Bitcoin transaction fees in April 2024 mirror past spikes during market events

Bitcoin transaction fees in April 2024 mirror past spikes during market events On-chain Highlights

DEFINITION: The total amount of fees (USD Value) paid to miners. Issued (minted) coins are not included.

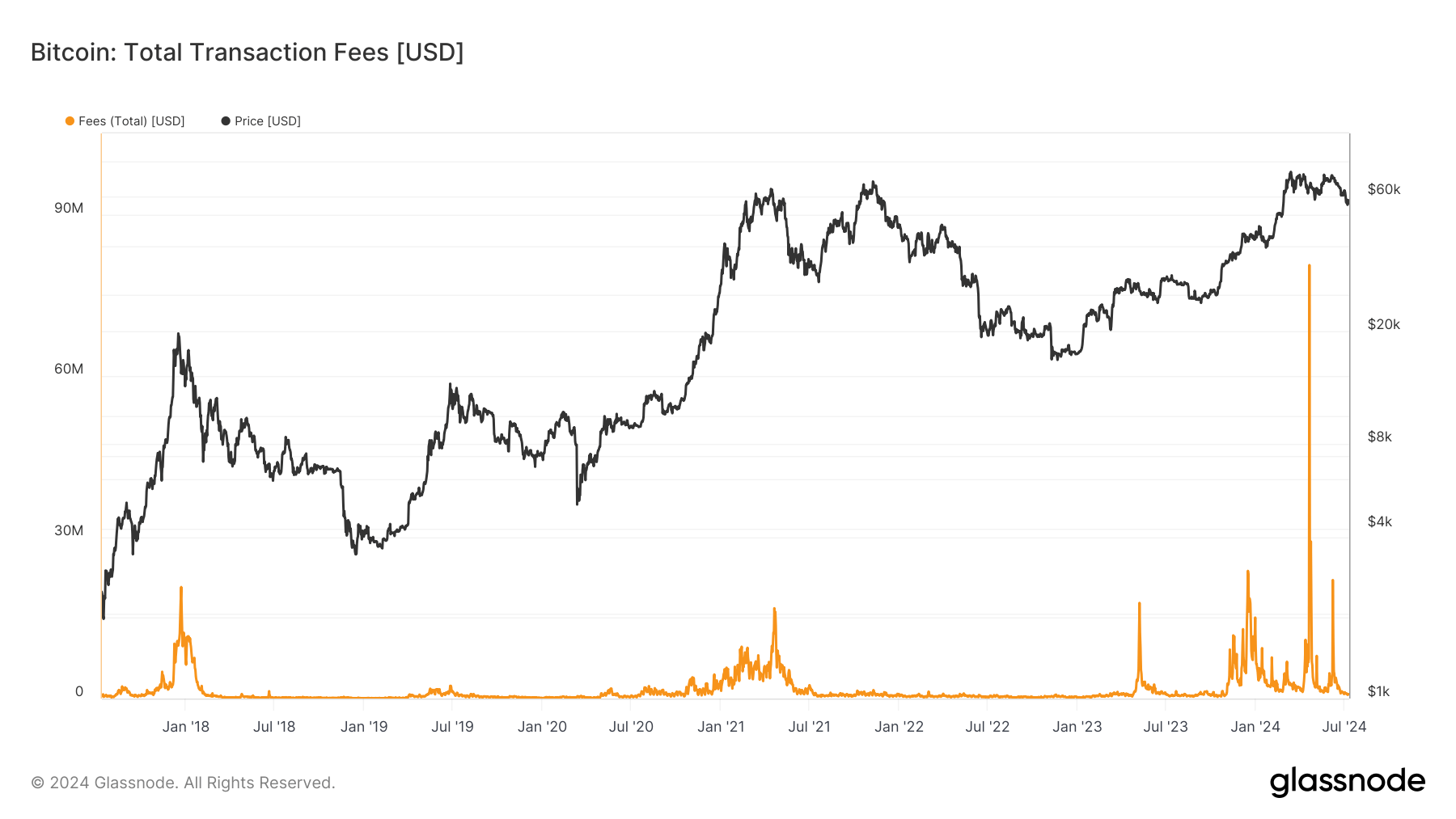

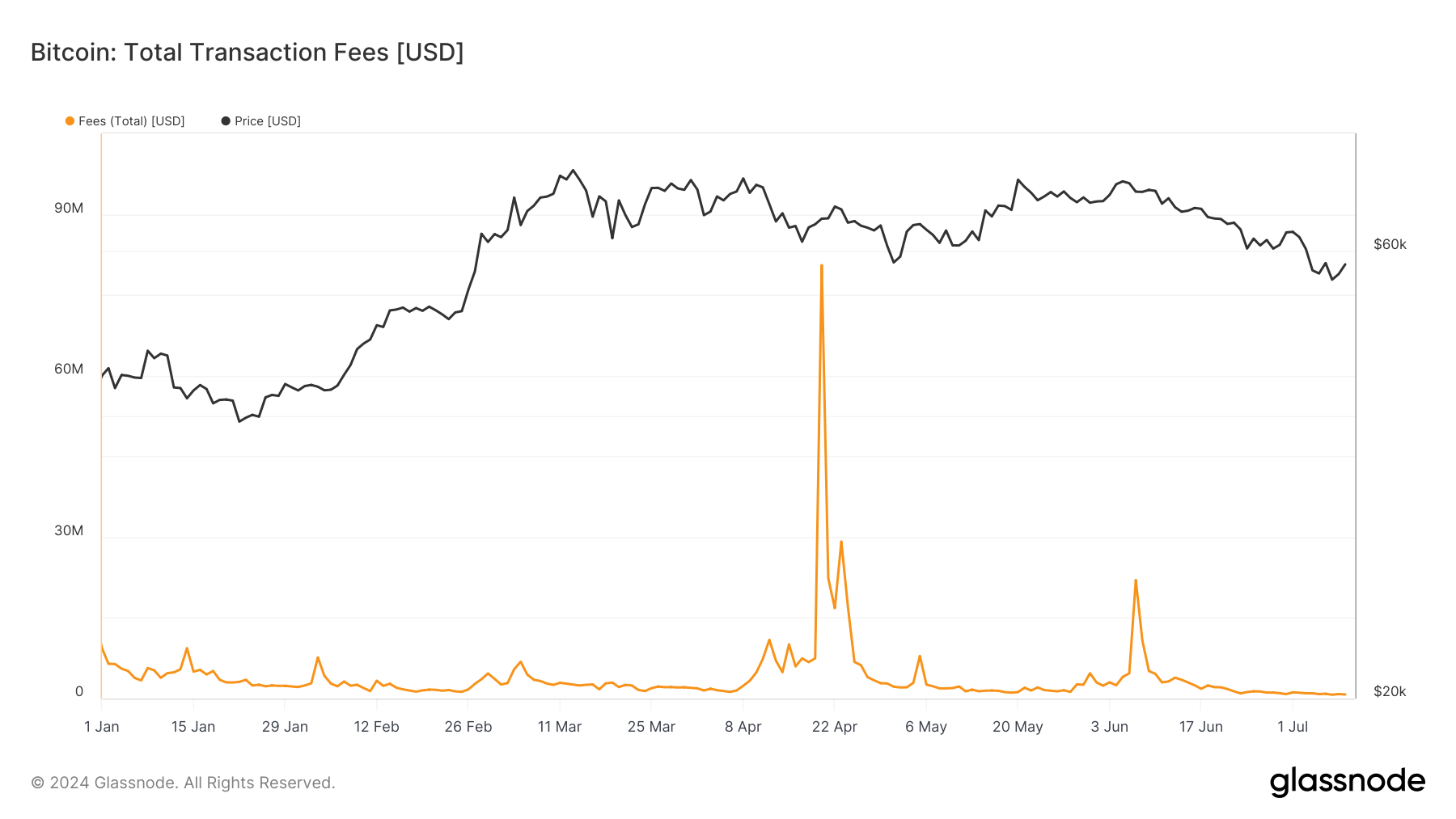

Bitcoin’s total transaction fees exhibit significant fluctuations over time. The charts illustrate a substantial spike in transaction fees around April this year. The peak around this period suggests increased network activity and congestion, which directly results in higher fees. This pattern mirrors previous years where notable increases in transaction fees coincide with significant market events or increased on-chain activity.

Comparing 2024 to previous years, it’s evident that transaction fees tend to surge during periods of heightened market activity. For instance, transaction fees began surging amid the 2021 bull run, notably peaking around the same time Bitcoin hit an all-time high around April that year — reflecting the network’s increased usage and congestion.

The long-term trend shows that while fees can decrease during periods of lower market activity, they remain a crucial indicator of the network’s operational conditions and user engagement.