Inside the Battle to Become the World Currency

Photo by Sara Riaño on Unsplash

As the former reserve currency of central banks and the default denomination of the global oil market, the U.S. dollar has dominated the world’s financial system for the past 70 years, as well as served as a safe-haven for those trying to escape their own, crumbling native currencies. However, the status of the greenback may soon change.

Despite the strong performance of the U.S. economy under President Donald Trump, the idea of a new currency as the centerpiece of the world’s financial infrastructure is gaining popularity.

Simon Yu, CEO of StormX, and Adam Draper, founder of Boost VC, recently hosted a lakeside chat in Seattle to discuss the future of Bitcoin and blockchain technologies.

Thanks to @Storm_Token @SimonYuSEA and @AdamDraper for hosting a great fireside chat on venture-capital in blockchain! Essential insight from deep experience. pic.twitter.com/jaVoWKPCTA

— lifeID (@lifeID_io) August 28, 2018

During the discussion, Draper predicted that “the world will one day be on one financial system,” with Bitcoin the most likely candidate to be at its foundation and security tokens as the vehicles of frictionless borderless exchange.

While this prediction would be in line with the growing number of analysts predicting the end of dollar hegemony, it would also differ from the common belief that the Chinese yuan is the most likely successor.

A Chinese Future

There are several reasons to believe in the yuan.

The first is China’s growing influence on the oil industry. Although oil has been traded in dollars since 1973, China is using its leverage as the world’s largest oil consumer to pressure countries into transacting with the yuan.

In addition, China and Russia have already agreed to transact some of their traded energy in the yuan, and China hopes to get other major suppliers–Iran, Saudi Arabia and Angola–to follow suit.

If it is successful in doing so, it is likely China will soon start transacting most, if not all, of its commodity trades in its native currency. A possible secondary effect of this would be other countries defecting from the dollar.

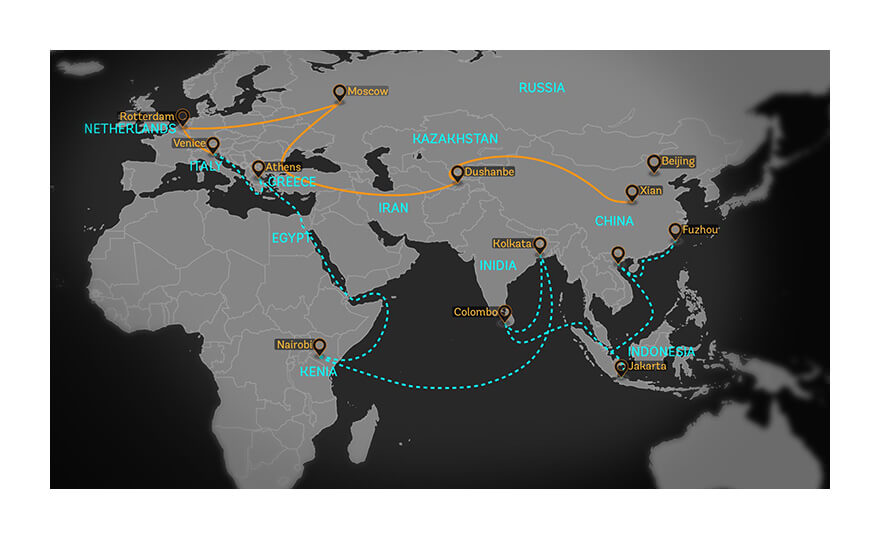

Another reason to believe in the renminbi is China’s growing power in the developing world. In 2013, Xi Jinping announced the Belt and Road Initiative.

The ongoing project aims to strengthen infrastructure, trade and investment links between China and some 65 other countries that account, collectively, for over 30 percent of global GDP, 62 percent of the population and 75 percent of known energy reserves.

Given its hefty investment, it’s clear that China expects strong political leverage in return.

A third reason to back the yuan is the strained relationship between the U.S. and a growing number of countries. The U.S. is currently waging economic warfare against one-tenth of the world’s countries. While not so problematic now, the U.S. risks the chance of those countries forming their own parallel financial system.

A Truly Global Currency

While the yuan certainly has a strong case, there is also a solid argument to back Draper’s beliefs in Bitcoin.

For one, countries experiencing rampant inflation have already demonstrated their belief in Bitcoin. In both Venezuela and Zimbabwe, the poster children of failed currencies, citizens flocked to Bitcoin as a store-of-value and medium of cross-border exchange.

Citizens’ actions in Venezuela and Zimbabwe clearly demonstrate the potential Draper sees:

“People who recently joined the space don’t understand the potential of how large the opportunity of owning your own money is.”

And it appears that some South American citizens have already caught on and are hedging their bets.

The rest of South America is learning from Venezuela.

You get a lot less Bitcoin if you buy it after hyperinflation occurs.

Argentina, Chile, and Peru have all been breaking exchange volume records on LocalBitcoins this summer. pic.twitter.com/e9JPt1Iucx

— Kevin Rooke (@kerooke) August 27, 2018

The same reasons that make Bitcoin useful for citizens during rapid inflation also make it a good candidate as the global currency.

While governments can try to cut citizens off from exchanging their failing currencies into secure currencies like dollars and euros, it’s much harder to shut off access to Bitcoin. Similarly, while countries can be sanctioned from participating in the financial market for a myriad of political reasons, no country has that kind of power over another with Bitcoin.

Bitcoin’s decentralized nature is just one of the many aspects that make it a potentially superior global currency.

#bitcoin vs Gold vs USD

The greatness in bitcoin is in its ability to positively impact the monetary system in so many diverse categories. pic.twitter.com/fxY3Iq9NoQ

— Corked Bat (@CryptoDeNiro) May 2, 2018

The comparisons of CryptoDeNiro’s chart are further illustrated in Vijay Boyapati’s excellent post, The Bullish Case for Bitcoin.

Multiple Winners

Barry Eichengreen, an economics professor at the University of California, Berkeley, meanwhile, argues for a future where multiple reserve currencies co-exist. He predicts that the future will consist of the dollar, euro and yuan, and discredits cryptocurrencies due to its volatility.

But perhaps all four could one day co-exist on equal footing, with Bitcoin used similarly to the gold standard. Overall, it remains to be seen whether Bitcoin will replace, co-exist or be outcompeted by the other currencies jostling for the top spot.