Binance Bitcoin reserves double, while proprietary stablecoin BUSD plummets in 2023

Binance Bitcoin reserves double, while proprietary stablecoin BUSD plummets in 2023 Quick Take

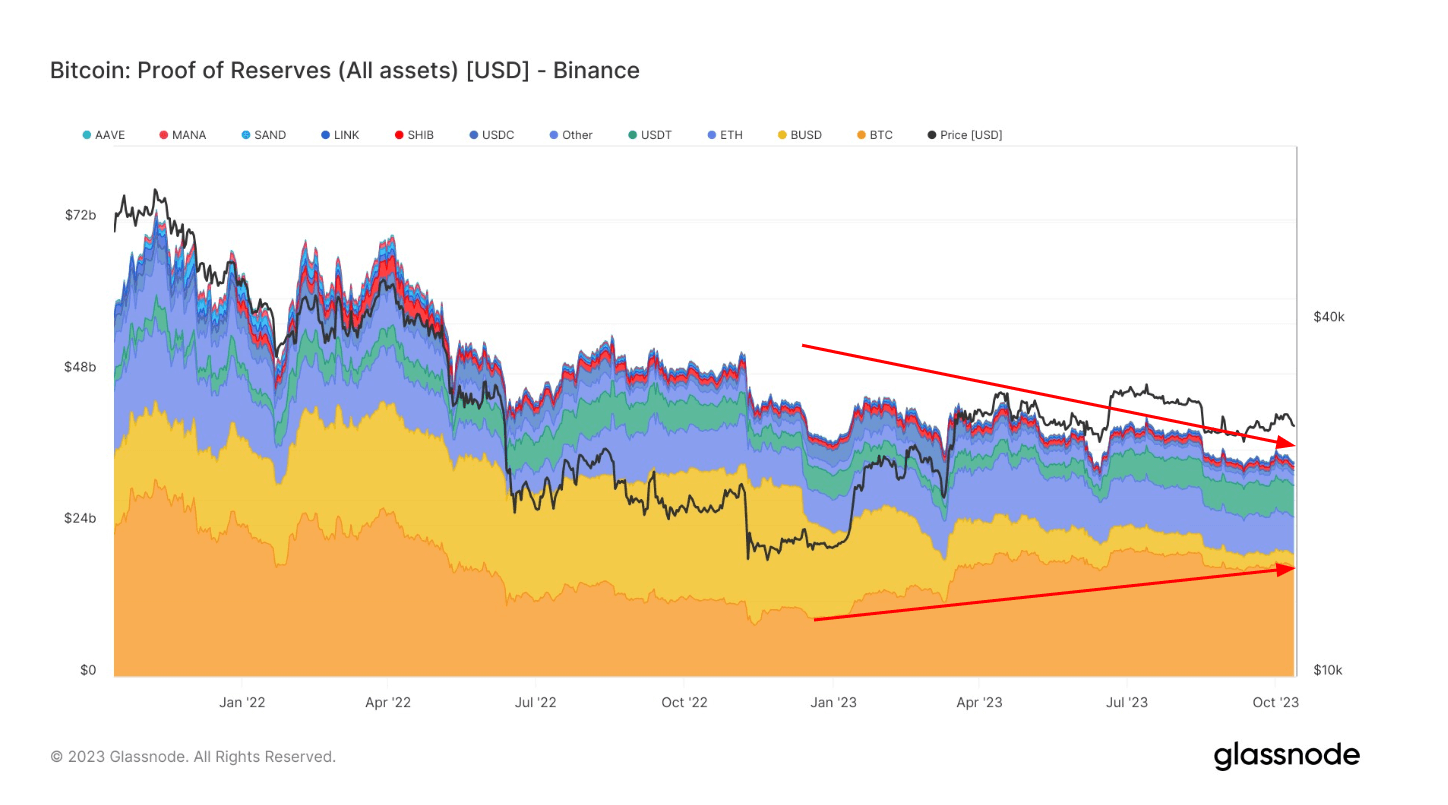

Year-to-date data for 2023 reflects significant shifts in Binance’s proof of reserves, an official disclosure of the exchange’s on-chain assets.

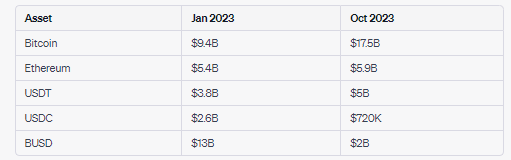

Bitcoin, buoyed by a 60% appreciation, has seen Binance reserves double from $9.4 billion in January to $17.5 billion in October. This surge has boosted Bitcoin’s share in Binance’s reserves from 27% at the start of the year to approximately 50% by October.

However, there has been a steep decline in BUSD, Binance’s proprietary stablecoin, whose reserves have plummeted from $13 billion to $2 billion. Ethereum reserve figures remained relatively stable, increasing slightly from $5.4 billion to $5.9 billion, despite the cryptocurrency appreciating 30% year-to-date. The Tether (USDT) reserves have grown from $3.8 billion to $5 billion, contrasting sharply with USD Coin (USDC), which tumbled from $2.6 billion to a mere $720,000.

This observation is backed up by Andre Dragosch, the Head of Research at Deutsche Digital Assets, who noted a paradoxical trend: While Bitcoin rallied by 80% since November 2022, there has been a noticeable decline in overall crypto reserve assets during the same period.

These shifts underline a clear trend: Bitcoin is becoming an increasingly dominant reserve for Binance amidst varied market dynamics.