Yield Farming Sector up 8% according to CryptoSlate data

Yield Farming Sector up 8% according to CryptoSlate data Yield Farming Sector up 8% according to CryptoSlate data

The market sector has seen big gains led by low-cap token Landshare, a DeFi protocol allowing investors to flip houses on-chain.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Yield farming platforms and protocols surged 8% over the last 24 hours, with a total sector market cap now north of $10 billion.

What are yield farming coins?

The yield farming token sector refers to a subset of the decentralized finance (DeFi) ecosystem that focuses on providing incentives to users for providing liquidity to various DeFi protocols.

Yield farming tokens are typically governance tokens that provide holders with voting rights and a share of the fees generated by the protocol. These tokens can be earned by staking or providing liquidity to various DeFi platforms, which in turn allows users to earn a yield on their investment.

The rally has benefited mid-cap tokens like Uniswap and Aave, up 3.7% and 4.3%, respectively, but it has not necessarily come from them.

Up much more are lower-cap tokens like Landshare.

House flipping on-chain

The sector rally appears to be mostly led by the newly launched project Landshare, a token fully integrated with the Binance Smart Chain, which has surged +44% in the last 24 hours.

The project allows for tokenized real estate assets to be flipped on-chain, a platform that merges the capabilities of DeFi and real estate investment, a platform that offers direct exposure to assets on-chain like Tokenized Assets and Crowdfunded House Flipping.

Badger DAO accelerates

Another low-cap token that has surged over the past 24H is Badger DAO, a project that aims to build products and infrastructure necessary to accelerate Bitcoin as collateral across other blockchains.

Badger has risen in price +6.75% over the past 24H, with a market cap of $72 million, the token price of Badger is now $3.79.

On Feb. 22., Badger DAO introduced an eBTC, a decentralized Bitcoin powered by Ethereum staking.

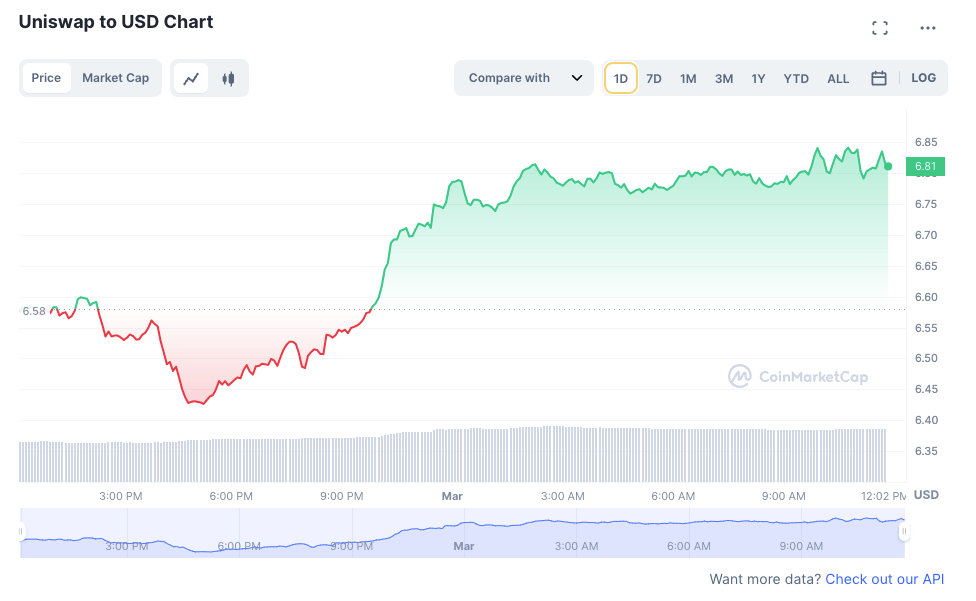

Uniswap rises

Uniswap is a decentralized cryptocurrency exchange that operates on the Ethereum blockchain and uses an automated market-making system. It has its own governance token called UNI and is considered a prominent player in the world of decentralized exchanges.

The current trading price for Uniswap is $6.81 USD, the token has seen a 3.31% increase in the last 24 hours, and currently holds the #18 rank on CoinMarketCap with a live market cap of $5 billion.

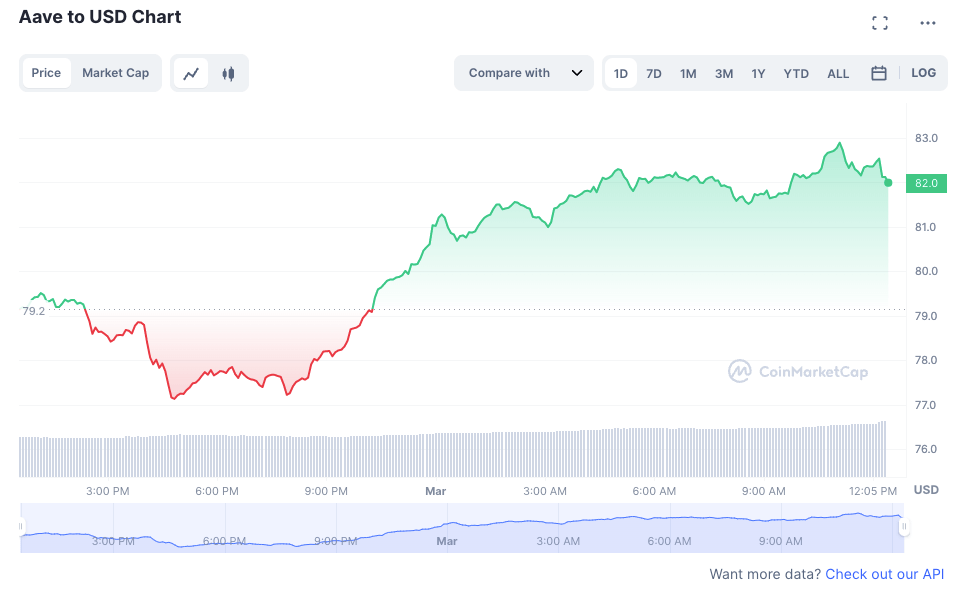

Aave gains too

Another yield farming token, Aave, is also up today. Aave is a decentralized finance protocol enabling users to lend and borrow cryptocurrencies by depositing their digital assets into liquidity pools, allowing borrowers to use crypto as collateral to obtain flash loans.

The current trading price of Aave is $82.32 USD, with a 24-hour trading volume of $82,338,720 USD. The token has experienced a 4.26% increase in the last 24H.

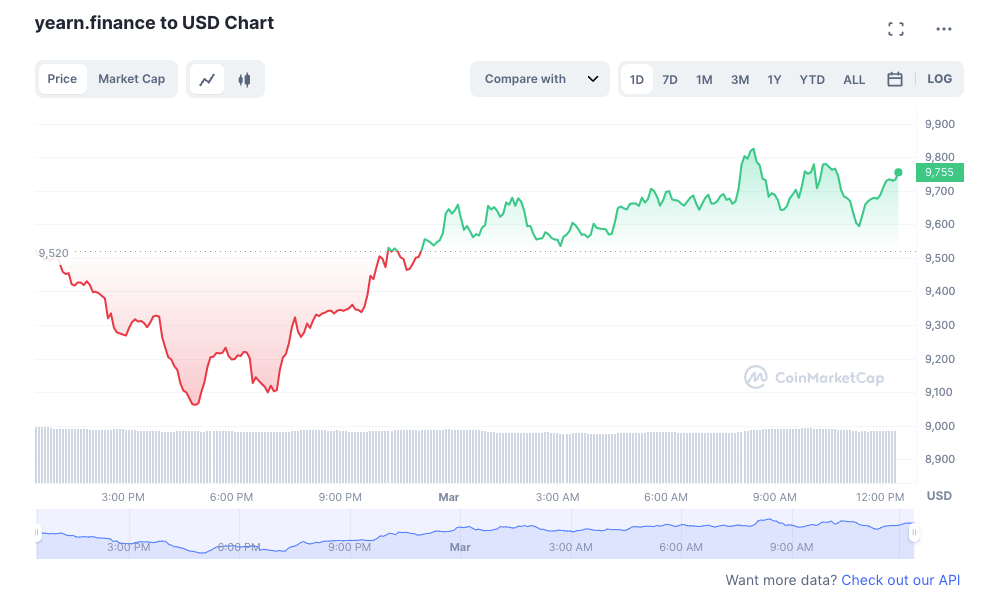

Yearn Finance sees modest gains

yEarn.finance is a DeFi lending protocol built on Ethereum, as an aggregator service designed for investors in DeFi that leverages automation to help them maximize profits from yield farming. The platform aims to simplify the complex DeFi landscape for less tech-savvy investors or those seeking a less intensive approach than that of professional traders.

The current price of yearn.finance is $9,735.50 USD, it has experienced a 2.86% increase in value over the past 24H. Its current market cap is $356 million, making it the 116th most popular token on Coin Market Cap.