Bitcoin market signals maturity with record divergence in long and short-term holdings

Bitcoin market signals maturity with record divergence in long and short-term holdings Quick Take

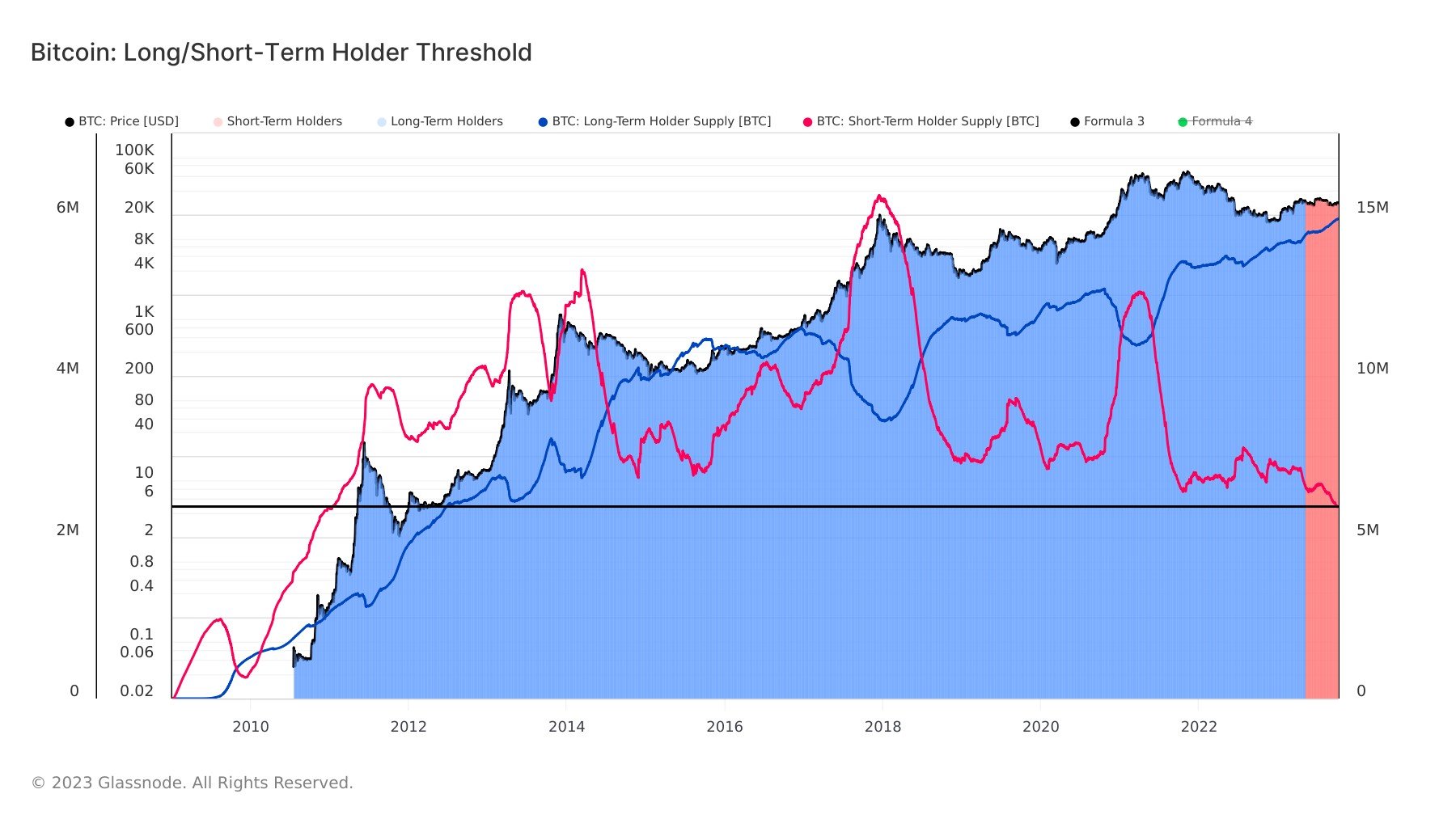

The Bitcoin market has recorded an intriguing divergence between long-term holders (LTH) and short-term holders (STH) with 14,852,000 and 2,378,000, respectively. This is the widest divergence ever recorded, marking a significant shift in Bitcoin holding patterns.

According to the provided data, an individual is defined as a long-term holder if their Bitcoin holdings exceed six months. Historically, at the cycle’s peak, the LTH supply typically diminishes, whereas the STH supply correlates with a surge.

For instance, on December 16, 2017, the LTH supply was 8,652,599, while the STH supply was 6,215,859. This reflected 58% of the circulating supply held by LTH.

On April 13, 2021, the bear market began in May, and LTH supply rose to 10,938,772 while the STH supply dropped to 5,017,026, meaning that LTH held 69% of the circulating supply.

This data suggests a sharp decline in speculative trading as more investors hold Bitcoin longer. The record divergence between LTH and STH might hint at a more mature market with a growing trend toward long-term investment in Bitcoin.