Bitcoin accumulation trend hits lowest point since October, signaling widespread distribution shifts

Bitcoin accumulation trend hits lowest point since October, signaling widespread distribution shifts Quick Take

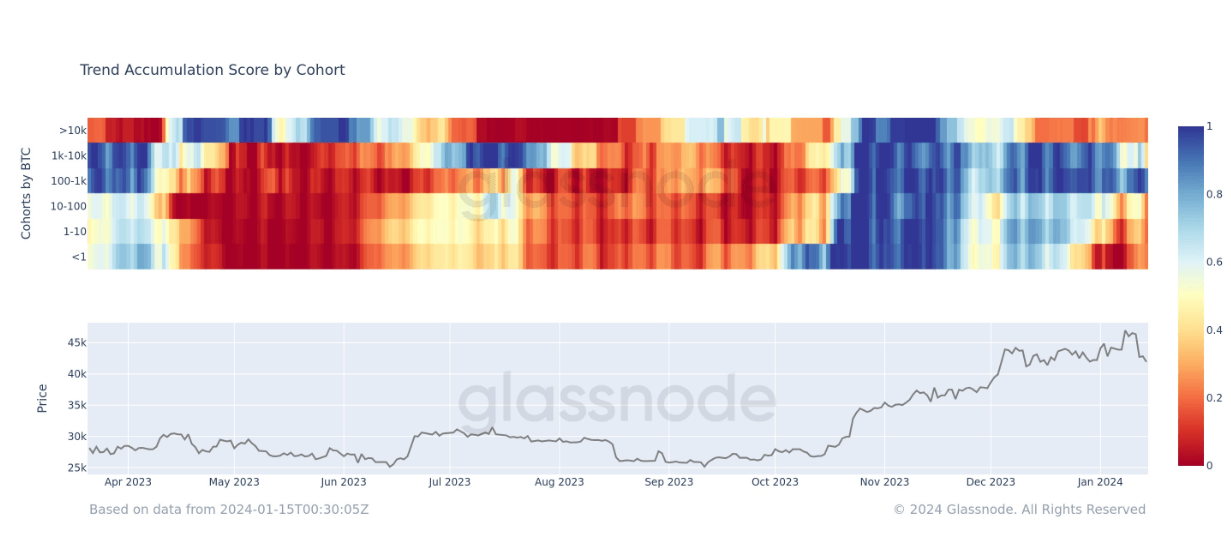

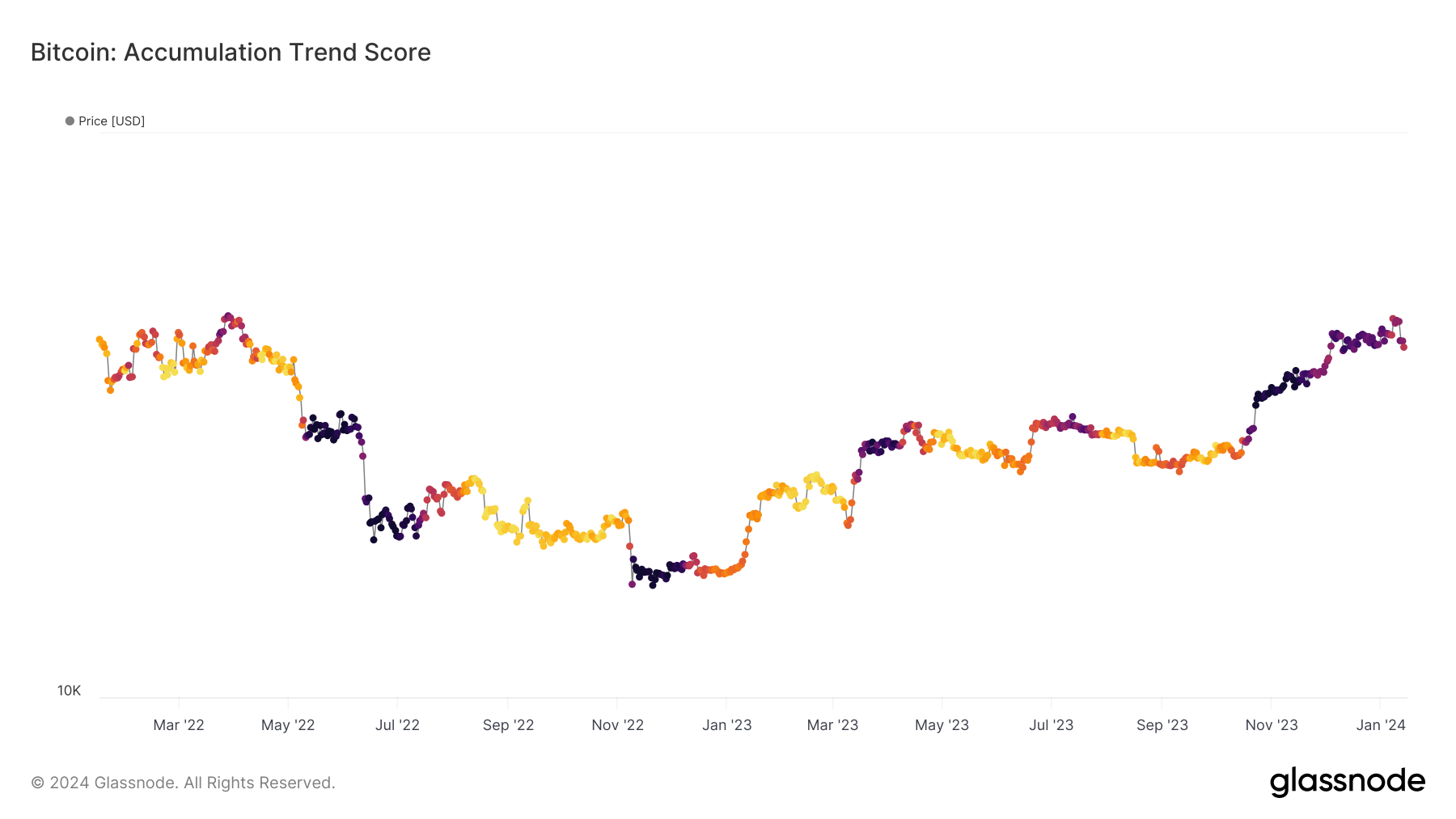

The Accumulation Trend Score, a metric that measures the relative strength of Bitcoin (BTC) accumulation by different entity wallet cohorts, has registered a significant shift. Notably, the trend score has plummeted to 0.5, the lowest level since October 2023, just prior to Bitcoin’s monumental rise from $25,000 to $49,000, spurred by the launch of the spot Bitcoin ETF.

This trend score dip indicates a transition from accumulation to distribution across almost all cohorts. This shift mirrors a similar distribution pattern observed in September 2023 before the rampant accumulation in October 2023. However, the 100 to 1000 BTC holders remain the sole cohort still in the accumulation phase.

Interestingly, the ‘whales‘ – entities holding 10,000 BTC or more – have transitioned to distribution since Dec. 15, 2023. Similarly, retail holders are now also marked by distribution. This overall distribution trend could have broader implications for Bitcoin’s market dynamics, potentially impacting price stability and liquidity.