Whale transactions and ETF records fuel Bitcoin’s push toward $60,000

Whale transactions and ETF records fuel Bitcoin’s push toward $60,000 Quick Take

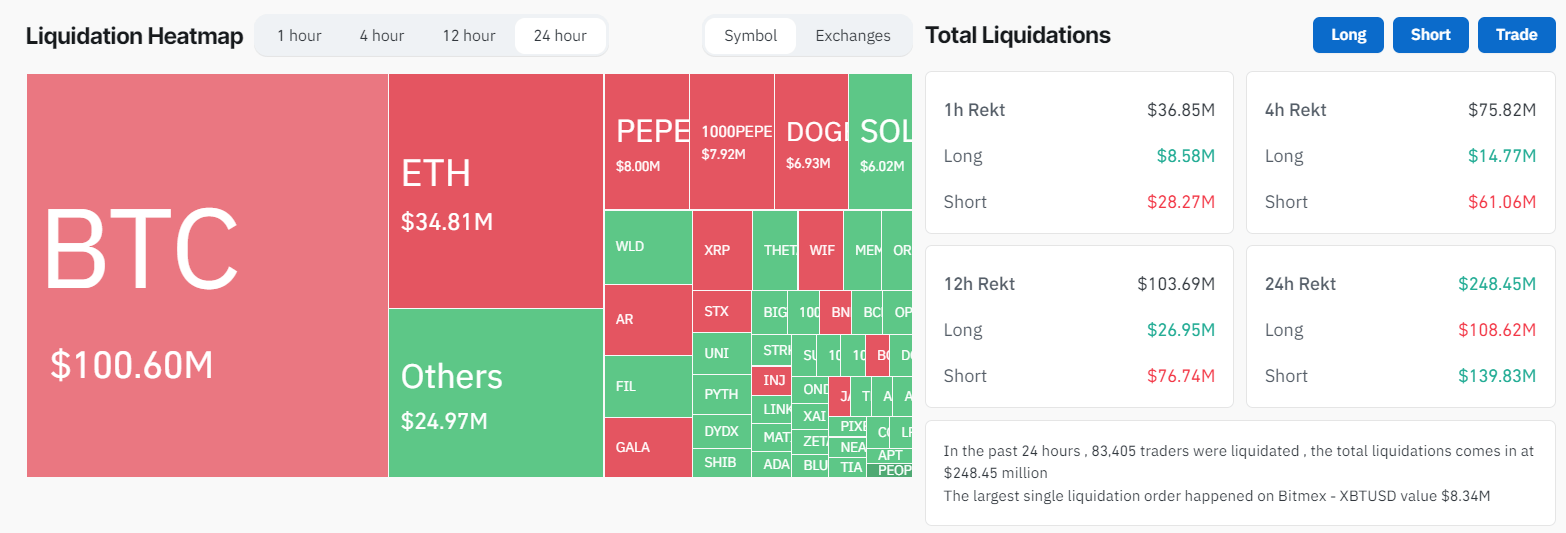

Bitcoin is currently demonstrating a robust market performance, bulldozing its way towards the $60,000 benchmark, up from its daily start of around $57,000. In the preceding 24 hours, a significant wave of liquidations hit the digital asset market, amounting to approximately $250 million. The liquidations depict a slight bias towards shorts, with an estimated worth of $140 million, according to Coinglass.

Coinglass data shows that in the same timeframe, Bitcoin experienced $100 million worth of liquidations, majorly shorts accounting for $70 million.

Simultaneously, the Exchange Traded Fund (ETF) inflows marked their third-best performance day, underlining the growing interest of institutional investors in this digital asset. A noteworthy mention is BlackRock, which recorded a record-breaking single-day performance with net inflows of $520 million.

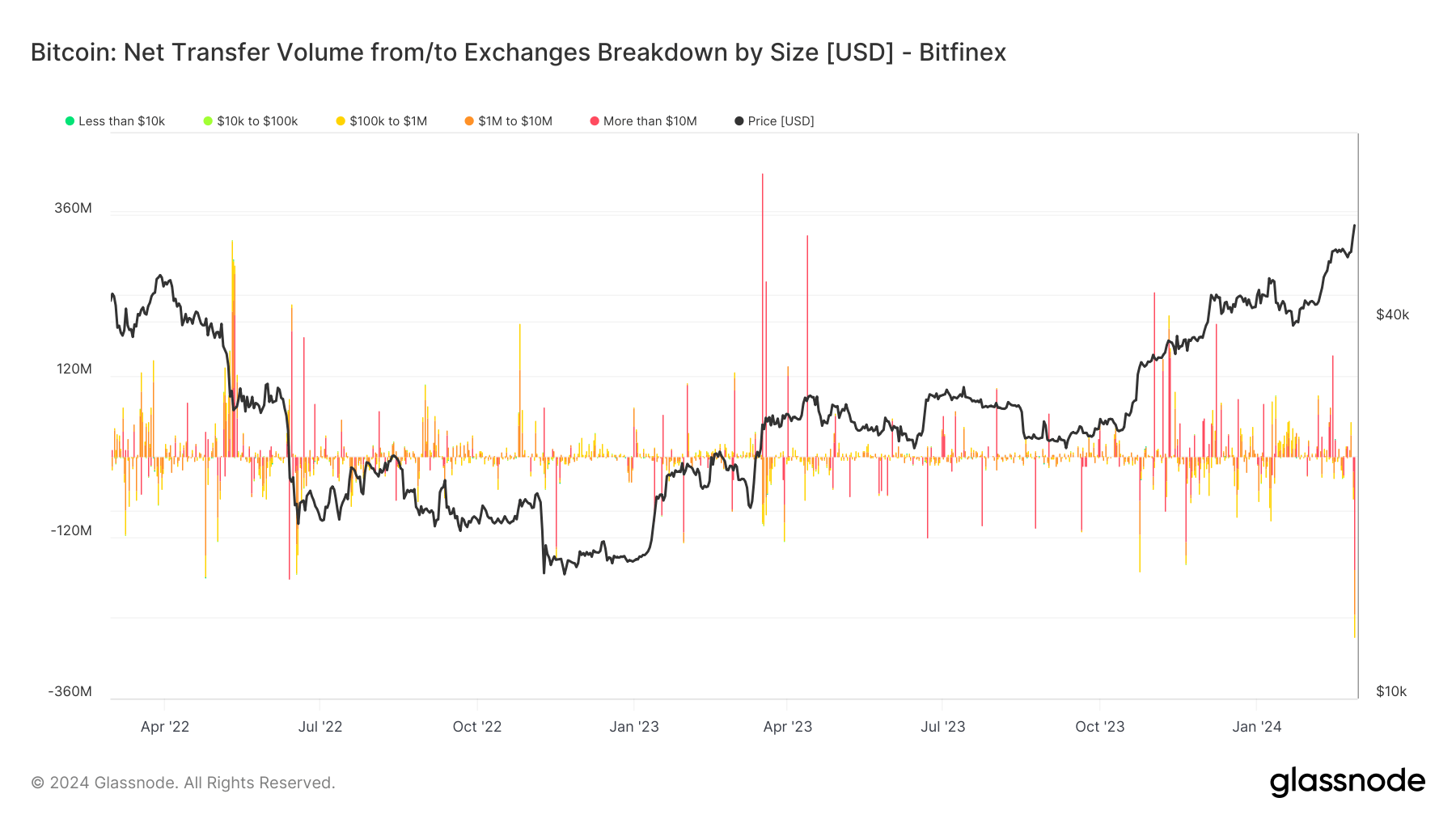

The day further witnessed the largest Bitcoin withdrawal from Bitfinex since 2021, exceeding $240 million. This substantial offloading, estimated to be the equivalent of 5,000 Bitcoins, was primarily attributed to large whale activities.