Bitcoin market absorbs mining output and more, sparking price spike

Bitcoin market absorbs mining output and more, sparking price spike Quick Take

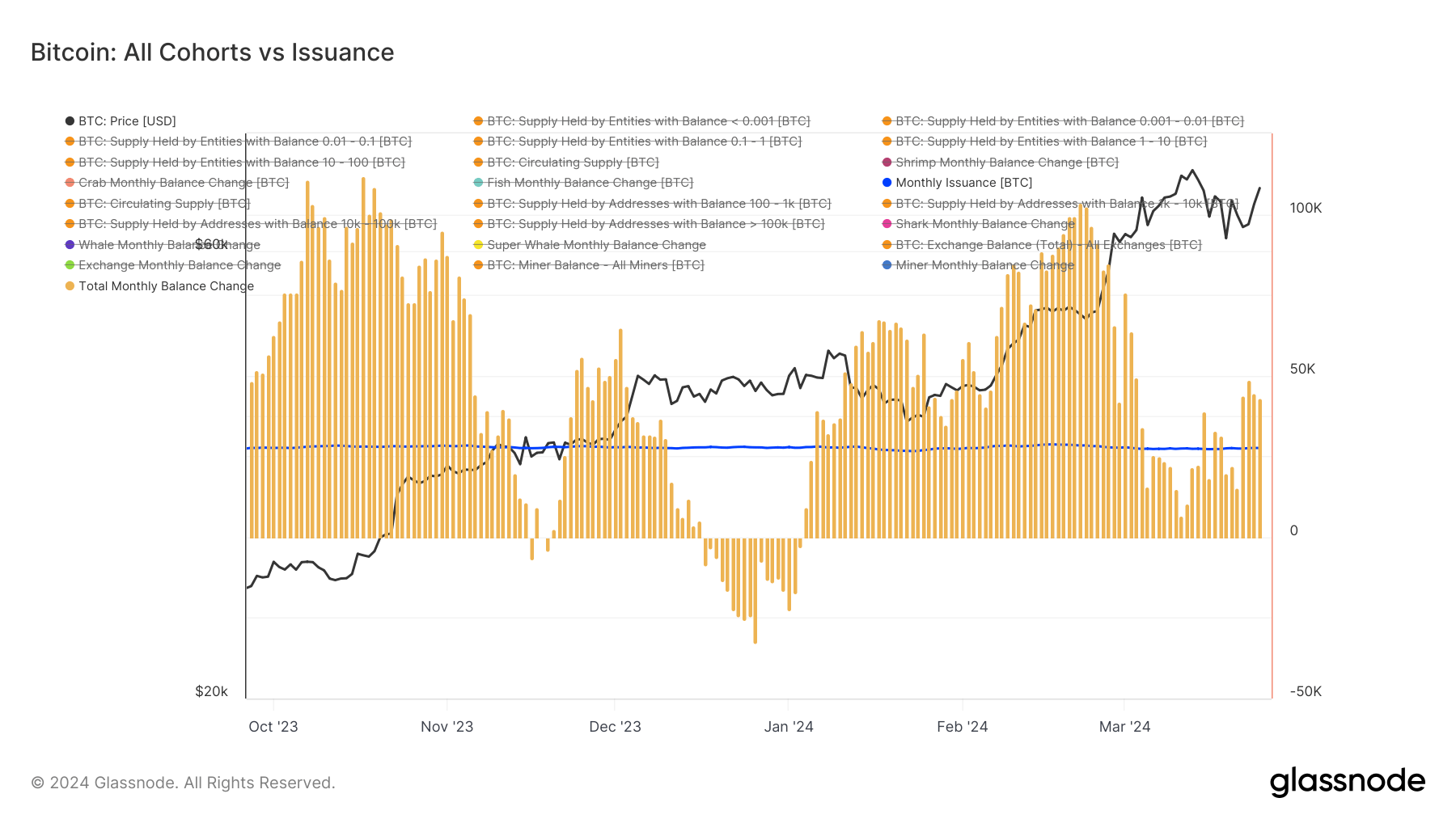

Examining the relative forces between Bitcoin cohort accumulation and monthly issuance offers intriguing insights into the current market situation. The ongoing epoch witnesses daily mining of approximately 900 BTC, translating to nearly 27,000 BTC per month, represented as the blue line in our analysis graph.

The distinct cohorts are classified from shrimps (holding less than one Bitcoin) to super whales (10,000+ BTC), in addition to tracking miners and exchanges. The analysis becomes particularly interesting when the orange bar chart, representing the cohorts’ aggregate accumulation, surpasses the blue line of monthly issuance.

However, when the orange bar chart falls below the monthly issuance line, it indicates that all cohorts are not accumulating the total monthly issuance on an aggregate basis.

Breaking down the data, as of March 25, the monthly issuance stands at 27,000 BTC, while the aggregate cohort accumulation has reached 43,114 BTC. Evidently, in the last 30 days, all cohorts have collectively absorbed the mined Bitcoin and have procured additional quantities from exchanges. This buying trend aligns with the recent surge of Bitcoin prices above the $70k mark.

Conversely, a contrasting period was observed between March 3 and March 22. Cohorts were accumulating less than the monthly issuance. This trend contributed to the dip in Bitcoin prices from its all-time high of $60k.