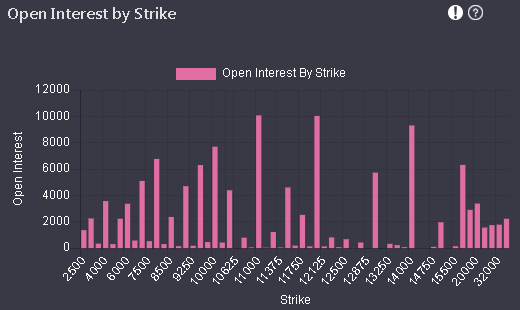

While looking towards Bitcoin’s options market’s open interest by strike price, there is a significant gap between $14,000 and $20,000.

This suggests that the crypto may not face too much resistance within this price region, making a clean break above $14,000 vital for BTC to have a chance at setting fresh all-time highs in the coming few months.

Kyle Davies – co-founder of Three Arrows Capital – spoke about this in a recent tweet, saying:

“BTC air above $14k up to $20k.”

Watching Bitcoin’s reaction to $12,000 should provide some significant insights into the cryptocurrency’s macro trend.

Bitcoin Market Data

At the time of press 12:34 am UTC on Aug. 12, 2020, Bitcoin is ranked #1 by market cap and the price is down 3.97% over the past 24 hours. Bitcoin has a market capitalization of $210.05 billion with a 24-hour trading volume of $26.78 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 12:34 am UTC on Aug. 12, 2020, the total crypto market is valued at at $348.35 billion with a 24-hour volume of $109.02 billion. Bitcoin dominance is currently at 60.30%. Learn more about the crypto market ›

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)