Top 10 metaverse tokens tank as interest wanes

Top 10 metaverse tokens tank as interest wanes Top 10 metaverse tokens tank as interest wanes

After the hype of 2021 saw the value of metaverse lands ballon to astronomical heights, the value of these lands have now drastically declined.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

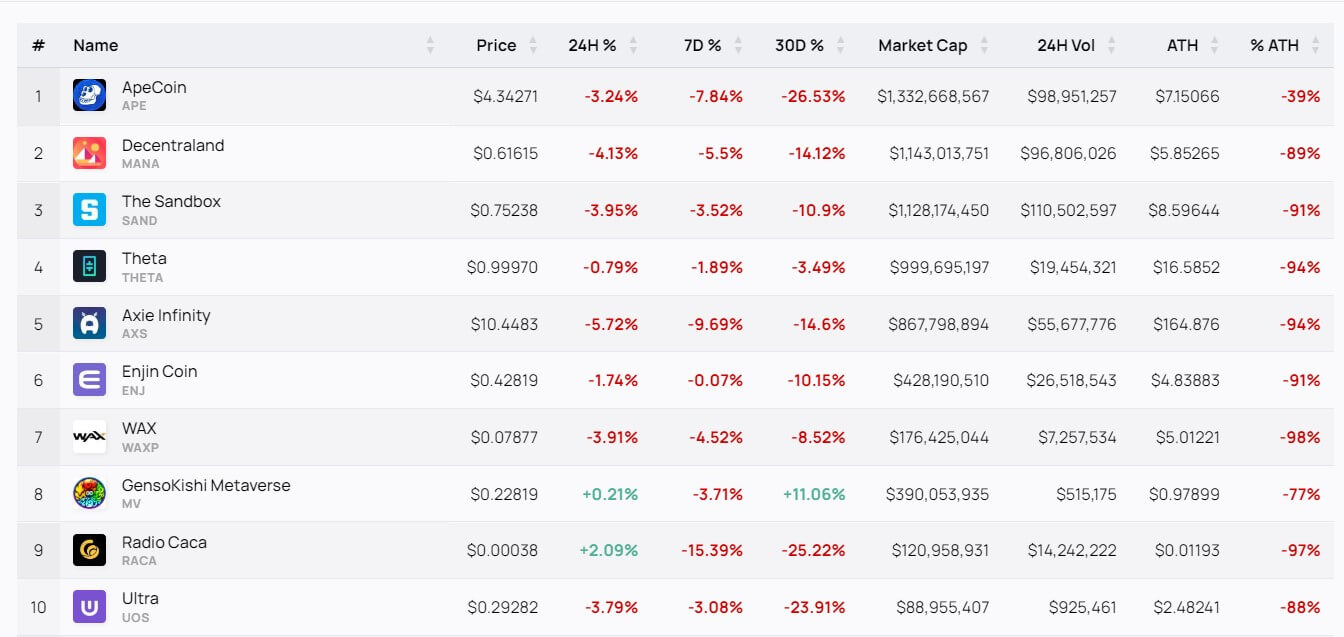

Investors appear to be losing interest in Metaverse-related tokens as only one among the top 10 crypto assets in the niche has recorded a positive performance in the last 30 days.

According to CryptoSlate data, Bored Apes affiliated ApeCoin (APE) has shed 26.42% in the last 30 days. Over the seven-day metrics, it has lost 7.84% and is currently trading for $4.34.

During this period, Decentraland’s MANA declined 14.2%, The Sandbox’s SAND lost 11%, Theta shed 3.8%, Axie Infinity’s AXS is down 14.76%, Enjin Coin’s ENJ plunged 10.84%. Others like WAX fell 9%, Radio Caca’s CACA fell 25.2%, and Ultra UOS lost 25.31%.

The only exception among the top 10 metaverse tokens over the last 30 days is GenshoKishi Metaverse MV which gained 11%.

Meanwhile, all metaverse crypto tokens have dropped by 5.65% in the last seven days and 2.97% in the last 24 hours.

As the metaverse real estate bubble crashed?

After the hype of 2021 saw the value of metaverse lands ballon to astronomical heights, the value of these lands has drastically declined.

As of August, land prices in metaverse projects have dropped by 85% since the peak. According to available data, land sales peaked on Decentraland at $37,238 in November 2021, but the average price is now around $6,600. The average land sale price on The Sandbox, which was also over $20,000, has tanked to roughly $3000.

Even Yuga Labs-related Otherdeeds for Otherside, which launched to much fanfare earlier this year with an average land price of $25,247, has seen its value crash below $5,000.

The user base on these metaverse platforms has also flatlined. The average number of concurrent players on Decentraland is down to 477 from 2,341 in February. Active traders have also declined. Otherdeeds had the highest number, peaking at 51,641 in April but down to 826.

Some projects, such as Decentraland, Voxels, Somnium Space, NFT Worlds, and Tree Verse, have active traders of less than 100 as of October 17. Unique buyers have also dropped, with none of Decentraland, The Sandbox, and Otherdeeds having up to 100 on the same day.

Facebook’s metaverse is empty

Facebook’s attempt to rebrand its business to focus on Metaverse has also been entirely successful. A recent report by the Washington Examiner stated that Meta’s main Metaverse Horizon world had only 200,000 monthly active users (MAU) in October.

This is far from its projection of 280,000 users, which it was forced to revise after realizing its goal of 500,000 MAU might be an overreach. While its metaverse interface tool, Meta Quest, is one of the market’s best-selling VR headsets, company data shows that over 50% were not used six months after purchase, as reported by Wall Street Journal.