The real roadblock Bitcoin faces is at $20k—and whales are awaiting

The real roadblock Bitcoin faces is at $20k—and whales are awaiting The real roadblock Bitcoin faces is at $20k—and whales are awaiting

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

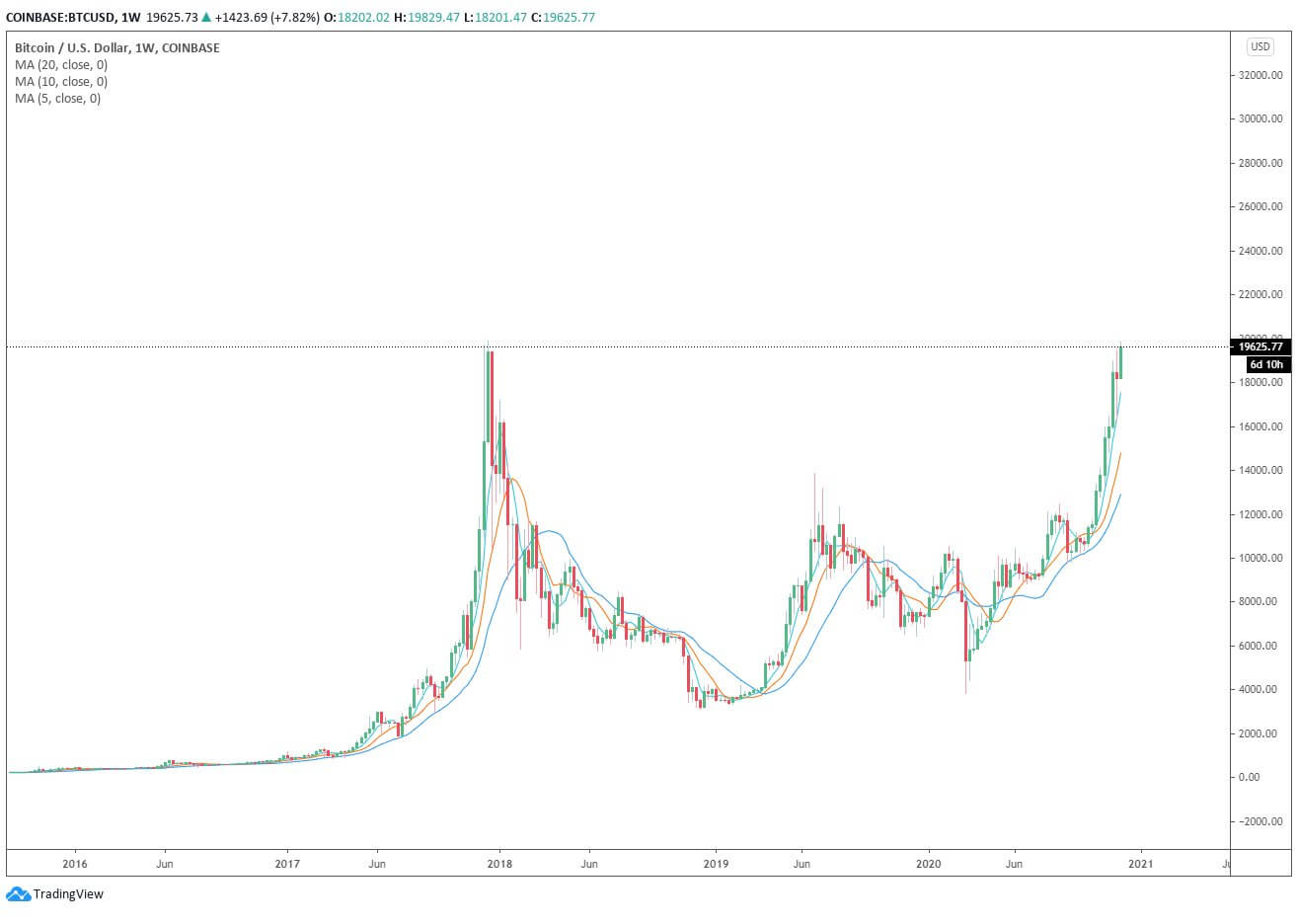

The real roadblock Bitcoin (BTC) faces is at $20,000, near its all-time high. Albeit its record high is different across major exchanges, it already hit its highest price on some exchanges.

But, whales have not been withdrawing BTC from exchanges at the same rate as they did in recent months. Atop this trend, stablecoin inflows have also been slowing. The combination of these two trends could cause BTC to see a pullback near $20,000.

Bitstamp just hit it https://t.co/GuifGm8Pcz pic.twitter.com/8yPMPOFo5X

— Dan McArdle (@robustus) November 30, 2020

What happens above $20,000?

In the near term, $20,000 could be a tough level to break in one go. That could make a new range between $19,400 and $20,000.

The variable remains if there is sufficient buyer demand to break past $20,000. Whales tend to sell when there is peak liquidity in the market. As such, if whales sell, BTC could see a pullback near or above its all-time high. CryptoQuant CEO Ki Young Ju said:

“I called short-term bearish based on miner-selling, whale activeness on exchanges, and no whale withdrawals. but I knew enough exchange stablecoin reserve would break $20k by this year. If ATH rejection happens, it could be a huge pullback as whales would sell BTC heavily.”

Shortly after Bitcoin surpassed $19,800 on Coinbase and other exchanges, BTC saw a sharp sell-off to around $19,100, as Ki predicted.

But, if Bitcoin does surpass $20,000, it would mean it enters price discovery.

In technical analysis, the term “price discovery” refers to a scenario in which an asset’s price reaches a new peak. Since there are no historical resistance levels, this would allow Bitcoin to search for a new ceiling.

As such, there is no specific peak Bitcoin would look towards as it surpasses $20,000. The options market seems to be expecting a $36,000 to $50,000 range as the next peak for BTC.

With BTC above $19,500, all of the circulating Bitcoin supply is in profit, which is indicative of the strength of the current bull run.

100% of the circulating #Bitcoin supply is in profit.

Chart: https://t.co/wDpd4s3BKJ pic.twitter.com/8vkssXJkYw

— glassnode (@glassnode) November 30, 2020

What will keep Bitcoin above $20,000?

There have been lots of selling pressure and short-sells at around $19,800. Considering that short contracts turn into buyer demand when short-sellers close their positions, this could continue to fuel BTC upwards.

Cantering Clark, a technical analyst, said:

“If the market keeps its footing here, it happens shortly. Big selling volume just came in, it’s enough to squeeze us up.”

Analysts have also theorized that since Bitcoin continues to increase during U.S. hours, institutions are buying BTC with the Time-Weighted Average Price (TWAP) algorithm.

If the trend gets sustained, it could place systematic buyer demand on BTC throughout the near term. The institutional demand has been continuously rising after high-profile investors, like Paul Tudor Jones, allocated a portion of his capital into Bitcoin.

Bitcoin Market Data

At the time of press 10:13 pm UTC on Nov. 30, 2020, Bitcoin is ranked #1 by market cap and the price is up 5.66% over the past 24 hours. Bitcoin has a market capitalization of $357.78 billion with a 24-hour trading volume of $46.33 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 10:13 pm UTC on Nov. 30, 2020, the total crypto market is valued at at $573.75 billion with a 24-hour volume of $199.49 billion. Bitcoin dominance is currently at 62.39%. Learn more about the crypto market ›