Bitcoin liquidity hits decade low as holding overtakes trading

Bitcoin liquidity hits decade low as holding overtakes trading Quick Take

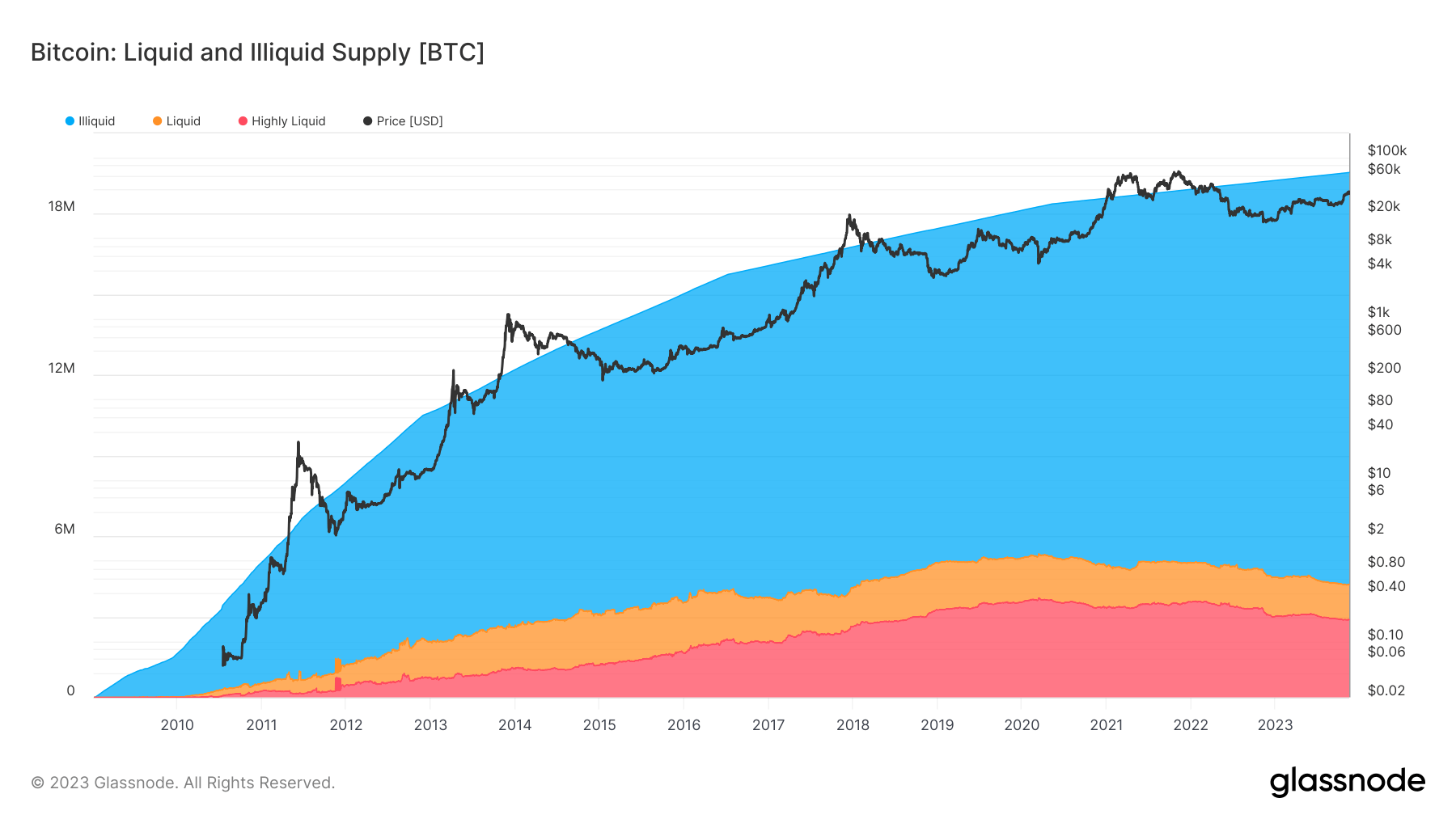

The Bitcoin market is witnessing an intriguing phase of liquidity transformation. The liquid supply, representing the traded Bitcoin, has dwindled to 1,295 million Bitcoin – a record low unseen since 2012. This indicates a shrinking pool of Bitcoin under active circulation, potentially creating supply-demand tension in the market.

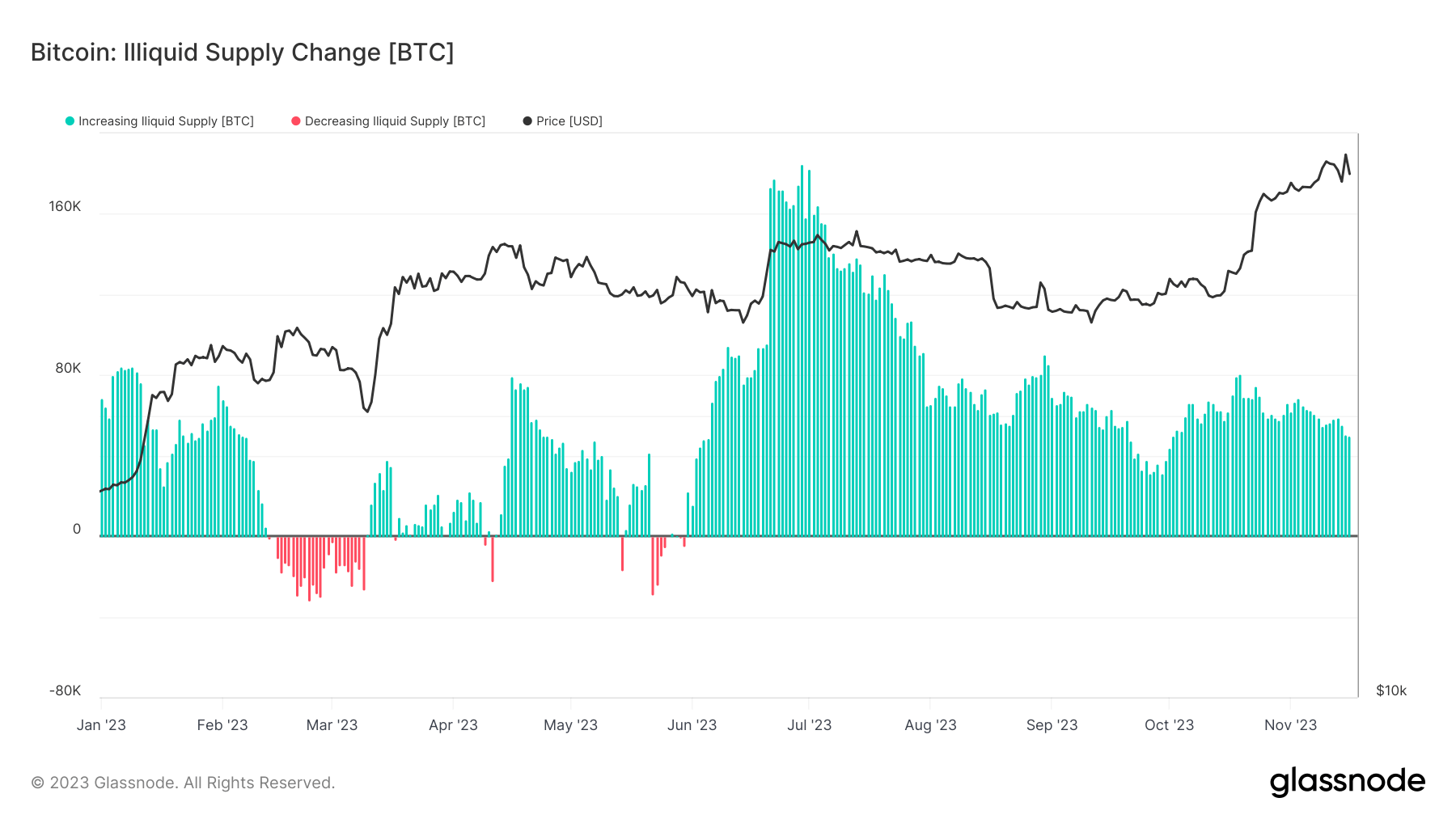

On a contrasting trajectory, the illiquid supply, defined as Bitcoin with minimal spending history, is escalating, registering a new peak at 15.4 million. In the previous 30-day span alone, illiquid entities have expanded by 50,000 BTC, a pattern that started in July. This surging trend implies a growing holder sentiment – more Bitcoin holders are retaining their assets, reducing the circulation and actively traded supply.

Interestingly, the highly liquid supply, which denotes Bitcoin readily available for transactions, has also contracted to around 2,888 million BTC, its lowest level since 2018. As such, the overall liquidity of the Bitcoin market seems to be diminishing, pointing towards an increasing trend of Bitcoin holding over trading.