SEC’s regulatory actions push US-based exchanges to withdraw staked Ethereum

SEC’s regulatory actions push US-based exchanges to withdraw staked Ethereum SEC’s regulatory actions push US-based exchanges to withdraw staked Ethereum

The SEC has urged US-based crypto exchanges offering staking programs and interest-bearing products to comply with securities laws.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Crypto exchanges in the U.S. Kraken, Coinbase, and Gemini

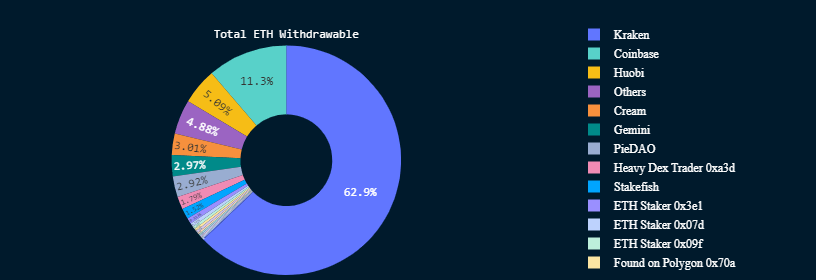

These exchanges want to withdraw 682,552 ETH of the 874,199 ETH tokens pending withdrawals as of press time.

Kraken leads entities processing withdrawals

Of these 682,552 ETH waiting to be withdrawn, Kraken wants to withdraw 556,272 ETH worth about $1.17 billion.

The exchange’s support team confirmed on Twitter that it was processing withdrawals for its U.S. clients immediately after the Shapella Upgrade was completed.

Kraken added:

“Any locked ETH will automatically enter the unstaking process [after the Shappella upgrade].”

In February, the U.S. Securities and Exchange Commission (SEC) fined Kraken $30 million for failing to register its staking product as a security. At the time, the exchange said it would end the staking service for its U.S. users and would automatically unstake their assets.

Is SEC’s regulatory threat also influencing Coinbase and Gemini?

Since the SEC’s action against Kraken, the regulator has issued a Wells notice to Coinbase, threatening to sue it for its staking service Coinbase Earn and other products like Coinbase Prime and Coinbase Wallet.

The Brian Armstrong-led exchange has vowed to fight the charges and maintained that staking is not a security under the U.S. Securities Act nor the Howey test. The exchange added that the regulator’s action would “prevent U.S. consumers from accessing basic crypto services and push users to offshore, unregulated platforms.”

Meanwhile, the SEC filed a lawsuit against Gemini in January over its defunct Earn program. According to the regulator, the Earn program constituted both an unregistered offer and sale of securities.

Under Chair Gary Gensler, the SEC has urged crypto exchanges offering staking programs and interest-bearing products to comply with securities laws.