Bitcoin “enters stratosphere” as massive OTC deals spark institutional demand

Bitcoin “enters stratosphere” as massive OTC deals spark institutional demand Bitcoin “enters stratosphere” as massive OTC deals spark institutional demand

Bitcoin achieved its highest price since January 2018 across major exchanges, seeing a massive rally as over-the-counter (OTC) deals grow. This trend shows that institutions and high-net-worth are actively accumulating BTC.

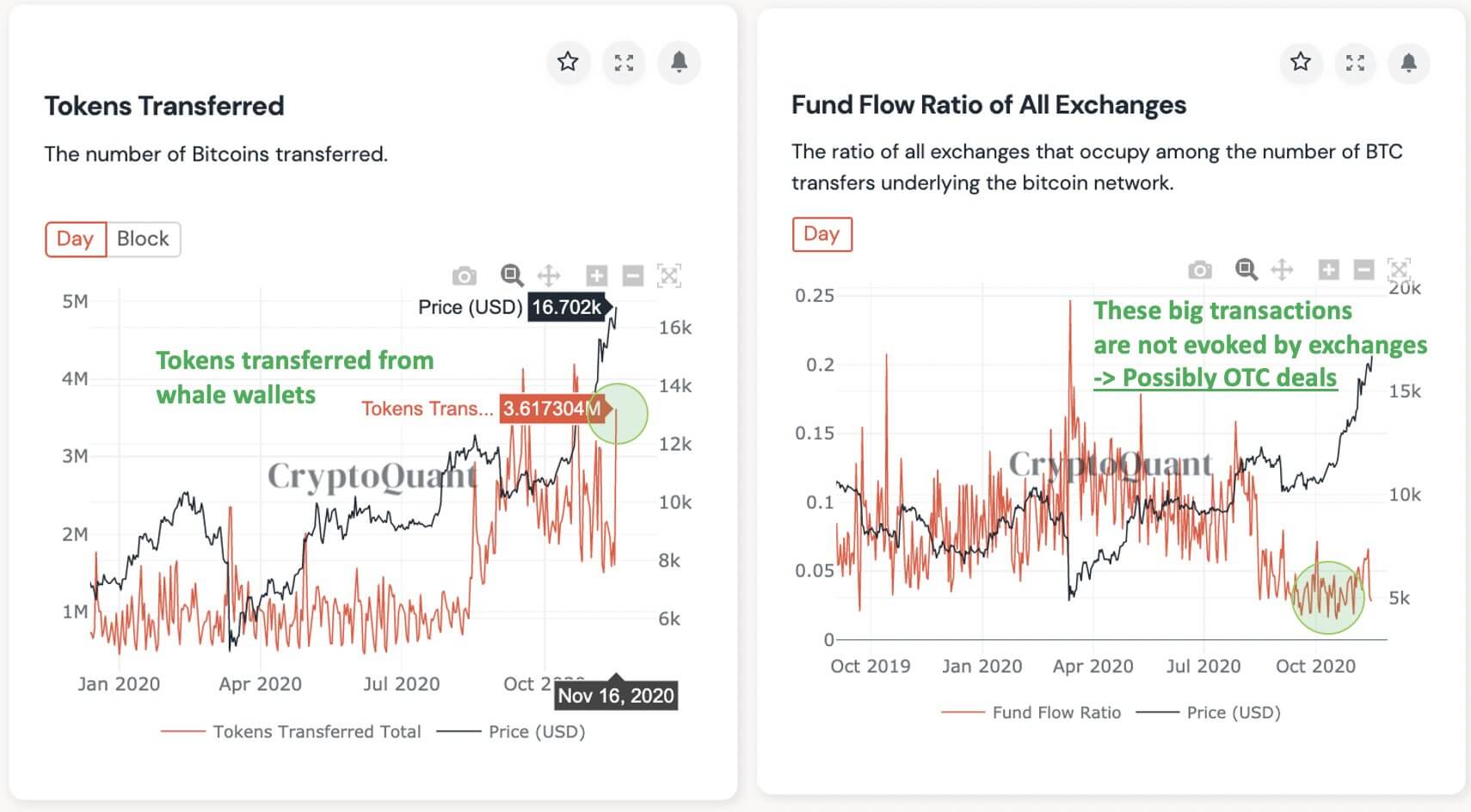

Throughout November, on-chain analysts, including Willy Woo, said the ongoing rally is being led by smart money. The rise in OTC deals and the simultaneous increase of Bitcoin depicts a similar trend.

Why are OTC deals indicative of high-net-worth buyers?

High-net-worth investors and large Bitcoin holders, like whales, miners, and institutions, often use the OTC market.

When large Bitcoin holders place massive buy or sell orders on exchanges, it can cause massive volatility. As such, when the deals are done in the OTC market, the likelihood of extreme volatility is low.

According to CryptoQuant CEO Ki Young Ju, on-chain data suggest major OTC deals are ongoing. He said:

“I think massive $BTC OTC deals are still on-going. Tokens Transferred(not entity-adjusted) is increasing, indicating that big wallets are moving their funds. Fund Flow Ratio is decreasing, meaning that exchanges didn’t make these transactions.”

Other data, such as the growing assets under management (AUM) of the Grayscale Bitcoin Trust, show a similar trend.

The AUM of Grayscale is nearing $10 billion as institutional capital continues to pour into Bitcoin. The institutional demand for BTC has been growing throughout the past five months.

There are three reasons big OTC deals are emerging and institutional appetite is intensifying.

First, Bitcoin is becoming increasingly perceived as a store of value. Alongside gold, institutions are starting to consider BTC as a potential portfolio asset.

Second, institutions are compelled by BTC as reserve currencies continue to lose their value due to inflation and liquidity injections. The U.S. dollar, as an example, has declined since May, which led BTC and gold to rally.

Third, the coverage around Bitcoin by major investment banks, like JPMorgan and Citibank, have either become more neutral or bullish.

In October, a note from JPMorgan emphasized that Bitcoin has considerable upside potential in the long term. It read:

“The potential long-term upside for bitcoin is considerable as it competes more intensely with gold as an ‘alternative’ currency we believe, given that Millenials would become over time a more important component of investors’ universe.”

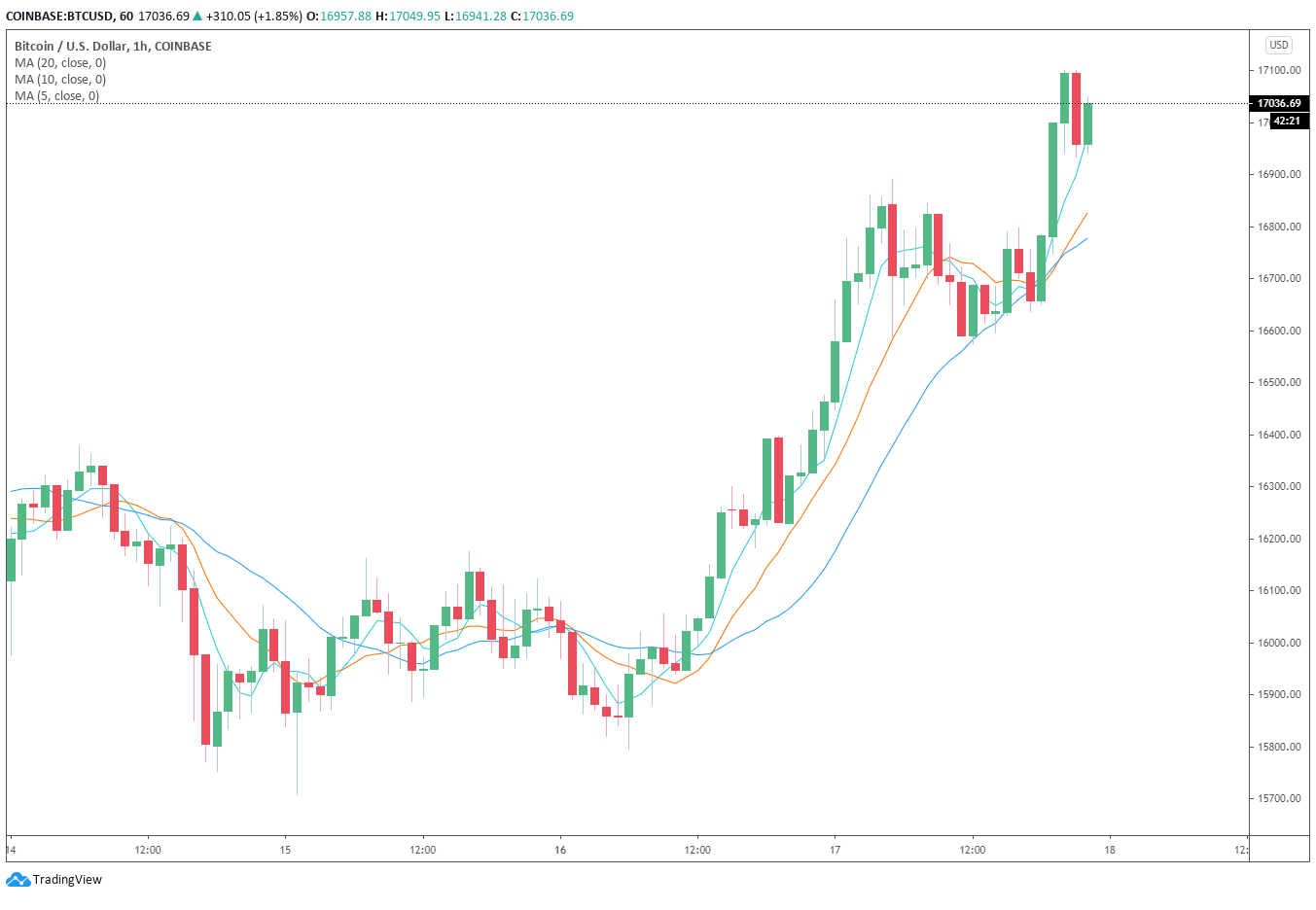

Bitcoin enters stratosphere

Bitstamp, one of the leading European cryptocurrency exchanges, described BTC surpassing $17,000 as “stratosphere.” It said:

“STRATOSPHERE: #Bitcoin passed $17k, placing us just 15.7% from a new ATH! Highest $BTC price at Bitstamp was 19666 on 17 December 2017.”

The positivity around BTC post-$17k rally makes sense because there is little resistance between $17,000 and $20,000.

There would be a lower appetite to sell BTC within the $17,000 to $20,000 range, given that BTC would face price discovery above $20,000.

The imminence of a price discovery, which occurs when an asset hits an all-time high, has the market sentiment at euphoric levels.

Bitcoin Market Data

At the time of press 2:39 am UTC on Nov. 18, 2020, Bitcoin is ranked #1 by market cap and the price is up 5.75% over the past 24 hours. Bitcoin has a market capitalization of $327.89 billion with a 24-hour trading volume of $40.07 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 2:39 am UTC on Nov. 18, 2020, the total crypto market is valued at at $499.02 billion with a 24-hour volume of $147.49 billion. Bitcoin dominance is currently at 65.72%. Learn more about the crypto market ›

CoinGecko

CoinGecko