Binance Bitcoin trading volume plunges 13% – lowest level in 8 months

Binance Bitcoin trading volume plunges 13% – lowest level in 8 months Binance Bitcoin trading volume plunges 13% – lowest level in 8 months

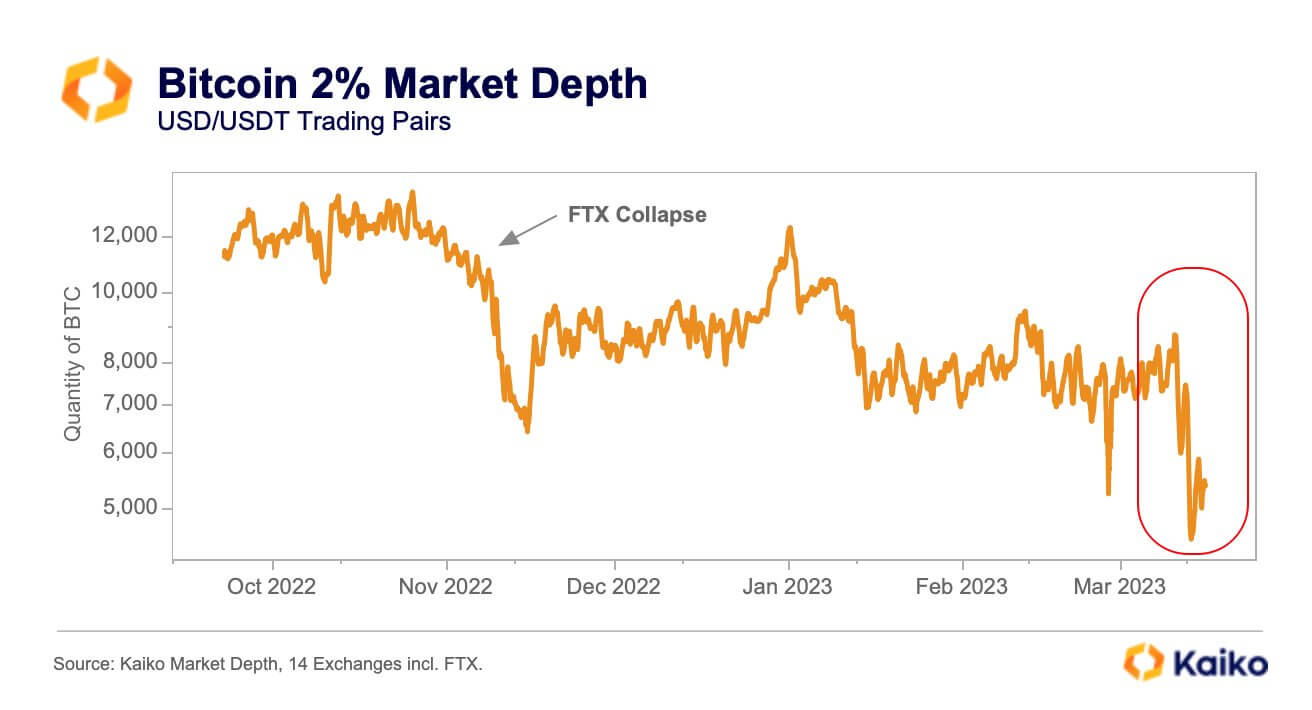

Bitcoin's overall market liquidity has dropped to a 10-month low despite the asset's continued rise in 2023.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

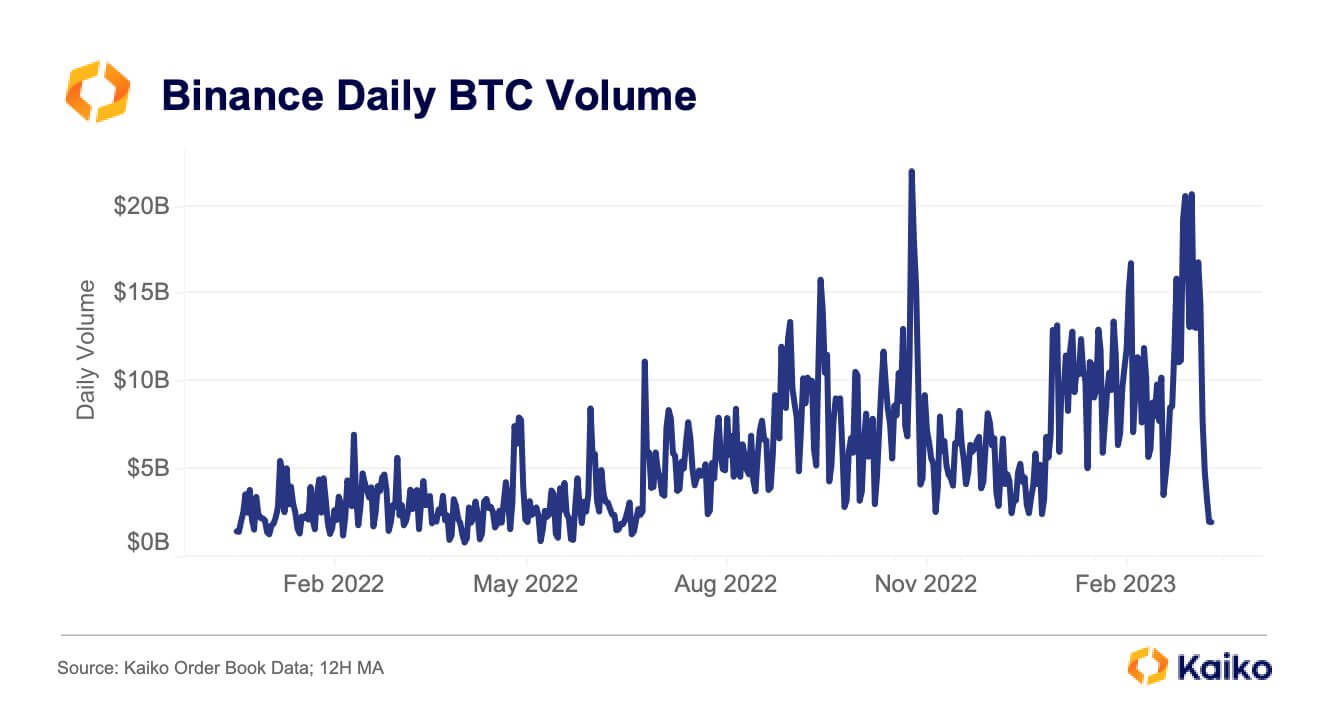

Binance’s Bitcoin (BTC) daily trading volume has fell to its lowest levels since July 4, 2022, as the result of ending its zero-fee trading for all trading pairs except TrueUSD (TUSD), according to Kaiko data.

Kaiko researcher Riyad Carey pointed out that the last time Binance’s volume went this low was two days before it introduced the zero-fee trading options. According to him, the volume decline coincided with the end of free trading.

Binance ended the free trading option for most of its BTC’s stablecoin pair on March 22 — citing the recent regulatory issues facing the space. The free trading option helped the exchange increase its market share to 72% from 50.5% — it also accounted for roughly 61% of its total volume.

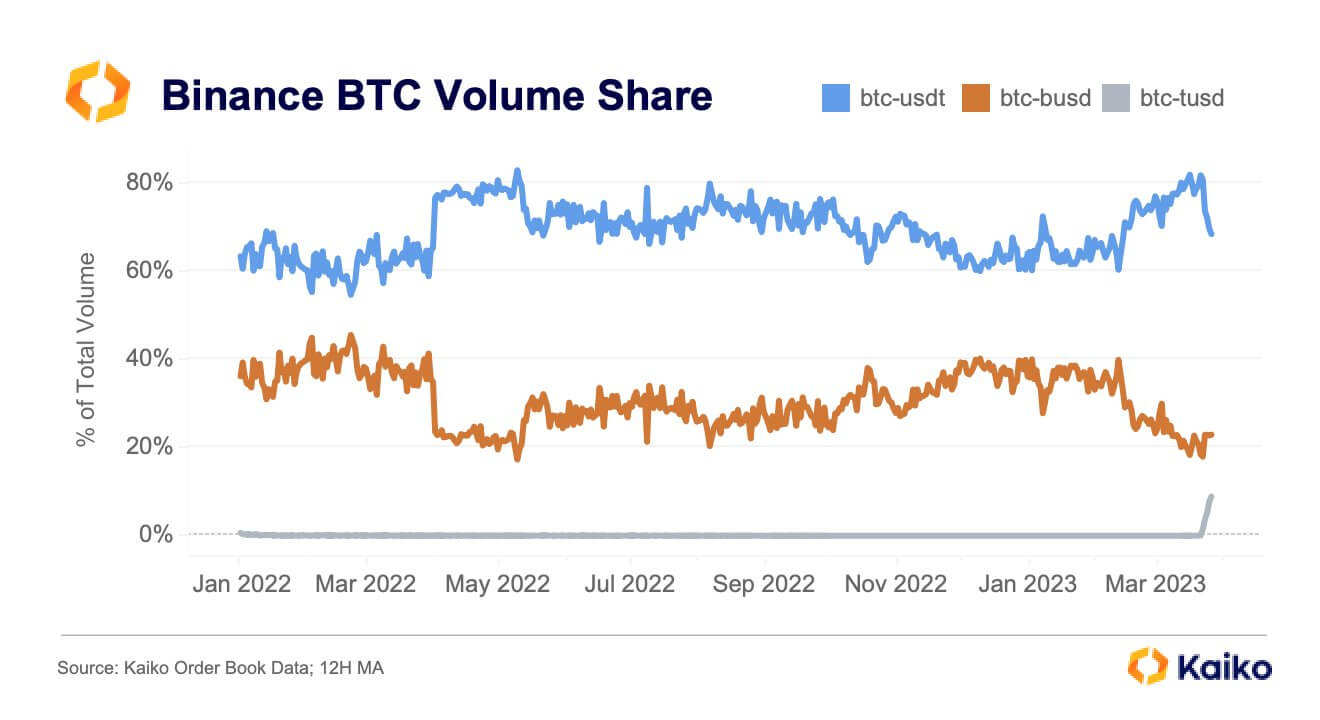

Meanwhile, Binance’s BTC-TUSD market share increased to approximately 10% while BTC-USDT volume on the exchange plunged to 68% from 81%.

Since Binance phased out the zero-fee trading, TUSD’s liquidity has risen by more than 250% — while liquidity for stablecoins like Tether’s USDT and Binance USD (BUSD) has declined more than 60%, respectively.

Bitcoin’s declining liquidity

While Bitcoin has rallied by around 70% in the current year, market liquidity surrounding the flagship digital asset has dropped to a 10-month low. Market liquidity is how easy it is to transact an asset without affecting price.

Kaiko’s Conor Ryder noted that the recent collapse of crypto-friendly banks has deeply affected U.S.-based exchanges due to the closure of US Dollar payment rails. He added that “market makers in the region [are] facing unprecedented challenges to their operations.”

According to Ryder, USD pairs spreads have suffered more volatility due to the uncertainty surrounding the crypto industry in the United States. Besides that, slippage on U.S-based exchanges has increased due to these issues.

For context, the slippage on a BTC-USD 100,000 sell order on Coinbase has increased by 2.5x from what it was in early March while that of Binance has barely moved.

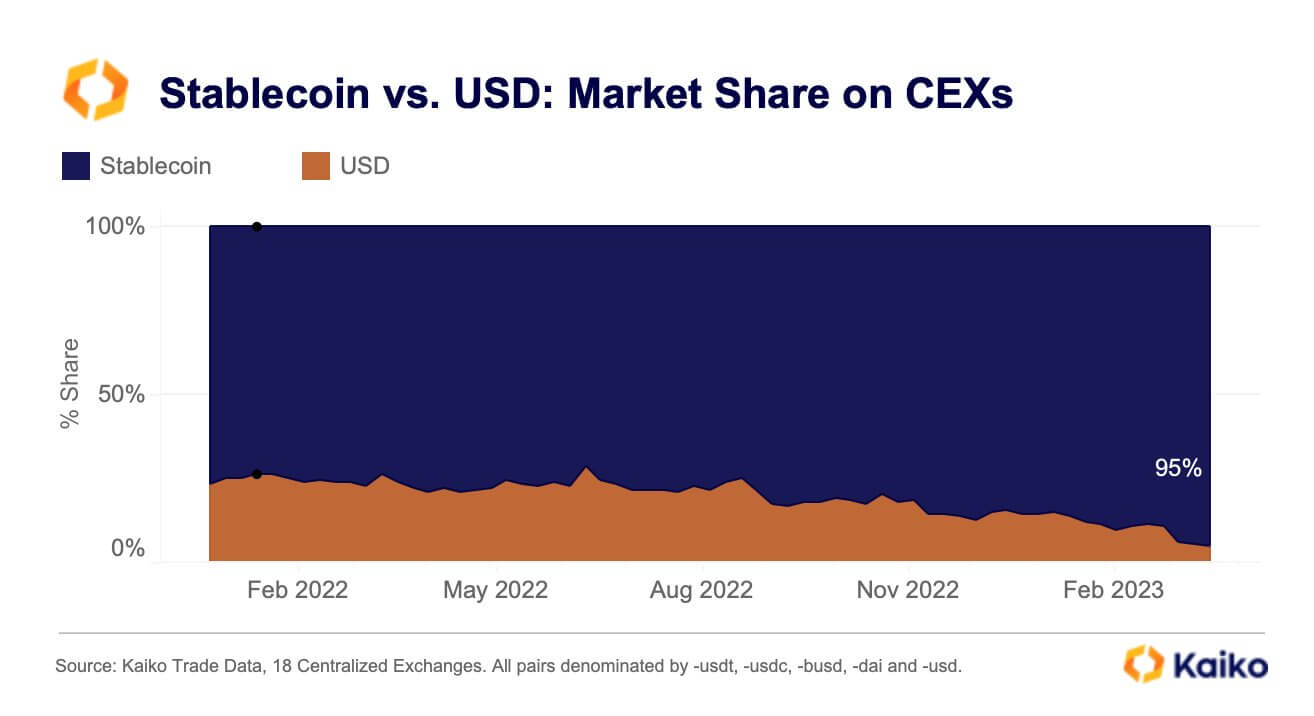

Meanwhile, the increased tightening of USD access has seen exchanges pivot to stablecoins. According to Kaiko data, stablecoins now account for 95% of trading volumes on centralized exchanges.

Ryder noted that while the pivot to stablecoins dulls the impact of US banking issues, it is impacting liquidity in the country and could indirectly hurt.