Tezos (XTZ) price surges following DAO framework announcement and Grayscale rumours

Tezos (XTZ) price surges following DAO framework announcement and Grayscale rumours Tezos (XTZ) price surges following DAO framework announcement and Grayscale rumours

New York-based tech company TQ Tezos has announced Homebase—a new project that allows Tezos (XTZ) users to easily set up and interact with decentralized autonomous organizations (DAOs) to establish a community governance structure.

The price of XTZ reacted quite positively to the news, surging by over 20% today on the heels of the announcement—up to $3.37, according to crypto metrics platform CoinGecko.

Included in today’s release are two initial DAO templates:

TreasuryDAO: create and manage a community treasury

RegistryDAO: govern arbitrary smart contracts, (e.g. parameter governance in a DeFi protocol)And we hope to launch the initial version of Homebase in March!

— TQ Tezos (@TQTezos) January 21, 2021

As the name suggests, DAOs allow various decentralized projects’ users to take an active part in the process of decision making and vote for new proposals.

Per the announcement, Homebase is built on a new smart contracts framework called BaseDAO which allows users to create and finetune DAOs that will govern resources, registries, or rules.

“A proposal executed by a BaseDAO can be as simple as transferring some funds to an address or, like Tezos, as complex as updating the DAO to an entirely new set of rules,” the post explained.

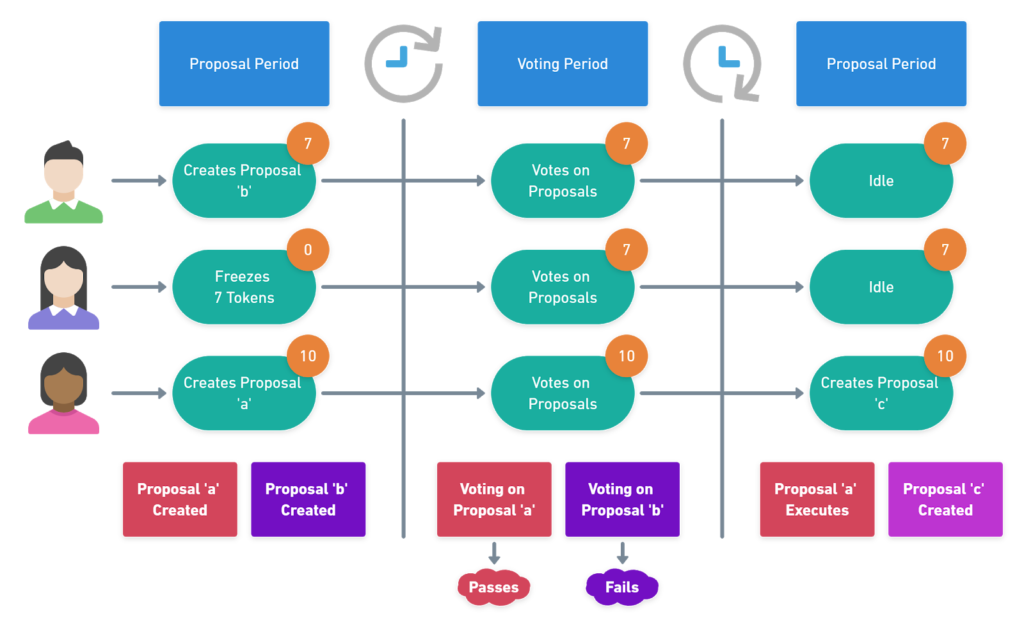

For example, a template called TreasuryDAO allows communities to manage treasuries while RegistryDAO enables governance of arbitrary smart contracts, TQ Tezos explained. The governance process comprises two stages—a proposal period and a voting period.

“Initially, Homebase will support the core behavior requested by users and the community: parameter selection (e.g. similar to Compound) and treasury management DAOs,” said the announcement, adding, “Over the coming weeks and months, we’ll be enhancing and extending these templates for new exciting applications such as fractional ownership of NFTs and DAOs for simple off-chain vote signaling like Snapshot.”

As CryptoSlate reported, Tezos’ major upgrade “Delphi” went live last November, allowing to speed up transactions and reduce fees.

Currently, Tezos developers are also working on the next upgrade—dubbed “Edo”—which, among other things, will introduce Zcash-like privacy features to the blockchain.

A Grayscale Tezos Trust?

In addition to the DAO announcement, rumours have been circulating about a new Grayscale Trust for Tezos.

Grayscale Investments is the world’s largest crypto asset manager and investment platform. It holds over $25.5 billion worth of various cryptocurrencies (mainly Bitcoin) over nine “trusts.” Its products are some of the only regulated crypto-offerings to trade on public markets in the US.

A Tezos trust would work in a similar manner. Grayscale would hold a fixed amount of XTZ per share, and accredited investors would be able to purchase it via regulated OTC brokers in the US.

Tezos Market Data

At the time of press 2:37 pm UTC on Feb. 20, 2022, Tezos is ranked #19 by market cap and the price is up 9.09% over the past 24 hours. Tezos has a market capitalization of $2.43 billion with a 24-hour trading volume of $987.99 million. Learn more about Tezos ›

Crypto Market Summary

At the time of press 2:37 pm UTC on Feb. 20, 2022, the total crypto market is valued at at $930.34 billion with a 24-hour volume of $120.74 billion. Bitcoin dominance is currently at 63.77%. Learn more about the crypto market ›