Bitcoin’s bullish swing backed by record high short-term holder realized price

Bitcoin’s bullish swing backed by record high short-term holder realized price Quick Take

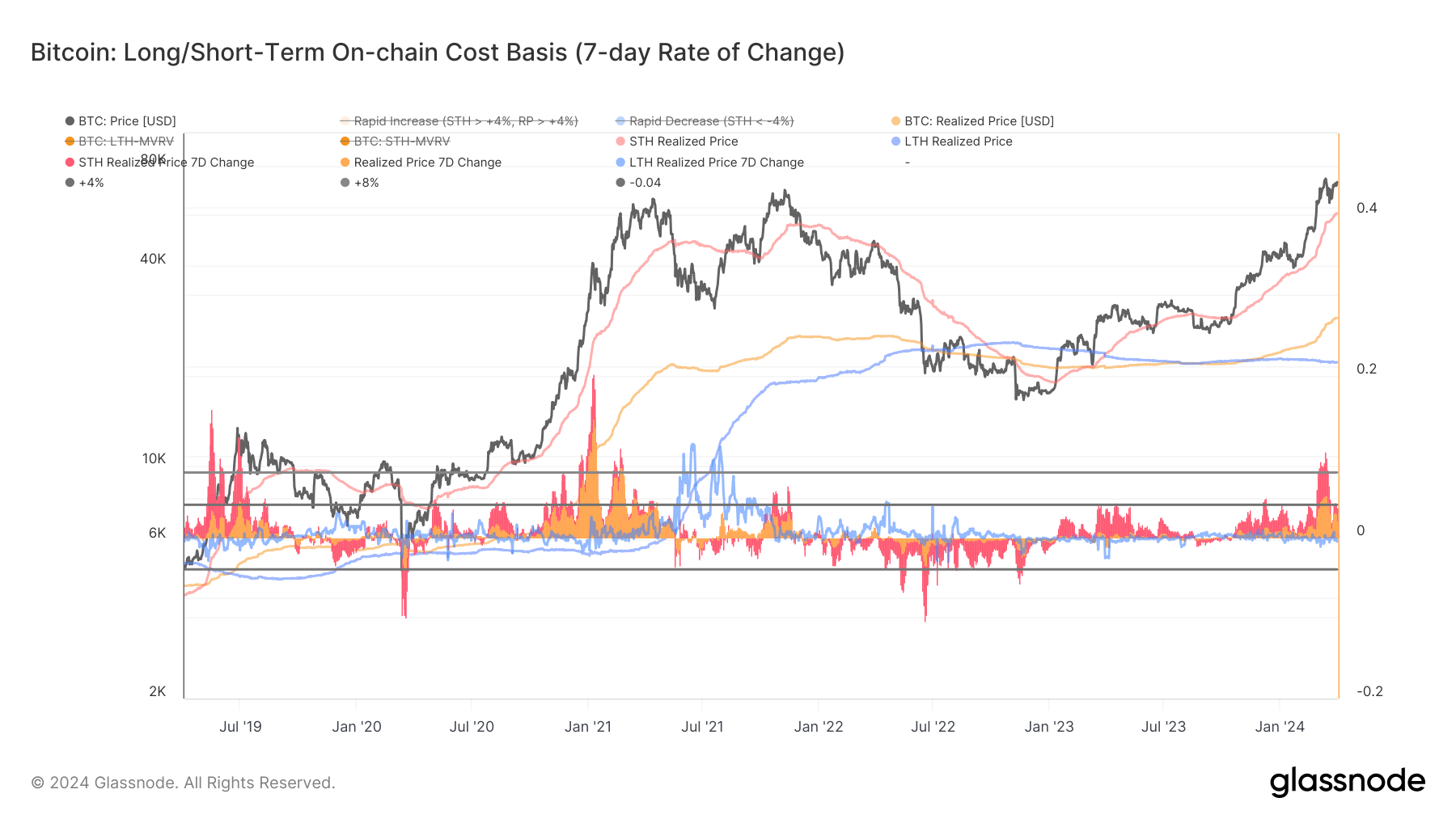

Bitcoin on-chain data by Glassnode portrays a bullish sentiment, underscored by robust support levels influenced by short-term holders‘ behavior. The Short-Term Holder Realized Price (STH RP), reflecting the average on-chain acquisition cost for coins moved within the last 155 days, recently soared to an all-time high of $57,547. Notably, its 7-day percent change stands at 4%, a significantly elevated figure following a remarkable 11% surge – marking the highest level since 2021.

Over the past 14 months, the STH RP has consistently acted as a reliable price floor for Bitcoin, albeit with a minor exception in July and August 2023. Present market forces echo those of late 2020, characterized by Bitcoin’s relentless ascent and shallow dips, finding steadfast support just above the STH RP level. Moreover, the overall Realized Price across Bitcoin’s circulating supply has surged to an unprecedented high of approximately $28,000.

This on-chain data suggests that short-term holders are actively accumulating Bitcoin at increasingly higher price levels. As long as the market adheres to these realized prices, Bitcoin’s upward trajectory may persist, potentially experiencing relatively modest drawdowns compared to prior cycles.