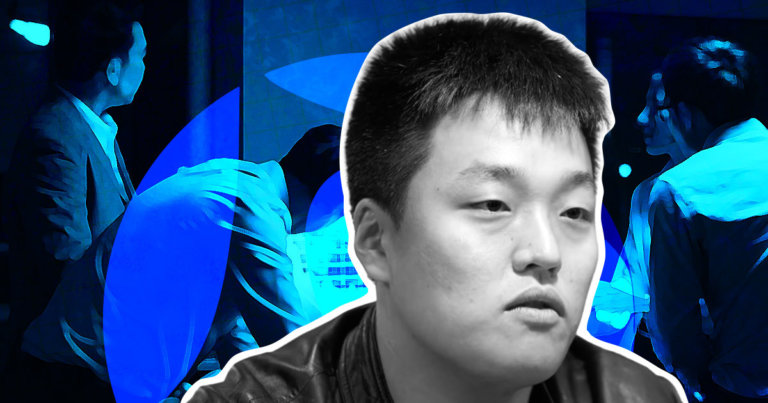

Luna insiders reveal info on Terra’s closed-door meetings including Do Kwon

Luna insiders reveal info on Terra’s closed-door meetings including Do Kwon Luna insiders reveal info on Terra’s closed-door meetings including Do Kwon

CryptoSlate spoke exclusively with two LUNA validators about what went on behind the scenes during the UST crisis. Our sources revealed key information about closed door conversations leading up to the relaunch of LUNA

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

CryptoSlate spoke to several Luna validators involved in the launch of LUNA 2.0 to get the inside track of what went on behind the scenes. The validators exclusively told CryptoSlate about Terraform Labs and Do Kwon’s involvement, the future of LUNA Classic, the rollout speed, and whether LUNA 2.0 was the right move.

We spoke to both verified validators ThorchainMaximalist and PFC, who were present during the “war room” conversations before Luna Classic was restarted.

Terra Luna Validator Interview

Akiba (CryptoSlate): Do you feel the group was able to communicate efficiently to get LUNA2 launched?

PFC: We had people all dealing with massive loss, in multiple timezones, coming from different places. The TG group was challenging as there were multiple topics going on, and things were discussed/agreed on/and then unagreed on all while you were sleeping but as no one had planned a ‘war room’ or incident response at this scale, there were no minute takes, summaries, or notes being taken so people knew what happened and most of us had other things to look after so couldn’t spend every minute looking at it so it could have been improved.. but it got the job done.

Akiba: Do you feel things had to go through Do Kwon and TFL before agreeing?

PFC: Do [Kwon] & TFL were very hands-off, in my opinion. (you should be able to see this when you read the logs and form your own opinion)

Akiba (CryptoSlate): Do you believe LUNA Classic has a future?

PFC: As is with no IBC , and no ability to stake, I don’t think it has much future. I actively validate on classic, and will continue to do so until it has no traffic. People are still using it, and getting value from it.. so who knows it may continue to run for a while, and get it’s own group of people using it.

Akiba (CryptoSlate): Is there anything said behind closed doors you feel should be made public?

PFC: There were a lot of side conversations. I don’t think it would have been productive having it made public what people thought about how inept certain people were. From what I was involved in, most of the side conversations was gossip, or potential ideas and using trusted members as sounding boards

I was involved in a private group that was trying to figure out who the initial validator set was.

I didn’t like that that conversation (and how individuals voted) should have been made public, but it was and it created a large uproar

Akiba (CryptoSlate): Do you think there was enough time to get everything ready for a new genesis chain in the few days the group had?

PFC: I think the choice of who was a validator was rushed. We have already seen people claiming to be validators from other chains, but had no affiliation with them (1-2 of them)people with no experience validating were told by their friends to ‘dm jared’ to get a spot.

Akiba (CryptoSlate): Do you think luna 2.0 was the right call and was the snapshot timing right?

Only time will tell. I like the idea of the vesting, it has a plan to keep the community & builders it will be a different L1 than the old one, but with USDT coming soon most of the apps should work quite well.

It is clear from PFC’s interview that there were significant issues with the process of handling the Terra crisis. He makes a great point that the same people who were trying to save the ecosystem were the ones who had likely lost the most. The validators were dealing with losing vast chunks of their net worth while trying to save what was left for the community. At least, this is one way of looking at it. With those involved in saving the project also having lost so much, it can be argued that there will have been some internal bias guiding their decisions.

There seems to be no evidence that validators or TFL were acting solely in their self-interest. However, they were working through the night during a highly emotional time. The ‘war room’ group had to coordinate a multi-national effort to collaborate on a decentralized project running on fumes with only a short break every few hours. Further, as PFC told us, they did so alongside managing other tasks and responsibilities.

Blockchain as an antifragile solution

According to PFC, the future of Luna Classic is limited, it views the legacy chain as unsustainable in its current form. However, the Terra crisis could have a silver lining of sorts. While the method by which LUNA was stopped, restarted, and then relaunched as LUNA 2.0 will be debated for years. However, one validator, ThorchainMaximalist, believes the whole incident is a bullish case study for blockchain technology. He told us directly:

“When Lehman Brothers crashed in 2008, the world was a few days away from not being able to take money out of an ATM machine. The regulators had to intervene, inject $700B in the market directly and a lot more indirectly through AIG and quantitative easing.

The Leeman investors lost all of their money. $luna and $ust had a bigger market cap than AIG. Every other protocol outside of the direct ecosystem kept working as intended. Smart contracts did their jobs and there was no big failure. A lot of the infra in crypto is built on first principles and is meant to be trustless and antifragile.

The designs is much more resilient and requires a lot less trust. Inside of a week the equivalent of a bankruptcy proposal was put into motion and fully executed. Around $10B of that wealth was given to original investors. If fraud was committed by the leadership they will see their day in court.”