Bitcoin Cash soars to 14-month high of over $300 as hash rate spikes

Bitcoin Cash soars to 14-month high of over $300 as hash rate spikes Bitcoin Cash soars to 14-month high of over $300 as hash rate spikes

BCH's trading volume across exchanges have soared following the increased interest.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin Cash (BCH) rallied to a 14-month high of over $320 after rising by 35% in the last 24 hours, according to CryptoSlate data.

Since June 20, the digital asset has enjoyed renewed interest as it is one of the four cryptocurrencies available on EDX Markets—a crypto exchange backed by traditional financial giants like Fidelity, Schwab, and Citadel Securities.

Additionally, the EDX launch coincided with a wave of institutional firms’ applications for a Bitcoin spot ETF triggered by BlackRock’s June 15 application.

Due to this flurry of activities, BCH’s value has more than doubled in price, rising to $308 as of press time from $127.90 recorded on June 21.

South Korean exchanges trading volume soars

In a June 30 tweet, Wu Blockchain attributed BCH’s pump to interest in South Korea.

Wu reported that South Korea’s biggest exchange UpBit was responsible for roughly 24% of BCH’s total trading volume, making it the most traded asset on the platform.

Data from CoinMarketCap corroborates this, showing that UpBit’s BCH/KRW trading pair has recorded a trading volume of over $620 million during the last 24 hours. This is four times higher than its BTC/KRW pair trading volume, which stood at $169.4 million as of press time.

Meanwhile, other exchanges’ trading volume, including Binance, OKX, and Coinbase, shows that BCH is heavily traded across these platforms.

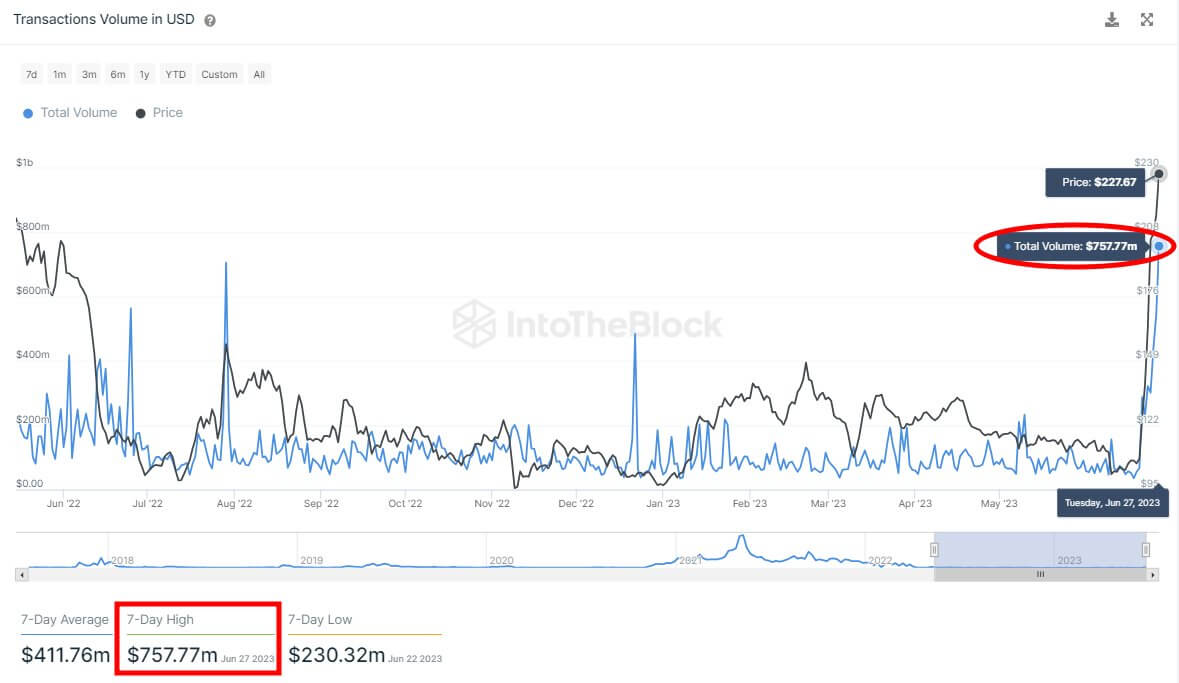

In a June 29 tweet, IntoTheBlock further pointed out that BCH saw its highest volume in a year, exceeding $750 million.

The data aggregator added the following:

“Our ‘Balance by Time Held’ indicator reveals something intriguing. Notably, this volume surge could largely be attributed to traders who have held BCH for less than a month, increasing by 33% in the last 30 days.”

Besides that, the network transaction volume has also risen to 2.60 million as of press time, according to OKlink data.

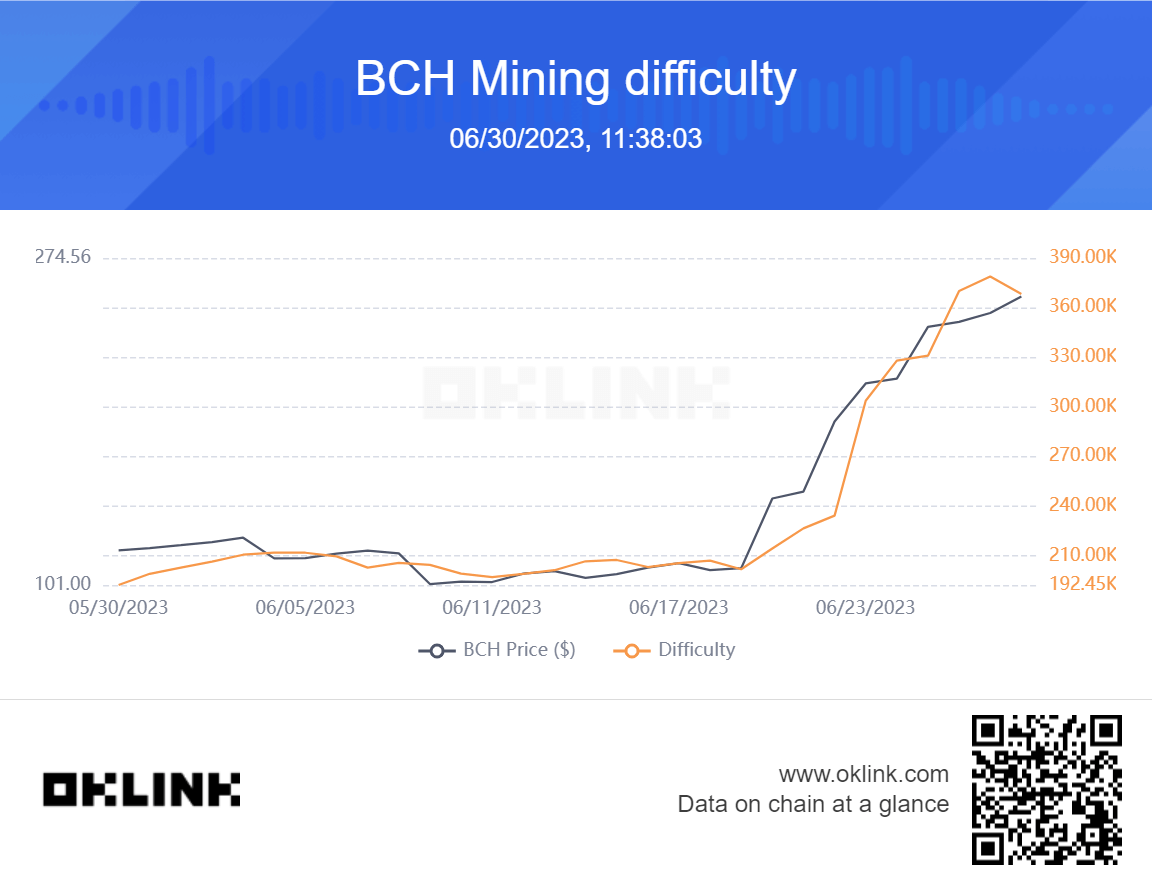

BCH mining difficulty rises

Meanwhile, additional data from OKlink shows that BCH’s network mining difficulty has trended higher since its price surge.

Its mining difficulty is currently at 464.78G, while its hash rate is 3.1EH/s.