Analyzing the WBTC FUD after the FTX collapse and its depeg

Analyzing the WBTC FUD after the FTX collapse and its depeg Analyzing the WBTC FUD after the FTX collapse and its depeg

This article analyzes WBTC on-chain indicators and the FUD around the asset’s depeg.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Wrapped Bitcoin is the leading form of Bitcoin “wrapped” in a smart contract on the Ethereum network. This allows it to be used in Ethereum-based decentralized finance (DeFi) applications. WBTC is backed 1:1 to the value of Bitcoin, so one WBTC is theoretically equivalent to one BTC.

BitGo is the main WBTC issuer, meaning they are responsible for the BTC backing and custody. Alameda Research, Sam Bankman-Fried’s Prop Fund, was a WBTC top merchant, which means they would accept BTC from customers and send it to BitGo to mint WBTC.

While being a merchant does not provide access into the custody, following the fear, uncertainty, and doubt (FUD) of FTX’s collapse, WBTC started to depeg under the assumption that its reserves were incomplete. This article analyzes WBTC on-chain indicators and the FUD around the asset’s depeg.

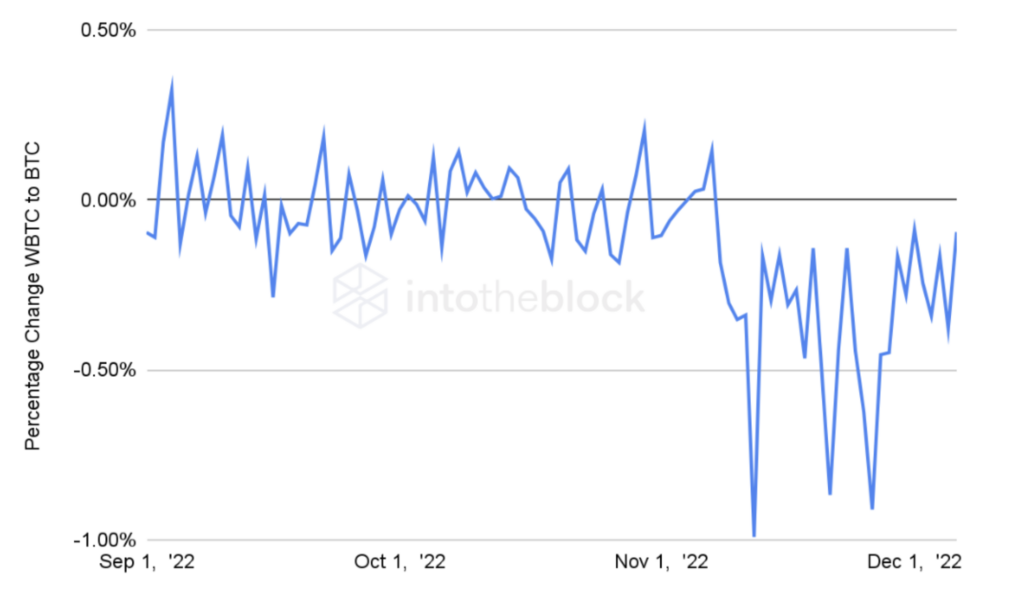

WBTC’s price dropped by 1.5%, while FUD about its custody emerged. Small depegs can present important concerns as they can lead users to lose confidence in the pegged asset and the issuer. A depeg asset may be perceived as a less stable and reliable store of value, which can cause people to lose confidence in it and potentially lead to a decrease in demand.

This can make it more difficult for the issuer to maintain the peg and lead to further redemptions and loss in value.

Additionally, in the case of WBTC, widely used as a medium of exchange across DeFi, its loss of value can cause disruptions in the entire ecosystem. In this case, arbitrageurs could process redemptions and bring the price back to parity, as the BitGo team confirmed its complete backing of reserves and processed the redemptions submitted.

Moreover, volatility also affected the markets during this time as traders sought to safeguard their assets from uncertainty.

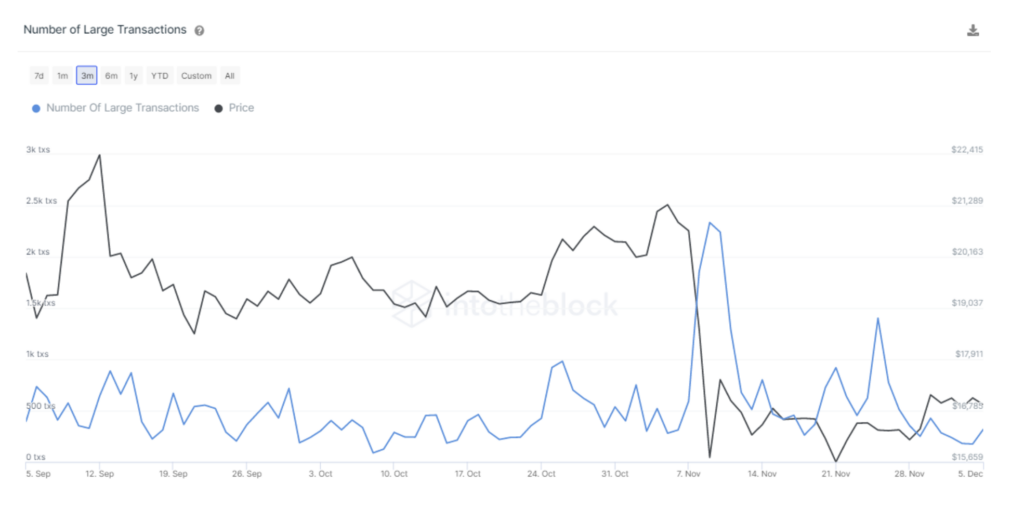

The indicator above shows the number of transactions greater than $100,000. Since this sum of money is not available to the average retail trader on-chain, the metric acts as a proxy to the number of whales and institutional traders that processed a transaction.

This helps understand major token holders’ behavior. As it can be seen, November 25th was the second highest recorded number of transactions after the date in which FTX collapsed in a 3-month spam. Transactions, in this case, can indicate users selling or transferring an asset to be sold.

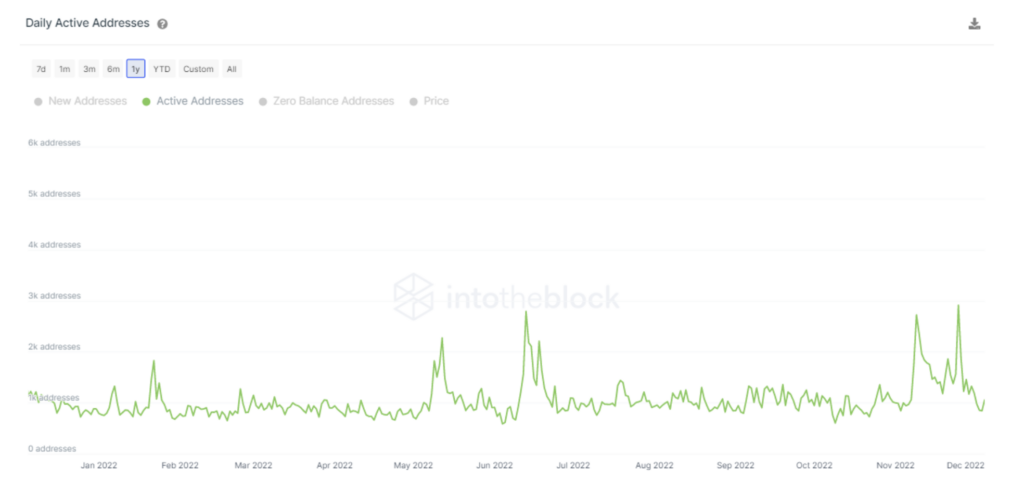

Whales and institutions were not the only ones worried about the underlying value of WBTC, as the number of “active addresses” on November 25th was the highest recorded in more than one year.

“Active addresses” stand as addresses that make one or more on-chain transactions on a given day. This helps show the network activity. In this case, it illustrates how people took precautionary measures towards the asset depeg.

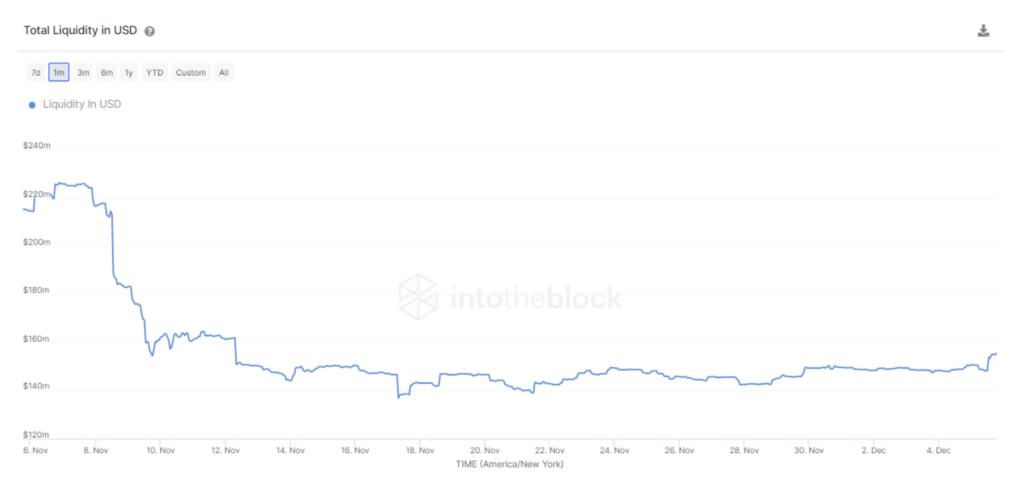

Despite many WBTC holders transferring and selling their assets, on-chain data reveals that Curve’s Tricypto2 pool liquidity was unaffected by these events. Rather than being affected by the BitGo FUD, the pool experienced heavy withdrawals during the FTX collapse. Tricypto2 currently stands as the biggest market, in terms of liquidity deposited, for trading WBTC on-chain.

Liquidity is an important factor in the functioning of a DEX, as it determines how easily users can buy and sell assets on the platform. A DEX pool with high liquidity will have a large number of assets available for trading, which makes it easier for users to buy and sell the assets they want.

This can increase the attractiveness of the DEX pool to traders and make it more widely used. In this case, the greater the liquidity in the pool the more available for users wanting to exit their WBTC positions.

Overall, if a pegged asset starts to lose its value, it can create several problems for both the issuer and the holders. Loss of confidence in its issuer can lead users to doubt the value of the pegged asset. Furthermore, its depeg can cause major disruptions across the DeFi ecosystem. In this case, BitGo was able to clarify the misconception that had been spread around tweeter and provide proof of the custody reserves.