On-chain Cardano analysis highlights ‘positive trends’

On-chain Cardano analysis highlights ‘positive trends’ On-chain Cardano analysis highlights ‘positive trends’

Analysis by IntoTheBlock suggested Cardano's On-Chain Metrics Signal Optimism with Stable Transactions, Rising Volume, and Whale Activity

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The Cardano network has shown “positive trends” throughout 2023 across several on-chain metrics, according to the analysis conducted by IntoTheBlock, including the examination of transaction count, transaction volume, and addresses in profit, among others.

A top-level highlight of the report noted that transaction count and transaction volume “stand out clearly.”

Cardano transactions

The Cardano transaction count has been relatively stable during this bear period – posting a 33.5% increase from yearly lows around mid-April.

In terms of transaction volume, the chart below shows an uptrend since the start of the year – leading to a year-to-date increase of 205%. This equates to over 26 billion ADA transacted daily.

“Recently, there was a notable peak in daily transaction volume, reaching a three-month high with 98,000 transactions in a single day.“

Other key points

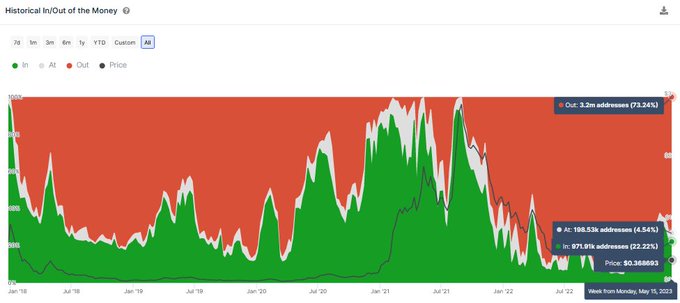

Analysis of addresses in profit revealed 22% are in profit, 5% are breaking even, while the majority, at 73%, are holding losses at the current price.

The price of ADA has sunk significantly from its $3.10 all-time high in August 2021. The coin has been between $0.25 and $0.46 since the start of this year.

The research platform concluded that most users, who are holding losses, continue to do so in the expectation of a coming price revival.

“The ADA token has faced some significant capitulation in recent months, but a majority of users are still holding strong in anticipation of a price increase.“

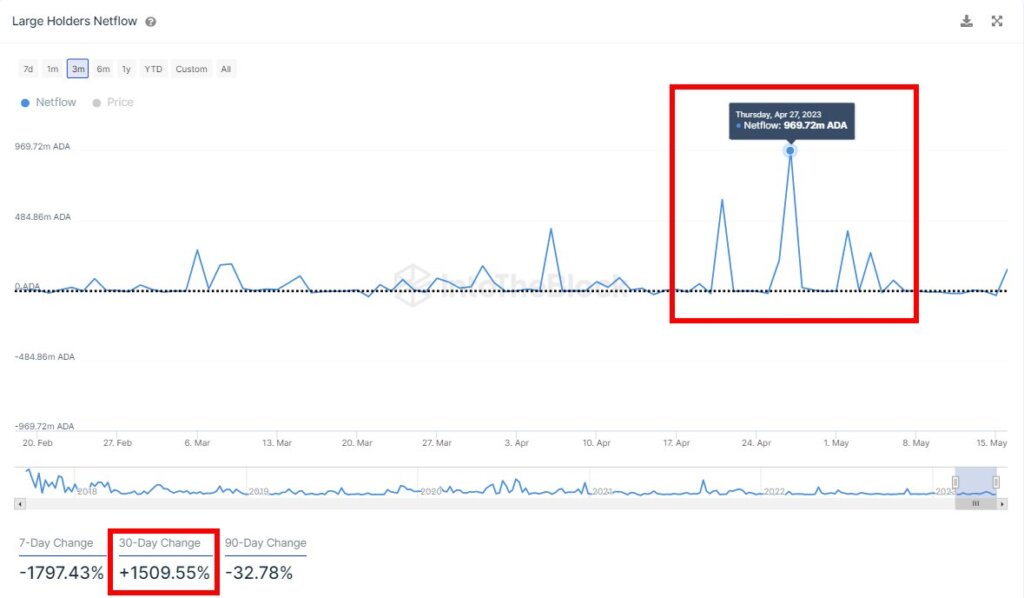

Regarding netflow from large holders, it was noted that the 30-day change saw a +1,510% increase in inflows – suggesting whale accumulation in play. The chart below also highlights that the majority of activity relates to inflows.

Mentioning the recent release of Hydra, IntoTheBlock does not expect it to make an immediate impact.

The Hydra layer 2 scaling solution was released on mainnet on May 4. It enables developers to create mini-blockchains, or heads, for processing data off-chain. This quickens processing time and takes load away from the main chain.

It was concluded that on-chain metrics point to positive trends, particularly the stable transaction count, rising transaction volume, and whale accumulation.