EU inflation outpaces expectations, energy prices hold key to potential rate hikes

EU inflation outpaces expectations, energy prices hold key to potential rate hikes Quick Take

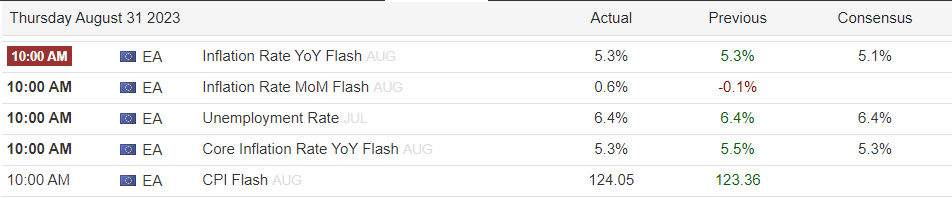

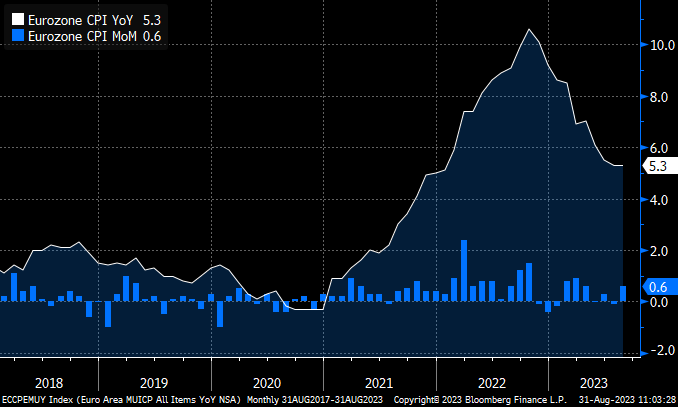

The latest EU inflation data highlights a persistent trend of inflationary pressure. Year over year inflation rates are stubbornly high, reported at 5.3%, exceeding the consensus by 0.2%. Moreover, with a positive month over month figure and a year over year core inflation still at 5.3%, the situation suggests a potential for the Consumer Price Index (CPI) to re-accelerate.

A key point made by analyst Fabian Wintersberger is the role of energy in shaping the inflation picture. Currently, energy stands at -3.3% year over year, but without this negative impact, the Eurozone CPI would have been reported at 6.3%. Its importance becomes even more evident when considering a potential scenario where if energy prices were to turn positive, the Eurozone could face a significantly higher CPI, further increasing the likelihood of more rate hikes.

Inflationary trends, therefore, continue to be a major force in European economic policy, with potential implications for monetary policy decisions and, by extension, the financial markets.