Grayscale’s Bitcoin Trust (GBTC) has seen a 4% increase in its value during pre-market trading

Grayscale’s Bitcoin Trust (GBTC) has seen a 4% increase in its value during pre-market trading Quick Take

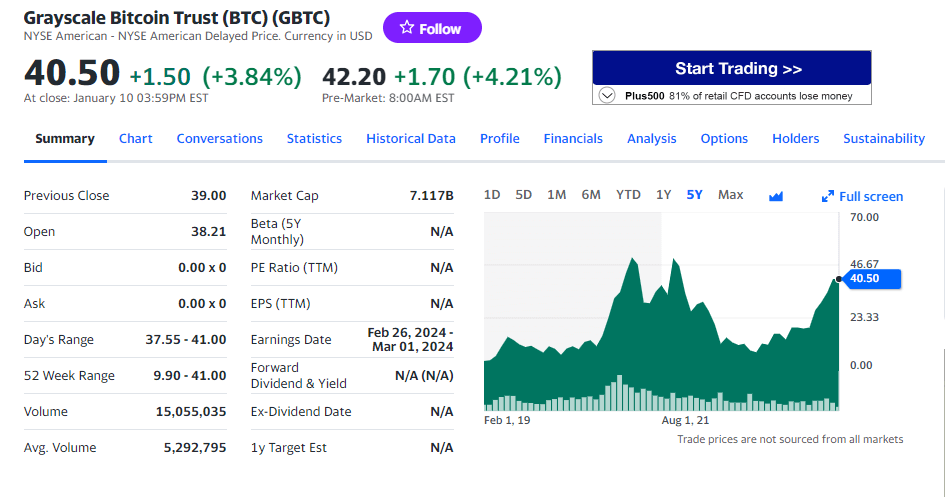

The recent transformation of Grayscale’s Bitcoin Trust (GBTC) into an Exchange Traded Fund (ETF), as confirmed by Senior Bloomberg ETF analyst Eric Blachunas, casts an intriguing light on the digital asset market dynamics. As GBTC transitions, it brings a 1.5% fee, setting it apart as the ETF with the highest fees. This does not seem to have dampened the market response, with GBTC seeing a 4.2% uptick and trading at $42.28, according to Yahoo Finance.

Even more remarkable is that during the peak of the 2021 bull run, GBTC was trading at around $50 a share, indicating the potential for further growth. However, it’s important to note that GBTC’s transition into an ETF has closed the discount to its Net Asset Value (NAV), aligning the market price closer to the actual value of the underlying assets.

The market’s reaction to GBTC’s transformation and its associated fees, juxtaposed against the pre-market performance of Blackrock ETF IBIT (up 25%), clarifies the ongoing struggle for supremacy amongst ETF providers in the ever-volatile, ever-fascinating world of digital asset trading.

Farside Investors

Farside Investors