Binary options trading with Bitcoin (BTC): How it works

Binary options trading with Bitcoin (BTC): How it works Binary options trading with Bitcoin (BTC): How it works

Have you ever wondered if there is a more expedient way to make money instead of waiting for the right opportunity to buy low and sell high?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Many traders would first think of margin trading, with its high risk, high reward approach. However, there’s another high-risk strategy out there: Binary options trading.

What Is Binary Options Trading?

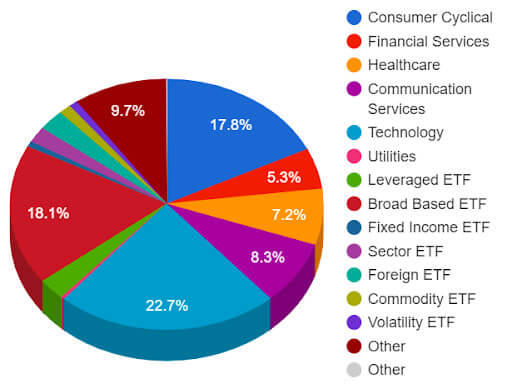

Among many financial instruments to tackle the securities market, options contracts are the most popular. As of mid-August, 2021, the average options trading volume amounted to 35.1 million, out of which 72% belonged to the top 100 public companies by market cap. According to a MarketChameleon report, they are mainly distributed across financial services, tech and consumer stocks.

Regular options are simply contracts that give investors an option (but not the obligation) to buy or sell an asset at a set price prior to a specific date in the future. Because it’s an option, this contract may or may not execute. If an investor decides to buy the option to acquire the asset down the line, they will make a “call option.” Likewise, if they decide to buy the option to sell the asset later, they would be engaging in a “put option.”

There are several different nuances in the world of options trading. As complicated as this world may initially seem, binary options trading is fairly straightforward.

In essence, a binary options trader is betting that the price of an underlying asset will either go up or down. Underlying assets could be stocks, forex, ETFs, futures, and even cryptocurrencies. The price of one contract is between $0 and $100. The expiration date of the contract (i.e. the expiry) can be in seconds, minutes, hours, or days.

This binary speculation is bound within the binary option contract. However, unlike regular options trading, binary contracts have limited stakes. Let’s take a closer look into what this means.

Example of Binary Options Trading with Bitcoin

Imagine a trader who is confident enough to place a bet—through a binary options contract—that the price of Bitcoin will go up. The trader enters a contract with an expiry period of one week. The contract will also feature a strike price, which is the point of profitability. In the world of binary options, different strike prices will be available with different odds. The tougher the odds, the higher the payout.

If the price of BTC is above the contract’s strike price at the end of that period, the trader will earn a profit according to the contract’s predefined odds. This is the traditional form of binary options, known as the up/down binary.

In practice, we can break down this process accordingly:

- You buy $100 worth of binary options contracts with Bitcoin as the underlying asset.

- You bet that money on the speculation that Bitcoin will increase to $55,000 (strike price).

- The expiry time for that bet is one hour.

- If at the end of the expiry time, the price of Bitcoin goes over $55,000, you would earn a payout percentage on your initial investment, depending on the broker involved. If it is 80%, you would gain $80.

- In turn, if you invest $100 for BTC to reach $55,000—but BTC fails to break this figure, then you would lose your entire investment.

Hence, simplicity is the main appeal in binary options. You either speculate correctly on the asset’s price move, or not. If the bet doesn’t pan out, you lose everything. Furthermore, there is only one thing you have to guess correctly—the price trajectory.

Since binary options contracts can be set for expiry periods with as little increments as seconds, minutes, or hours, it’s possible for traders to conduct hundreds of binary trades daily.

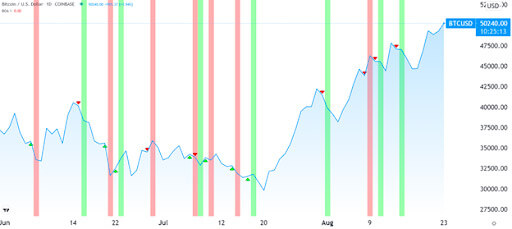

When visualized, each green line (price goes up) or red line (price goes down) represents Bitcoin’s price movement. Depending on your bet that the price will go up or down, you would either gain a percentage payout or lose your entire initial bet. Accordingly, the expiry span of a binary options contract is critical.

Types of Binary Options

Outside of up/down binary options, there are also several other variations:

- In/Out: This involves a range boundary. It ultimately entails guessing within which price range the asset will be upon expiration. If the underlying asset is outside of the specific range on expiry, you will lose your investment.

- Touch/No Touch: This largely involves price levels. It’s essentially guessing whether the asset will (or will not) touch a specific price level prior to the contract’s expiration. If that happens at any point within the expiry time, the trade will automatically close with a payout. As such, touch/no touch options are largely seen as one of the safer ways to engage in binary options trading.

- Ladder – This is similar to up/down binary options, except that the ladder offers preset price levels to bet on. The price of the underlying asset must move in certain, predefined intervals—similar to rungs on a ladder—in order for the trade to be in the money.

This leaves traders with a fairly simple payout pathway accessible to anyone without having to absorb dozens of investing books. Choosing the right exchange/broker, expiry time, and trading size is all that it takes. Unfortunately, such simplicity has brought forth many fraudulent trading platforms.

Pros and Cons of Binary Options Trading

Given the yes/no proposition at the core of this financial instrument, binary options trading is akin to gambling in terms of risk-reward ratio. Because of the simplicity and clear rewards involved, binary options trading also tends to be quite addictive, having to win over 50% to break even. Most brokers facilitate seamless credit card payments to fund accounts, making it easy for traders to continue to deposit funds.

However, even if one is an expert at reading technical indicators, they still remain indicators, not future tellers. This is why the Securities and Exchange Commission issued a special alert notice on the dangers of binary options trading. After the SEC subsequently cracked down on exchanges and brokers that manipulated their software to sabotage expiry times and wins, only a few remained.

Now, for US-based traders, the only available platforms are highly regulated by the CFTC and have to be registered as both a Derivatives Clearing Organization (clearinghouse) and a Designated Contract Market (exchange). So far, Nadex is the only exchange for binary options trading to fit those requirements within the US.

For traders outside the US, there are a number of popular brokers that offer binary options trading, though their regulatory status varies by jurisdiction.

On the upside of binary options trading, it doesn’t matter whether the market is bullish or bearish. You can place bets in either direction. Options trading allows traders to profit even if the market is falling—and binary options are no different.

Is Binary Options Trading the Right Call?

Overcoming the hurdle to find the right binary options broker is one issue, but the more important one is your trading disposition. If you are prone to anxiety and folding under pressure, then it might be better to simply gain exposure to Bitcoin through a long-term, passive strategy—as opposed to the high-risk nature of binary options.

On the other hand, for those who are already familiar with options trading—especially those who utilize strategies that seek quick short-term gains—and don’t mind the high-risk stakes, trading Bitcoin through binary options contracts could be a better fit.

Thankfully, the risks involved with binary options trading are much clearer than they are with margin trading. The latter can cascade and accumulate, while with the former, you can allocate precisely how much you are willing to lose, every single time. One only has to pick the right asset and stick to mastering a single strategy—which, admittedly, is still easier said than done.