High volatility drives spot Bitcoin volume to $26 billion

High volatility drives spot Bitcoin volume to $26 billion Quick Take

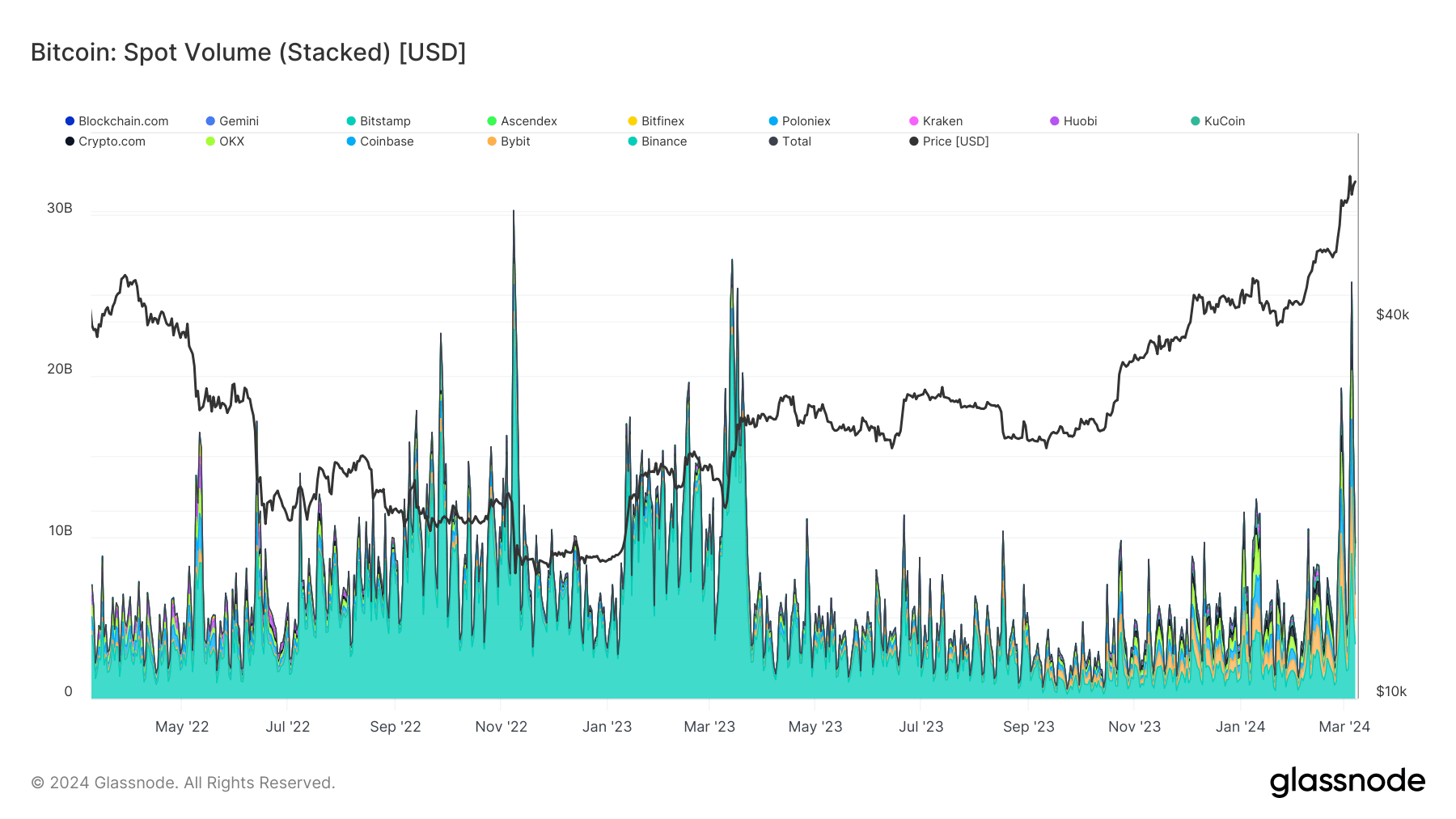

Recent Glassnode’s data captures intriguing shifts in Bitcoin’s spot volume, tracking the aggregate trading volume of Bitcoin against USD-based currencies, both fiat and stablecoin, across various exchanges. On March 5, there was a surge in spot volume to $26 billion across all exchanges, a pinnacle not reached since the SVB collapse in March 2023.

During the SVB collapse, Binance dominated the spot volume, contributing $22 billion of the total $27 billion, as reported by Glassnode. Now, spot volume has again reached a similar level, spurred by Bitcoin’s surge to a record $69,000 and its subsequent 15% drop. In this latest bout of volatility, the exchange landscape was more distributed, with Binance, Coinbase, and Bybit recording spot volumes of $9 billion, $4 billion, and $4 billion, respectively.

The data depicts a stark decrease in Binance’s market share over the year, as its spot volume shrank from $22 billion during the SVB event to $9 billion in the following year’s volatility peak.