Why are ‘dino coins’ like Ethereum Classic and NEO pumping?

Why are ‘dino coins’ like Ethereum Classic and NEO pumping? Why are ‘dino coins’ like Ethereum Classic and NEO pumping?

It’s altcoin pumping season all over again.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

“Altcoin season” is back. At least if you consider what cryptos have been pumping the past days in our little part of the world.

Crypto pump season

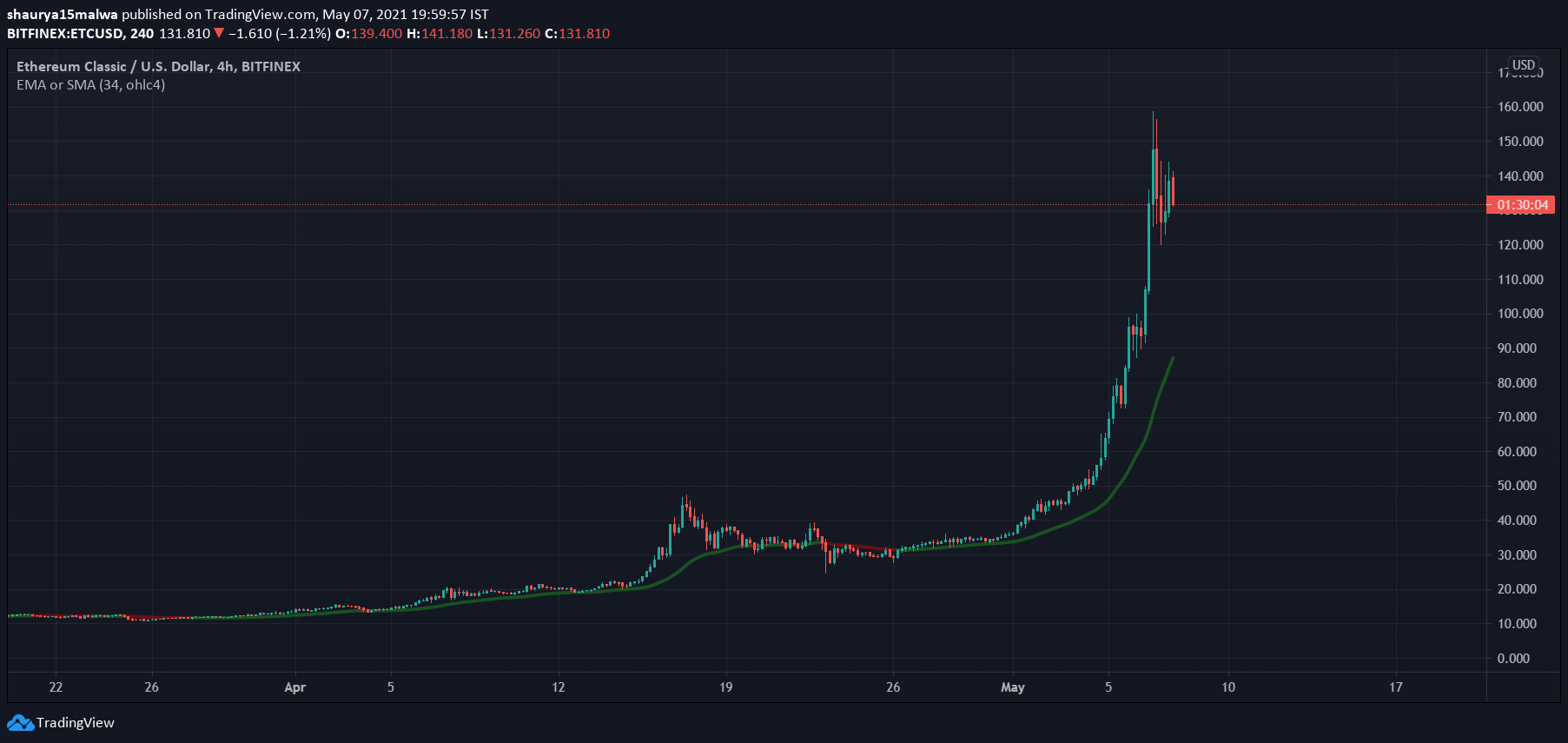

Data from CryptoSlate shows Ethereum Classic—the original Ethereum prior to The DAO hack—has pumped over 300% in the past few days and 600% in the past month. Take the needle back to a year ago, and it’s up nearly 1,800%!

$ETC

~5 Years of price history got obliterated the fuck out by a 2 week chadness

ONLY IN CRYPTO pic.twitter.com/HR6DCI1SmR— Edward Morra (@edwardmorra_btc) May 6, 2021

The decentralized platform runs smart contracts and is a continuation of the original Ethereum blockchain, one that preserves “untampered history,” is free from external interference and subjective tampering of transactions.

A very small number of apps run on Ethereum Classic (as this list from their official site shows). Ethereum, in comparison, runs tens of thousands of apps and handles billions of dollars worth of value transfer on its network daily. ETH has, as a result, pumped over 1,600% in the past year.

But while ETH has steadily risen to its current $3,400. ETC’s rise has been strangely vertical, however.

As the below image shows, ETC traded in the $5-$11 range for a large part of 2020, and the $11-$14 for the first two months of 2021. In March, it went from $14 to over $40 (setting a new high), before falling back to $30. Then, the launch happened. ETC pumped to over $155, reaching a market cap of $17 billion in the process.

Other so-called ‘dino’ coins—or cryptocurrencies that had an exciting use case once upon a time but have since lost ground to other new projects—pumped significantly as well. Chinese smart contract project NEO has risen 93.4% in the past month and 1,229.8% in the past year, while ‘Ethereum killer’ smart contract platform EOS has risen 63.1% in the past month and 302.6% in the past year.

Even IOTA, a so-termed ‘internet of things’ blockchain, has risen 27% in the past month and 1,189.4% in the past year.

Correlation or ING report?

Most of that surge can be attributed to the fact that cryptocurrencies remain highly correlated to each other, meaning that when large-caps like Bitcoin and Ethereum move upwards, most other cryptocurrencies follow suit as well.

But part of that surge can be attributed to the increasing public attention (thanks Dogecoin) for the crypto space and several institutional reports valuing DeFi protocols, smart contract platforms, and Ethereum-like blockchains more than Bitcoin.

One such report by Dutch bank ING yesterday explored the intricacies of DeFi protocols, concluding that the booming market could be “more disruptive than Bitcoin to the financial sector.”

ING Bank has released a report analyzing the DeFi space, stating that “DeFi could be more disruptive than Bitcoin to the financial sector,” https://t.co/9RSgSxMTis pic.twitter.com/1TOAUwOcZu

— Bloqport Insights (@Bloqbot) May 6, 2021

“Although DeFi currently appears to be a domain on its own, we envision that centralised and decentralized financial services will converge at some stage as both have unique capabilities that are beneficial to the other,” the paper said, adding:

“This way a DeFi service could comply with AML regulation. However, as this is uncharted territory, more research is needed to determine the validity of such [cooperation] between centralized banks and decentralized financial services.”

The above is, by no means, causation of the pumps among coins like ETC, NEO, and EOS. However, it does suggest that interest in most large-cap smart contract platforms could be present regardless of the hype associated with newer projects like Solana.