Bitcoin wealth distribution leans toward decentralization as small investors take the lead

Bitcoin wealth distribution leans toward decentralization as small investors take the lead Quick Take

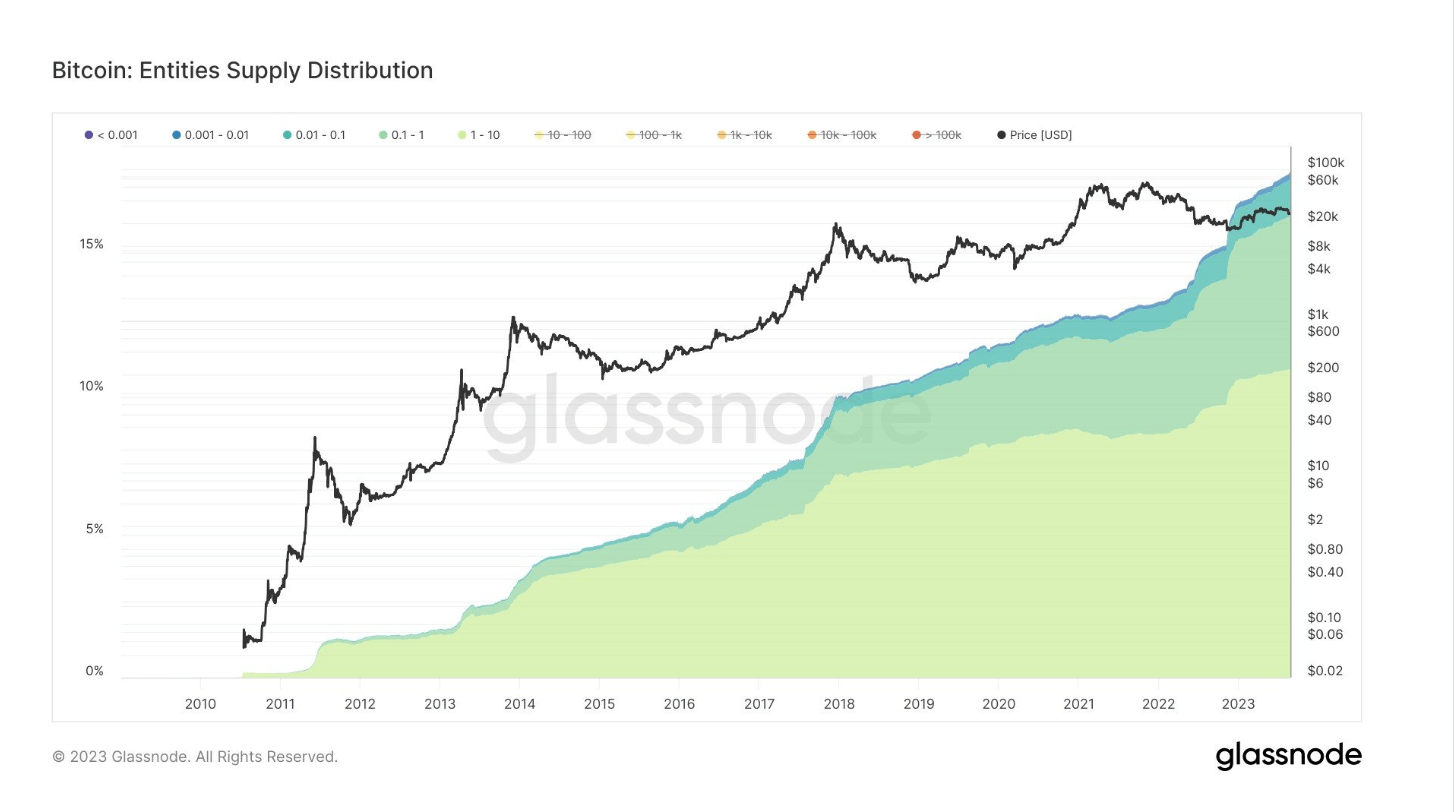

The landscape of Bitcoin holders is reflecting a notable shift towards decentralization, as evidenced by the latest data analysis. Nearly a fifth of the circulating Bitcoin supply is in the possession of investors who own 10 BTC or less, indicating a broadening in the distribution of this digital asset. The growing adoption rate is a substantial factor in this trend.

An in-depth examination of the proportions held by smaller investors reveals a fascinating pattern. Those holding between 1 and 10 Bitcoin account for 11% of the circulating supply. Those in possession of 0.1 hold a further 5.4% to 1 Bitcoin. Surprisingly, even the smallest investors, those with 0.1 Bitcoin or less, make up approximately 1.5% of the supply.

This trend signifies a democratization in the world of cryptocurrency, with a greater number of smaller investors entering the market. This could lead to a more balanced distribution of wealth within the Bitcoin ecosystem, and potentially increase Bitcoin’s stability as a result.