a16z’s ‘State of Crypto’ report shows crypto is in a really good state

a16z’s ‘State of Crypto’ report shows crypto is in a really good state a16z’s ‘State of Crypto’ report shows crypto is in a really good state

Despite the current market downturn, a16z's report shows that the Web3 industry is thriving.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Few companies in the VC space have exposure to crypto as a16z has. Founded in 2009 by Marc Andreessen and Ben Horowitz, Andressen Horowitz began investing in crypto companies in 2013 with investments in Coinbase and Ripple and now has just under 50 Web3 companies in its portfolio.

On May 17th, the company published the first of an annual overview of trends in the industry, shared through a16z’s vantage point of tracking data and engaging with builders.

Its “State of Crypto” report dives deep into the hottest segments of the Web3 space, analyzing past performance and identifying prevailing trends that have the potential to shape the future of the industry.

“It’s for anyone who seeks to understand the evolution of the internet, and where we are on the journey towards a decentralized, community-owned-and-operated alternative to the centralized tech platforms of web2 – especially as it touches creators and other builders,” the company said about the report.

And according to the report—crypto is in a really good state.

Chaotic cycles obscure consistent growth

Almost every market moves cyclically, and crypto is no exception.

However, unlike other industries where prices are often a lagging indicator of performance, prices in the crypto industry are a leading indicator. This means that rising numbers drive interest, which drives ideas and activity, which in turn drives innovation in the industry. Andreessen Horowitz calls this feedback loop “the price-innovation cycle” and believes it to be the engine that propelled the industry through several distinct waves since Bitcoin was first invented in 2009.

The report notes that the recent market downturn means that we could be entering a crypto winter. However, advances made by builders during market downturns eventually re-trigger optimism and spearhead an upward momentum, which could be what the industry will see when the dust settles.

The chaotic cycles of crypto winters and bear markets obfuscate the actual reality of the crypto industry—that’s consistently thriving.

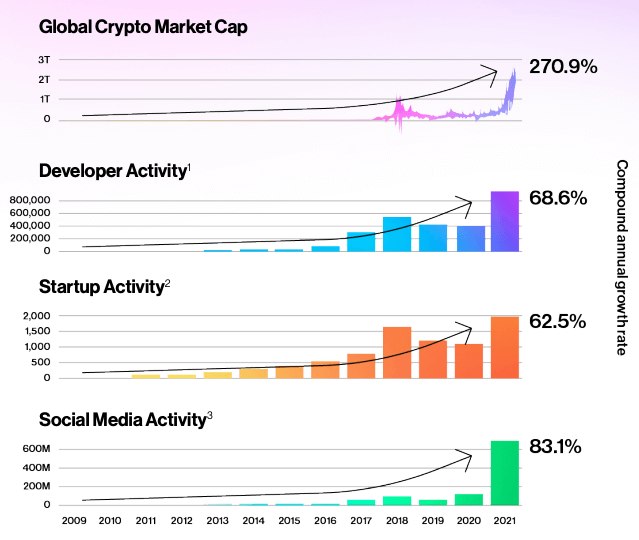

According to the report, the global crypto market cap saw a compound annual growth rate of over 270% in 2021. At the same time, developer activity, startup activity, and social media activity in the crypto industry experienced compound annual growth rates of 68.6%, 62.5%, and 83.1%, respectively.

There also seems to be almost unlimited space for further growth.

With a huge chunk of the world being underserved by existing financial institutions, decentralized finance has a market of almost two billion people that’s currently untapped. a16z notes that 1.7 billion people don’t have access to a bank account, and 1 billion of them have access to a mobile phone—a perfect combination of circumstances for the advance of DeFi systems.

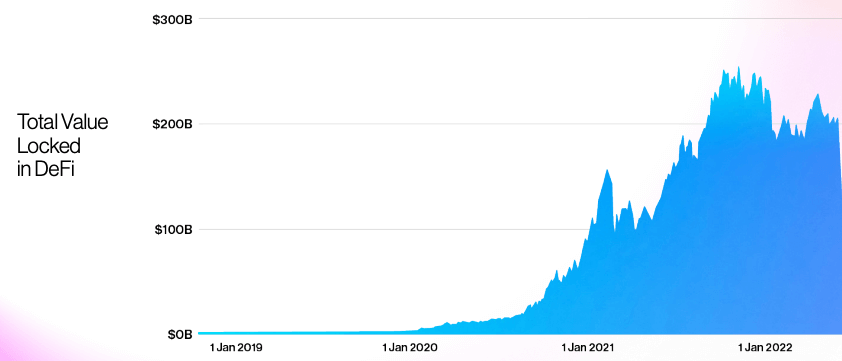

Despite its recent slump in total value locked (TVL), the DeFi market has experienced a parabolic rise that’s unheard of even in the crypto industry, growing from nearly zero in 2019 to over $100 billion in less than two years.

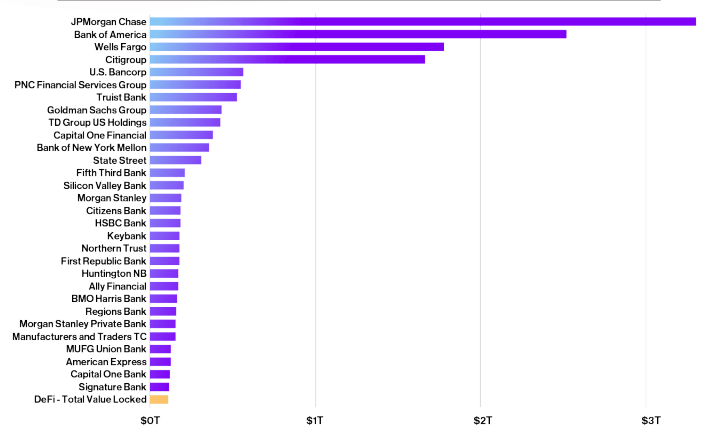

However, the current size of the DeFi market doesn’t even come close to the value of legacy financial systems. Compared to legacy banks, the entire DeFi market would represent only the 31st largest bank in the U.S. by total assets under management, leaving more room for growth.

New protocols and better tech are coming for Ethereum

It’s impossible to look at the crypto space without seeing the impact of Ethereum. The world’s second-largest blockchain network by market capitalization, Ethereum seems to have its own gravitational field, shaping the space around itself.

Since it positioned itself as the leader of the DeFi space, countless networks have popped up trying to take the reign from Ethereum—some already rival it in users, while others report significantly more usage.

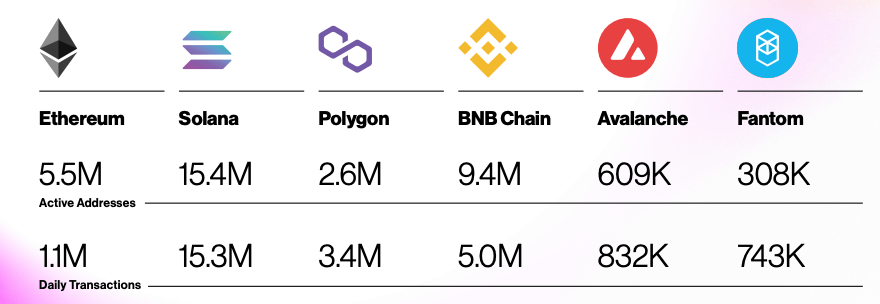

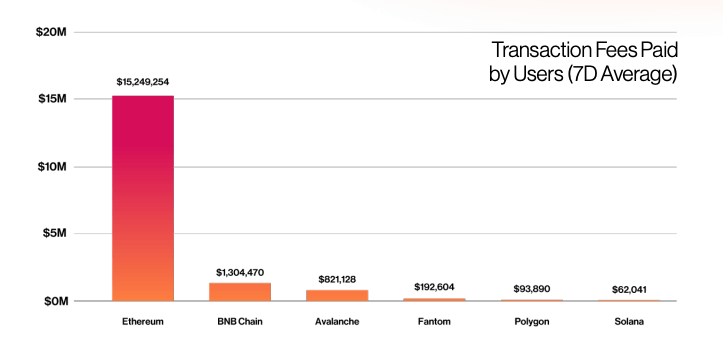

With 15.5 million daily transactions recorded between April and May this year, Solana outpaces Ethereum’s 1.1. million daily transactions. Its 15.4 million active addresses also cast a shadow on the 5.5 million active addresses Ethereum recorded last month. Even relative newcomers to the industry like Avalanche and Fantom are on their way to surpassing Ethereum when it comes to daily usage.

When it comes to the sheer size and network effect, Ethereum is still king. Data from a16z showed that the demand for block space on Ethereum was unmatched, with the network averaging around $15.5 million in transaction fees weekly.

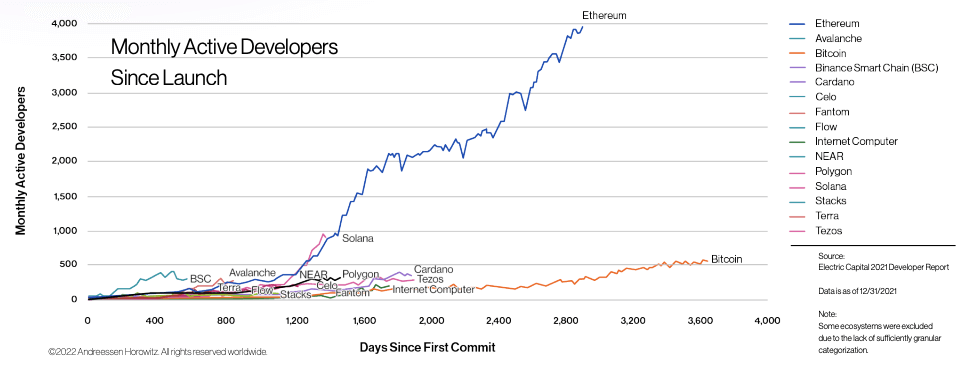

Ethereum has also historically attracted the most developers, with the number continuing to grow as time passes. Some of its competitors have assumed a similar trajectory but still, fall way behind both in the number of developers working on the protocols and in the overall number of commits.

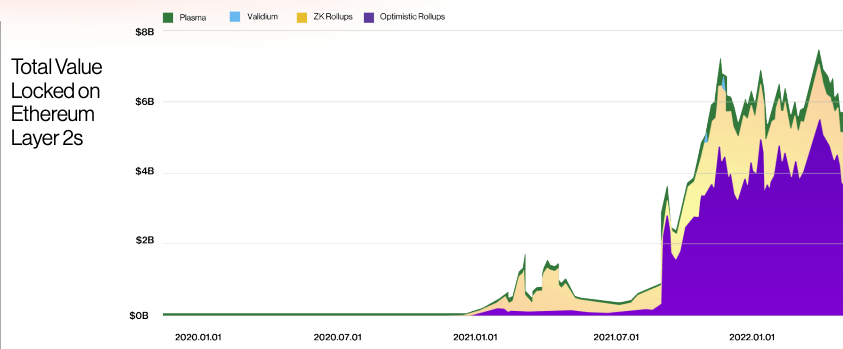

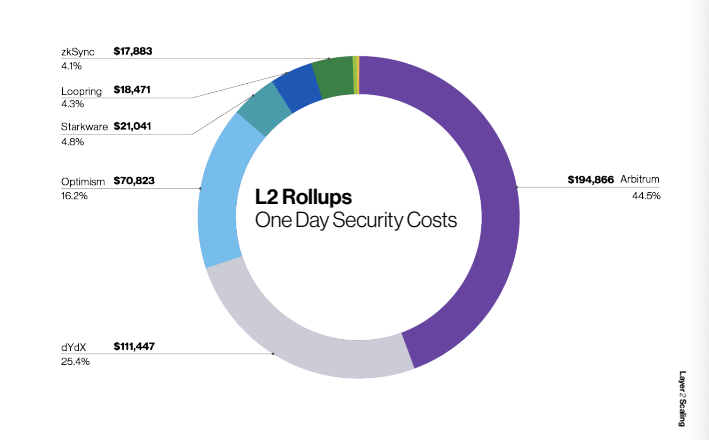

The power of Ethereum’s network effect is visible in the advancements made in Layer-2 networks and technologies. Instead of launching on other blockchain networks, some of which offer significantly lower fees and faster settlements, developers are working on introducing rollup technologies to Ethereum to create second-layer blockchains that inherit the security guarantees of Ethereum.

In L2 technology, optimistic rollups and zero-knowledge rollups dominate the space. And while optimistic rollups, which assume that all transactions are valid unless challenged, are the most popular L2 solution, zero-knowledge rollups are beginning to take up more meaningful space in the L2 game.

The importance of L2 rollups is seen in the amount of value they provide to Ethereum’s baseline security. According to a16z, L2 rollups accounted for around 1.5% of all fees paid on Ethereum.

The untapped potential of NFTs

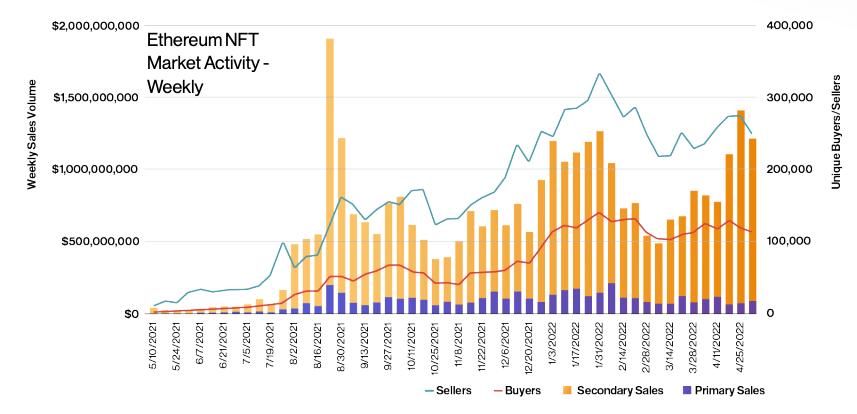

After 2021’s NFT boom, it looked like the market was oversaturated with the novel asset class and the hype surrounding it.

But, as the fall gave way to winter, NFT market activity recovered and continued to grow throughout 2022.

a16z believes that the NFT market is still “hot,” despite the recent slump in prices and the overall NFT trading volume reduction. The company believes that the NFT market is still in its infancy and that the true potential of the asset class is yet to be tapped.

This is because NFTs represents one of the core pillars of the Web3 space, which offers decentralized alternatives to the Web2 platform’s creators and developers are used to.

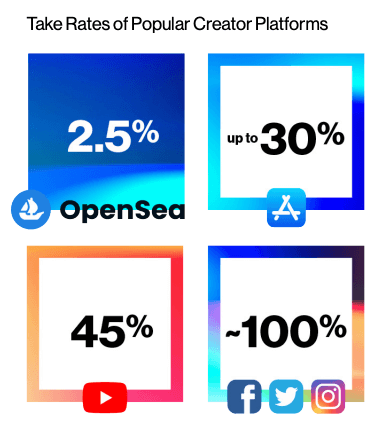

a16z sees enormous potential in this, saying that the take-rates of Web2 giants are “extortionate,” while Wbe3 platforms offer fairer economic terms.

“Compare Meta’s nearly 100% take-rates across Facebook and Instagram to NFT marketplace OpenSea’s 2.5%. As U.S. Congressman Ritchie Torres noted in a recent op-ed, ‘You know something is profoundly wrong with our economy when Big Tech has a higher take rate than the mafia.'”

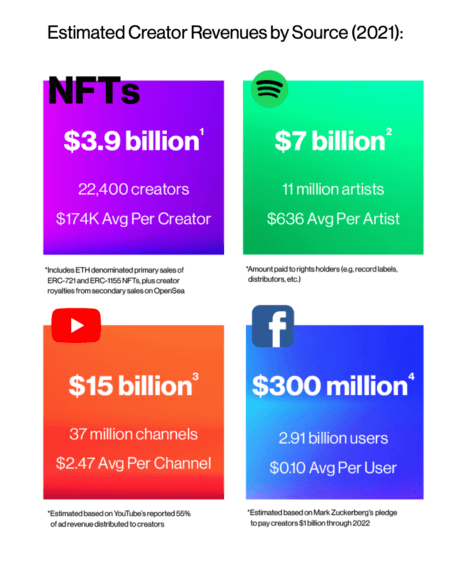

To estimate just how better these economic terms are, a16z calculated how much Web3 platforms paid out to creators compared to their Web2 alternatives.

In 2021, the primary sales of Ethereum-based NFTs and the royalties paid to creators from secondary sales on OpenSea totaled $3.9 billion. Based on 22,400 creators included in the research, this averages around $174,000 per creator.

That’s almost quadruple the $1 billion Meta has earmarked for creators throughout 2022. Last year, Web2 giant YouTube paid out an estimated $15 billion to creators. And while this number might look significantly higher than what we’ve seen in the Web3 market, the payout amounts to around $2.47 per channel based on the 37 million channels the platform reports hosting. Streaming platform Spotify hosts 11 million artists, and its $7 billion payout amounts to around $636 per artist.

Web3 in 2022 is the internet in 1995

And while current market movements paint a bleak picture, zooming out shows that the crypto industry is heading for the stars. To put the market into perspective, a16z compared the current state of the Web3 industry to the early days of the internet, revealing that more growth was bound to come.

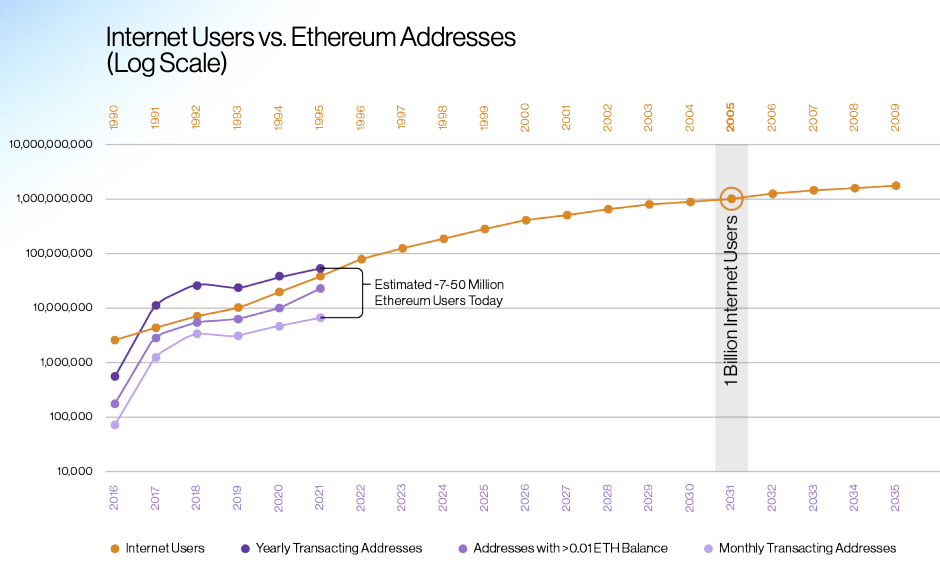

Based on various on-chain metrics, the report estimated somewhere between 7 and 50 million active Ethereum users today.

“Analogizing to the early commercial internet, that puts us somewhere circa 1995 in terms of development,” the company said in the report. “The internet reached 1 billion users by 2005—incidentally right around the time Web2 started taking shape amid the founding of future giants such as Facebook and YouTube.”

Based on its research, a16z believes that the Web3 infrastructure will continue to improve and grow. More creators will embrace NFTs in their communities as they discover they can offer better monetization than other Web2 platforms and services.

The company also expects that new Web3 users who earn tokens through NFTs and games will most likely choose to save them in DeFi protocols rather than cash out and keep the money in TradFi banks. This will lead to a significant increase in DeFi users, further growing the market.

“Again, though it’s very hard to estimate, if the trendlines continue as depicted, web3 could reach 1 billion users by 2031. In other words, you’re still early.”