BlackRock’s iShares surpasses Grayscale’s GBTC as the largest digital asset fund by AUM

BlackRock’s iShares surpasses Grayscale’s GBTC as the largest digital asset fund by AUM Quick Take

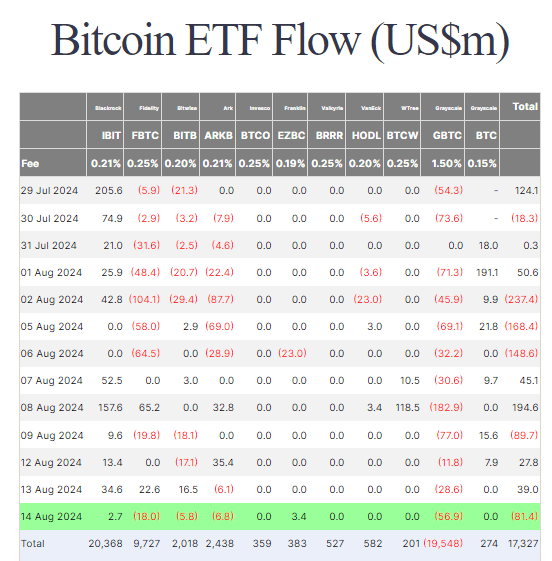

Bitcoin

On Aug. 14, Bitcoin ETFs experienced an outflow of $81.4 million, according to data from Farside. Among the major ETF issuers, BlackRock’s IBIT was one of only two funds to register an inflow, continuing its strong performance with only one outflow since its launch. In contrast, the other top issuers saw withdrawals: Fidelity’s FBTC had an $18 million outflow, Bitwise’s BITB lost $5.8 million, Ark’s ARKB saw $6.8 million withdrawn, and Grayscale’s GBTC suffered a $56.9 million outflow. Despite this, total inflows into Bitcoin ETFs have reached $17.3 billion.

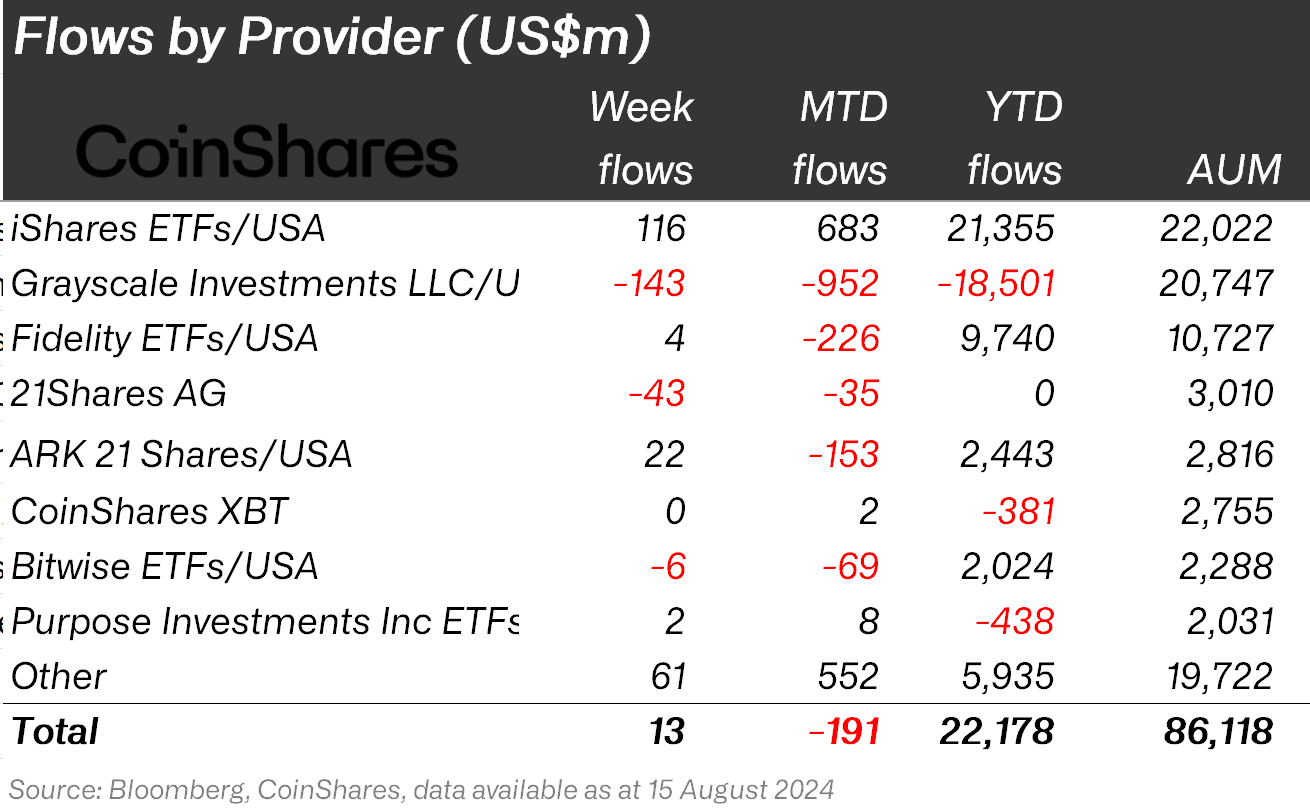

James Butterfill, Head of Research at CoinShares, noted that BlackRock’s iShares has overtaken Grayscale’s GBTC as the largest digital asset fund by total assets under management, with iShares holding $22.0 billion compared to Grayscale’s $20.7 billion.

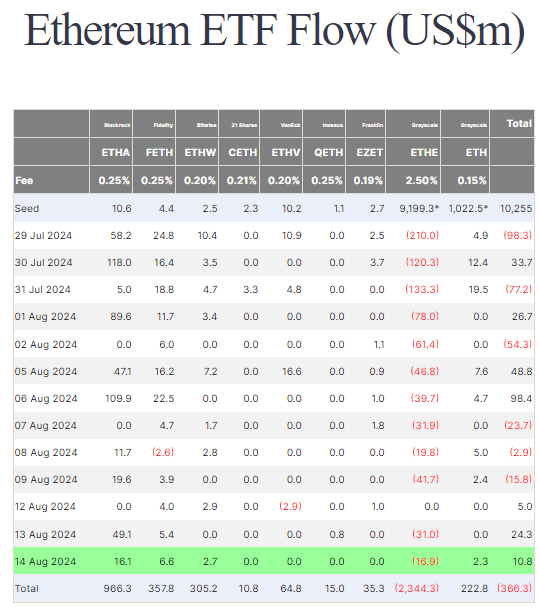

Ethereum

Ethereum ETFs, on the other hand, saw a $10.8 million inflow on the same day, led by BlackRock’s ETHA, which added $16.1 million. Grayscale’s ETHE saw reduced outflows of $16.9 million, with total outflows now reduced to $366.3 million.