Ampleforth price drops following AMPL futures listing on FTX

Ampleforth price drops following AMPL futures listing on FTX Ampleforth price drops following AMPL futures listing on FTX

Photo by iam_os on Unsplash

Ampleforth (AMPL) has been one DeFi-related token that has been garnering significant popularity in recent weeks, with attractive annual staking yields leading to an influx of new investors.

Although the AMPL token is designed to be pegged at roughly $1.00, massive inflows of capital have caused its price to rocket well past this peg, with it even trading as high as $4.00 earlier this month.

Users who stake their tokens are currently receiving yields of nearly 300 percent APY, which has been one of the main impetuses for its growth.

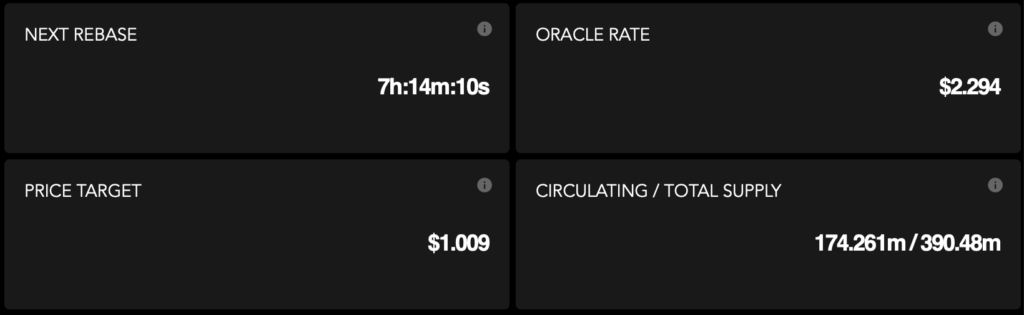

To provide its price with stability, the token rebases daily, leading its circulating supply to vary by large amounts.

It is important to note that although it has been starting to find some equilibrium, the addition of Ampleforth futures on popular crypto trading platform FTX has caused its price to see a notable decline.

Ampleforth price slides after AMPL futures listing on FTX

At the time of writing, Ampleforth is trading down over 20 percent at its current price of $1.90.

Although this marks a 50 percent decline from where it was trading at just a few weeks ago, it is still 90 percent above the token’s intended peg at $1.00.

Throughout the past five weeks, AMPL’s market cap has risen from just over $5 million to recent highs of $350 million. It has since declined slightly.

These massive inflows of capital are what has caused its price to see anomalous volatility. Still, as its market cap stabilizes, its price will likely begin drifting back down towards $1.00.

Today’s price decline has also come about concurrently with news regarding Ampleforth futures being listed on FTX.

The trading platform’s CEO, Sam Bankman-Fried, spoke about the news in a recent post, noting he is excited to see how perpetual and quarterly futures handle the daily splits AMPL undergoes.

“[Ampleforth] has built AMPL, a token that automatically rebases each day at 11am HKT to attempt to maintain a peg near $1, though due to heavy inflows recently it’s been trading higher! I’m excited to see how perpetual and quarterly futures handle the daily splits.”

Will AMPL drop below $1.00?

Each day when Ampleforth undergoes its rebase, the system attempts to bring the token’s price down towards $1.00.

It does so by adjusting the circulating supply for all wallets, making the AMPL supply elastic.

These supply adjustments are non-dilutive and occur across all wallets, so users keep their ownership of the network.

Because AMPL could be used as reserve collateral in decentralized banks, many users have been trading it like a DeFi token – which is part of the reason behind its price growth.

Although it may continue inflating in value as long as it continues seeing massive inflows of capital, eventually, its ongoing supply inflation will cause the Ampleforth price to drift down towards $1.00.

Ampleforth Market Data

At the time of press 5:27 am UTC on Aug. 1, 2020, Ampleforth is ranked #43 by market cap and the price is down 11.12% over the past 24 hours. Ampleforth has a market capitalization of $253.1 million with a 24-hour trading volume of $13.47 million. Learn more about Ampleforth ›

Crypto Market Summary

At the time of press 5:27 am UTC on Aug. 1, 2020, the total crypto market is valued at at $287.27 billion with a 24-hour volume of $70.1 billion. Bitcoin dominance is currently at 61.46%. Learn more about the crypto market ›

CoinGecko

CoinGecko