Bitcoin dips amid surge in Ordinals minting, $166M in crypto liquidations reported

Bitcoin dips amid surge in Ordinals minting, $166M in crypto liquidations reported Bitcoin dips amid surge in Ordinals minting, $166M in crypto liquidations reported

The increased minting of Ordinals-like transaction clogged the Bitcoin network, pushing transaction fees very high.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin’s price starts the new week in the red after a surge in Ordinals minting resulted in a clogged blockchain network over the weekend.

Data from CryptoSlate shows that BTC’s price fell by around 2% during Asia trading hours to $41,189, reminiscent of how the flagship digital asset began the previous week.

Similarly, other large-cap alternative cryptocurrencies like Ethereum, Solana, Cardano, and Avalanche recorded substantial losses between 2% and 5% during trading hours.

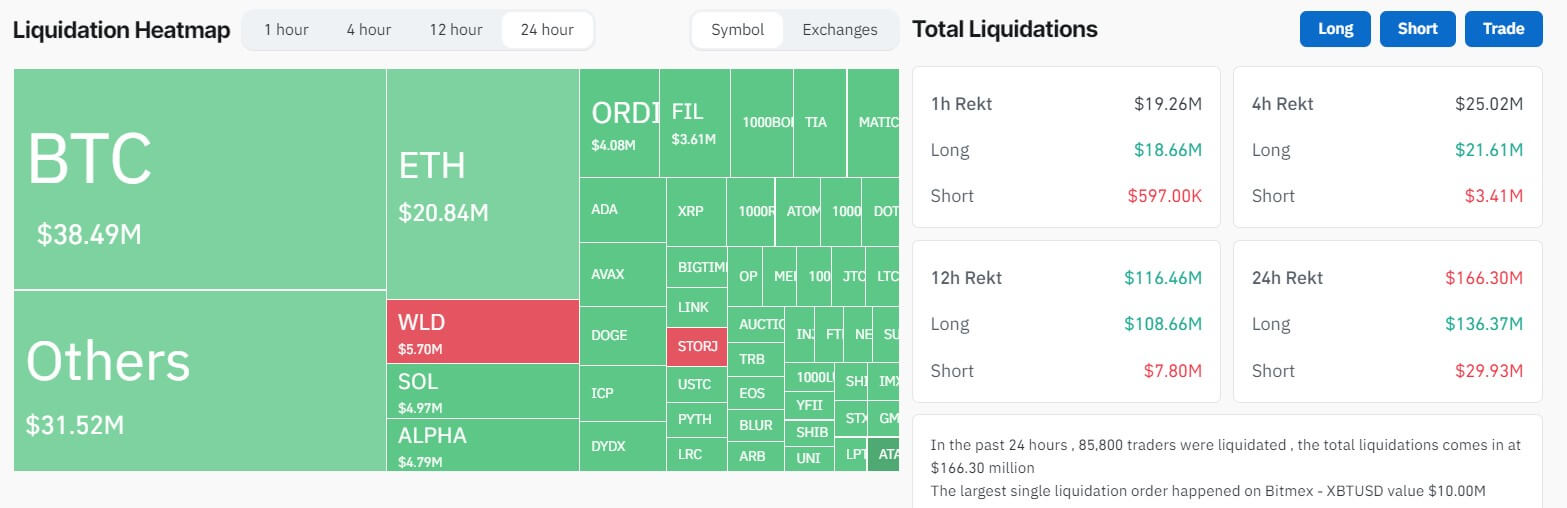

$166M liquidated

Coinglass data shows that the recent price decline caused approximately $166 million in losses for roughly 85,000 crypto traders with active market positions.

The breakdown of these liquidations reveals that long traders suffered the most significant losses, totaling $136 million, while short traders lost $30 million.

Traders with positions on BTC saw losses totaling over $40 million across different positions. Long positions, or those speculating on higher BTC prices, contributed $38 million to this sum, while short position holders, or traders betting on lower prices, accounted for $7 million.

Ethereum investors also experienced notable losses, with approximately $20 million liquidated from long positions and $2.66 million from short positions.

Across exchanges, Binance and OKX recorded the most substantial losses, with liquidations exceeding $74 million and $42 million, respectively. Notably, the most significant individual loss was a $10 million long bet on Bitcoin’s price through BitMEX.

Notably, Bitcoin retains a low Liquidation Sensitivity Index (LSI) score of just $15.5 million USD/%, highlighting the reduction in leverage compared to the 2021 bull run, which saw an average of $74 million liquidated per 1% change in Bitcoin’s price.

Clogged network

Over the weekend, a surge in Ordinals Inscriptions resulted in a clogged blockchain network that pushed the average transaction fee on Bitcoin to over $37, according to BitInfoCharts data.

Data from Mempool further shows that these transactions resulted in over 288,000 unconfirmed transactions as of press time.

Earlier in the month, Ordinals generated heated debate among the BTC community, with purists arguing that these assets were exploiting a vulnerability in the Bitcoin Core to spam the blockchain.

However, many in the community oppose this view, arguing that inscriptions will never stop and are an evolution of the blockchain network.

Interestingly, a similar trend was observed in Ethereum virtual machine (EVM)-compatible chains like Avalanche, Polygon, and Arbitrum, with users spending more than $10 million as transaction fees on these assets over the weekend, per a Dune analytics dashboard by Hildobby.