Bitcoin’s diminishing cycle returns stir speculation ahead of halving

Bitcoin’s diminishing cycle returns stir speculation ahead of halving Quick Take

As we stand less than 28,000 blocks away from Bitcoin’s next halving, scheduled for April 21, 2024, the spotlight sharpens on the peculiarities of Bitcoin’s subsidy epochs.

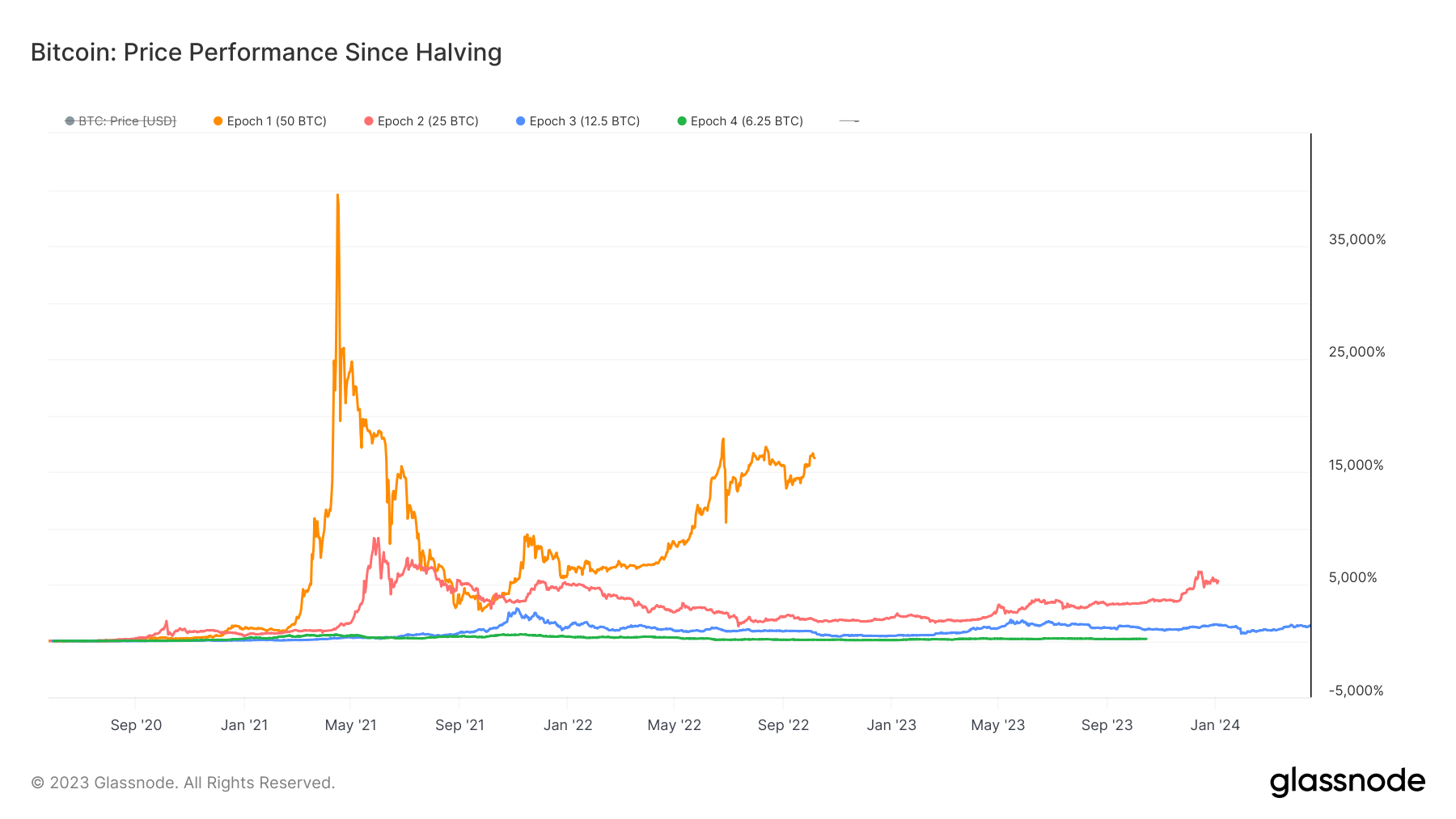

A subsidy epoch refers to each epoch, or the period between halvings, exhibiting a unique pattern in market behavior. The contemporary epoch, Epoch 4, offers a block reward of 6.25 Bitcoin. However, a closer examination reveals an interesting trend—diminishing returns.

Although Bitcoin has ascended by roughly 180% since the start of this epoch on May 30, 2020, the returns pale in comparison to the same stage in previous epochs. Epoch 3 boasted an impressive 1,000% return, while Epoch 2 outshone with a 3,394% spike.

These emerging patterns bolster the theory of extended cycles in Bitcoin’s price trajectory. As we inch closer to the forthcoming halving, the repercussions on investors and the crypto market at large remain uncertain.