New Grayscale mini-trust plans to offer lowest fees in Bitcoin ETF market at 0.15%

New Grayscale mini-trust plans to offer lowest fees in Bitcoin ETF market at 0.15% Quick Take

The Grayscale Bitcoin Trust (GBTC) is planning to launch a new Bitcoin mini-trust with a groundbreaking fee of 0.15%, Coindesk reported on April 22.

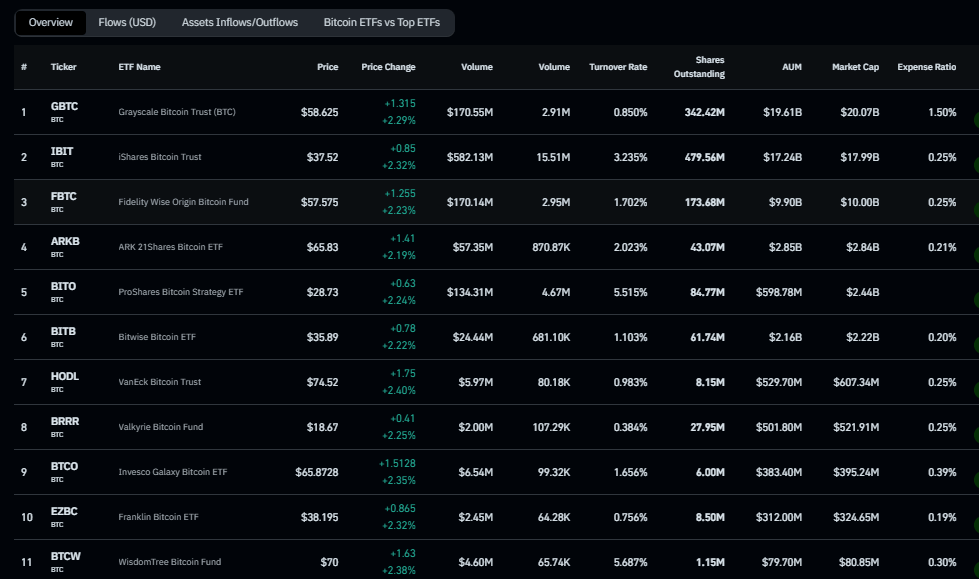

If realized, this new offering would undercut the current lowest-cost spot bitcoin ETF — the Franklin Bitcoin ETF (EZBC) — which charges a 0.19% fee, according to Coinglass.

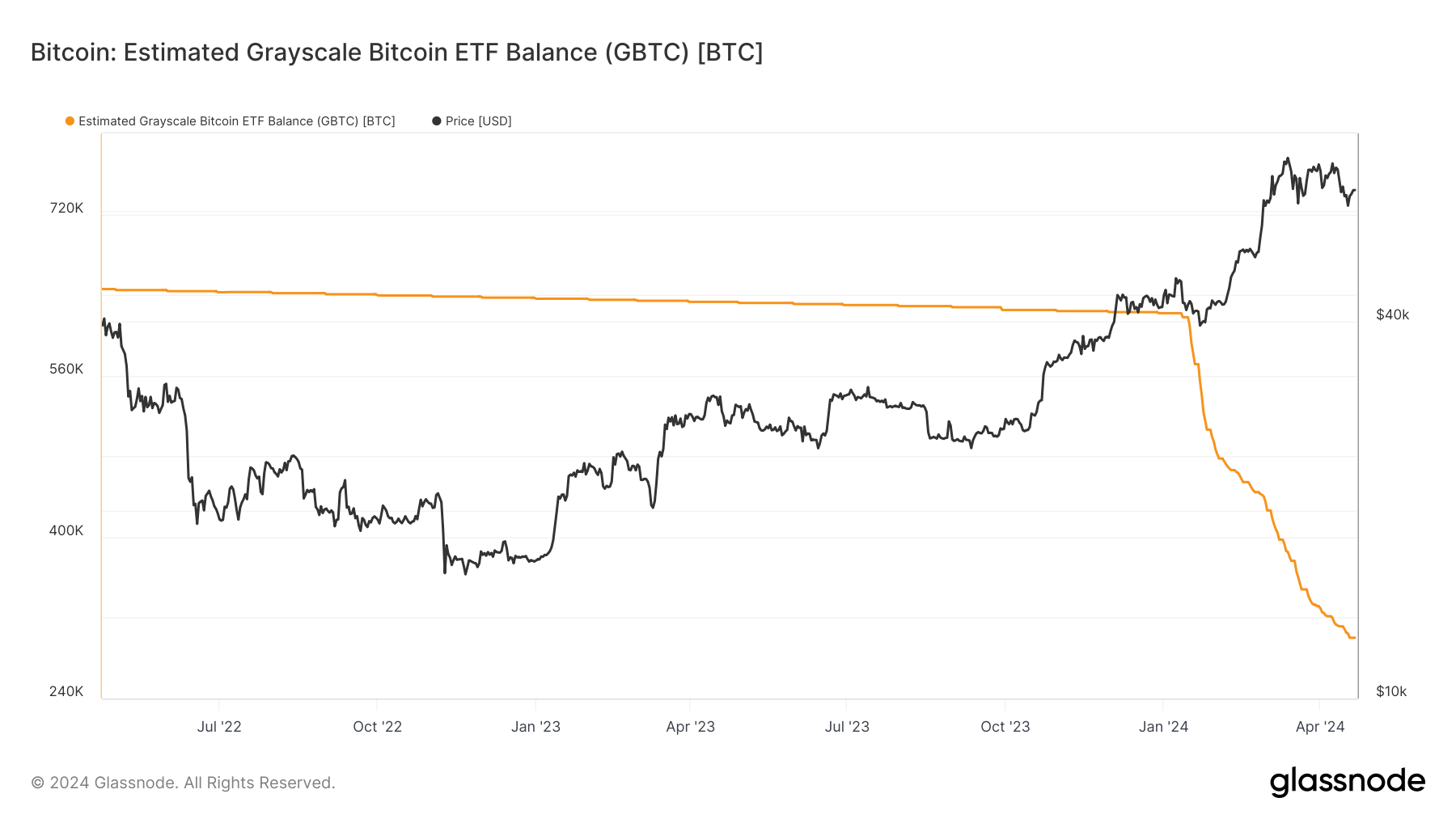

The move comes following significant outflows from GBTC, with the trust’s Bitcoin holdings dropping from 622,000 before the ETF launch on Jan. 11 to roughly 300,000 as of April 19, according to Glassnode.

The high 1.5% fee associated with GBTC, compared to lower fees offered by competing ETFs, has been a significant driver of the outflows. However, the proposed mini-trust could provide a tax-efficient way for investors to convert their holdings, as the transition would not be considered a taxable event, according to Coindesk.

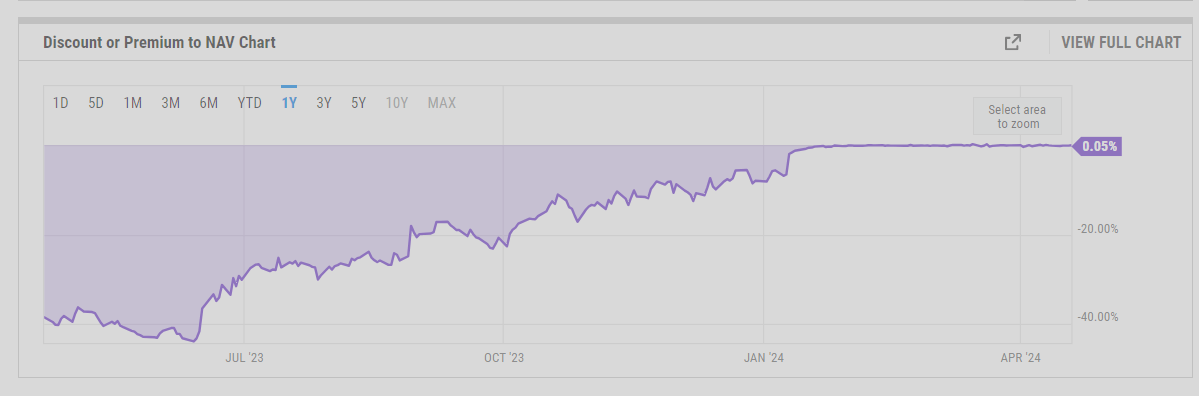

This is particularly attractive for investors sitting on substantial unrealized gains due to GBTC’s significant discount over the years, according to ycharts.

According to an SEC filing, GBTC will contribute 63,204 BTC to the new BTC Trust, with 692,370,100 shares of the trust being issued and distributed to GBTC shareholders.

The Sponsor’s Fee for the BTC Shares will be set at 0.15%, positioning the new trust as the most cost-effective option in the spot Bitcoin ETF market.

Bloomberg’s senior ETF analyst Eric Balchunas noted:

“This is pro-forma financials and as such hypothetical. It doesn’t [necessarily] mean BTC will be 15bps.”

CoinGlass

CoinGlass

Farside Investors

Farside Investors