The Race for a Bitcoin ETF: The Winklevoss Brothers’ Effort

Photo by Maico Amorim on Unsplash

On June 26th, 2018 the SEC received an application for a Bitcoin ETF license from the Chicago Board Options Exchange (Cboe) in partnership with Van Eyck Investment and SolidX. The SEC recently published the file and investors and crypto-enthusiasts now eagerly await their decision.

The partnership between Cboe and SolidX is significant. Together, Cboe and SolidX represent two of the three financial institutions that filed for a Bitcoin ETF with the SEC. SolidX’s last attempt in 2017 was rejected by the SEC due to fears of an unregulated overseas market.

VanEck, which operates more than 70 ETFs and ETPs, is also a major advantage for the application group. Together, the three companies offer a real chance of getting the first Bitcoin ETF approved.

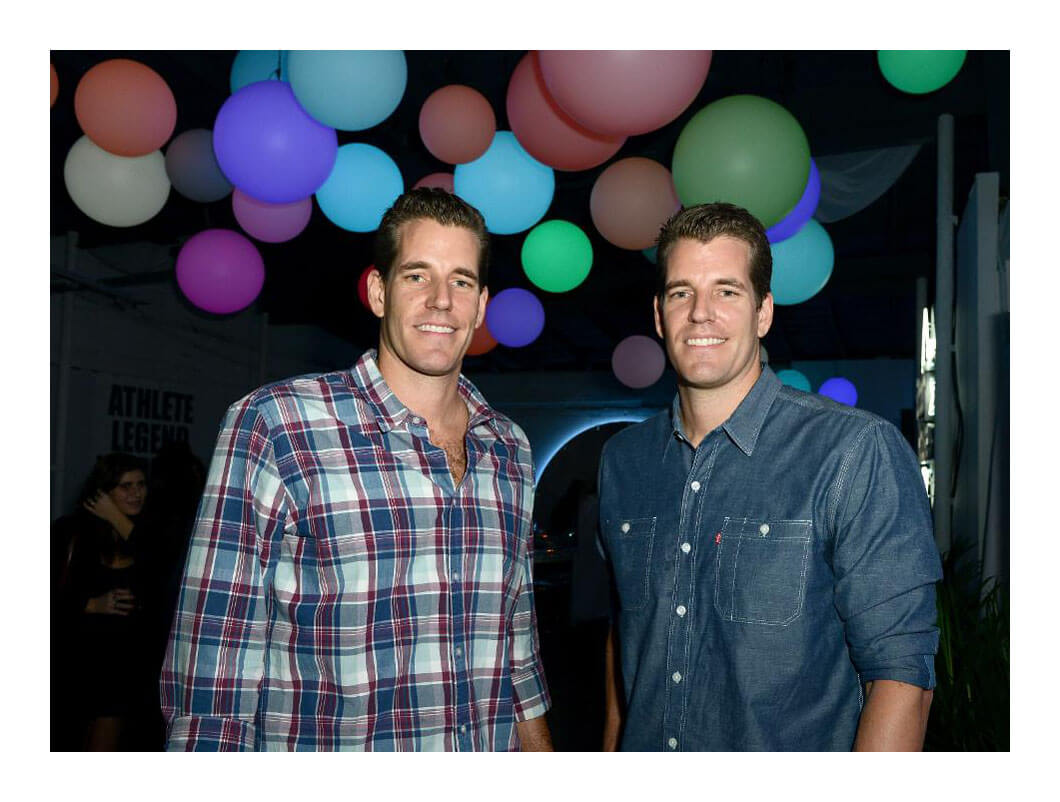

The Winklevoss Twins and Bitcoin

(Alli Harvey/Getty Images for Spotify)

Gemini, the exchange of the Winklevoss twins, is the third financial institution that applied for a Bitcoin ETF. In March 2017, the SEC denied their request citing concerns of “fraudulent and manipulative acts,” in the crypto market.

Given their history, it is unlikely that Cameron and Tyler will be deterred by their latest setback. And so, the race for world’s first Bitcoin ETF continues.

The former Olympian rowers have long recognized the potential of bitcoin. In 2013, Cameron stated:

“Bitcoin and gold have a lot of things in common, but in a lot of areas, I think, bitcoin is preferable to gold. It’s very clear to see why people are talking about bitcoin as a digital gold, or gold 2.0.”

That same year, they also filed an S-1 proposing The Winklevoss Bitcoin Trust ETF. There are a few big differences from their 2013 proposal and Cboe’s one today.

- While Cboe plans to offer Baskets composed of five Shares worth 25 BTC each, for a total of 125 BTC per Basket, the Winklevoss’ 2013 application proposed Baskets composed of 50,000 shares worth 0.2 BTC each, for a total of 10,000 BTC per Basket.

- On July 1st, 2013, the day of the S-1 filing, Bitcoin was worth $97.51. Today, bitcoin is worth over $6000.

- In 2013, exchanges like Mt. Gox still existed. Mt. Gox, which at one point handled over 70% of the global bitcoin transactions, ultimately suffered a massive hack, catapulting cryptocurrencies into a multi-year bear market. Although hacks still occur today, asset security is one of the primary focuses of all exchanges and proposed ETF funds.

While time will only tell whether the Winklevoss twins will manage to launch the first Bitcoin ETF, it is almost certain they will continue to build and invest in the cryptocurrency space. Afterall, in February 2018, Cameron predicted that the bitcoin market could one day be worth $3-4 trillion.

Recently announced, Robert Cornish, CIO of the New York Stock Exchange, will be part of the Gemini team. By doing so, he joins people like former Goldman Sachs Executive Director Priyanka Lilaramani and Facebook executive David Marcus, to become the latest executive to jump on the crypto train.